NEW YORK (CNN/Money) -

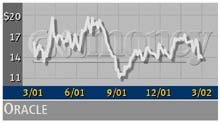

Oracle Corp. on Thursday logged a fiscal third-quarter profit that was down slightly from the same quarter a year earlier as sales slipped more than 18 percent amid a continued slowdown in corporate technology spending.

At the same time, executives of the No. 2 independent software maker reined in their revenue and earnings estimates for the fourth quarter, cautioning investors that things do not appear yet to be improving.

"As far as we can tell, technology spending for enterprise hardware and software remains very soft and does not appear to be improving," Jeff Henley, Oracle's chief financial officer, told analysts during a teleconference Thursday evening.

As a result, he said he was taking a more "conservative" stance and forecasting fourth-quarter per-share earnings ranging between 13 cents and 14 cents as software license revenue falls between 25 percent and 30 percent from the this year-ago period.

Previously, Oracle executives had been aiming for fourth-quarter earnings ranging between 17 cents and 18 cents per share, but most analysts had anticipated a reduction in estimates. By First Call's most recent count, analysts generally have been expecting Oracle's fourth-quarter earnings to be 14 cents per share.

Earlier Thursday, Oracle logged a profit of $508 million, or 9 cents per share, on $2.2 billion in total revenue. That's down from a profit of $583 million, or 10 cents per share, and $2.7 billion in sales a year earlier.

Oracle's new-license revenue, a key measure of the health of its business, was $776.9 million. That's down from $1.1 billion in the third quarter of fiscal 2001.

The company's third-quarter numbers came with little surprise as well.

On March 1, Oracle, the second-largest independent software supplier behind Microsoft, pre-announced the quarter, telling investors to expect earnings of nine cents per share. That's a penny short of most analysts' previous estimates and a penny shy of its results in the same quarter a year ago.

Oracle (ORCL: Research, Estimates), which sells its products primarily to corporate customers, has been hard hit by a slowdown in information-technology spending as large corporations, struggling to hold onto dwindling profits in a weakening economy, have scaled back their information technology budgets.

Executives of Oracle in Redwood Shores, Calif., said despite signs that the overall economy has begun its recovery, technology spending is lagging.

At the same time, they said some key industries for Oracle -- specifically telecommunications, financial services and high-tech manufacturing -- remain stressed, and as a result Oracle's sales to them have slowed markedly compared with last year.

They blamed that and a sharp slowdown in the Asia-Pacific region, in large part for the third-quarter's shortfall. Still, many of Oracle's competitors have come out recently and emphasized that their business in Asia appears to be tracking within expectations.

From a product standpoint, Oracle's applications business was weakest.

Although primarily known for its database products, Oracle has recently extended its reach into related business applications, a shift that has exposed it to intense competition from companies including Siebel Systems (SEBL: Research, Estimates), BEA Systems (BEAS: Research, Estimates) and SAP (SAP: Research, Estimates).

At the same time, Oracle's database business has faced growing competition from the likes of Microsoft (MSFT: Research, Estimates) and IBM (IBM: Research, Estimates).

Wall Street is banking on Oracle's applications business for future earnings growth. And so far, it's been off to a rough start.

In the third quarter, Oracle's new-license revenue for applications totaled $147.9 million. That's down 41 percent from $249.4 million a year earlier.

New-license revenue for database software in the third quarter fell 26 percent to $629.1 million from $851.5 million a year earlier.

Oracle executives downplayed recent reports that it is losing market share to rivals Microsoft and IBM, each of which recently has said its database revenue is improving. They called the recent trend "a temporary phenomenon" caused by the general market slowdown which has disproportionately affected Oracle's largest customers.

|