Arthur Andersen just doesn't get it.

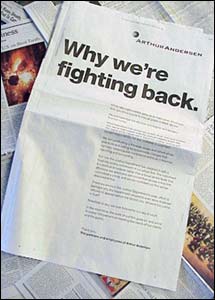

"When late-night comics gang up to make jokes about your firm, you know you're in a tough place. Indeed, we are," the besieged firm whined in full page ads Wednesday, its first court day. "We acknowledge the obvious, but forgive us if we don't find the humor."

The strait-laced Victorian outrage routine is misplaced -- Andersen is not the victim here. And if Andersen really did grasp the obvious, it'd be a little more contrite.

When it became clear the government intended to probe deeply into the Enron meltdown, accounting documents were dumped into an Andersen shredder. That makes it a little hard to figure out what Enron executives -- or any beancounters who were advising Enron executives -- were trying to put over on investors. Convenient, huh?

Andersen argues that the shredding was the action of a few rogue accountants, particularly David "Take the Fifth" Duncan, the now-ousted partner who oversaw the Houston account.

But the Feds argue that the Houston office, and other offices, were taking their cue from headquarters. Hence, the obstruction of justice charge against the company and not the individuals. That charge -- which essentially casts a shadow over Andersen's credibility as an accountant -- is leading more customers to dump the accounting firm. And its overseas units are looking to drop their connection to the U.S. operation as well.

Adam Smith would be proud -- the market is determining the fate of the company that couldn't meet the requirements of the job. In this case, credibility. When Enron imploded and the Feds got interested, Andersen should have been upfront with investigators and said, "Here's the stuff we were looking at and what we based our audits on." That's what a firm truly concerned about a crisis of investor confidence should have done.

Andersen disagrees -- remember it was the rogue accountants, not the firm, that sanctioned the shredding.

"What happened has tainted all 28,000 of us, men and women who serve their clients with the utmost integrity every day. We regret what happened in the Enron matter, and we will accept responsibility for any mistakes in judgment."

Ah, excuse me, but you're going to court in the hopes that you won't have to accept responsibility.

|

|

| Andersen's indignant ad |

And where's the integrity in a corporate culture that allows a shredder to be turned on after a government investigation is revealed -- and no one protests? Apparently it's the kind of integrity that lets you make partner. In Houston, at least.

"We are conducting a firmwide review and reform of our practices and calling for systemwide changes that can help restore public confidence and trust in financial reporting and accounting."

Better late than never, I guess. Waste Management and Sunbeam, both of which imploded in accounting scandals while Andersen was their auditor, apparently didn't give the firm enough of a hint.

There are folks who disagree with this cynical take. And there are some important points to be made. Yes, financial statements are ultimately the responsibility of a company's management. True, there is no proof, yet, that there was any crime to obstruct. Yes, Enron is the bigger fish here. And it's worth noting that Microsoft, which a judge has already decided acted illegally to support its monopoly, is getting better treatment than Andersen, which remains innocent until proven guilty.

| |

More columns

More columns

| |

| | |

| | |

|

Well, Andersen will get its day in court and lawyers will wrestle all these questions beyond reason. In the meantime, as you read their self-pitying ad, just ask: When the Enron hit the fan, did Andersen do the right thing?

Allen Wastler, managing editor of CNN/Money, can be emailed here.

|