NEW YORK (CNN/Money) -

Walter Hewlett, the dissident Hewlett-Packard director who led the proxy challenge against its proposed purchase of Compaq Computer, has taken his fight to the courthouse, hoping to invalidate last week's shareholder vote.

In a complaint filed in the Delaware Chancery Court, Hewlett alleges that executives of HP used "corporate assets to entice and coerce" Deutsche Bank to vote in favor of the proposed deal. The complaint asks the court to declare that the proposed deal was defeated at a March 19 shareholder meeting, when the final votes in the matter were collected.

The legal challenge is the latest twist in what has been one of the bitterest, most publicly-fought proxy contests in recent memory. And it is not unexpected, considering how close the outcome of the HP vote appears to have been.

Last week HP executives claimed that they had won the support of a "slim but sufficient" majority of shareholders for the proposed $21 billion deal, although it will take weeks before an official tally is returned.

Hewlett maintained that the vote remains too close to call.

It had been reported that Deutsche Asset Management initially voted its block of roughly 25 million HP shares against the deal prior to the March 19 deadline, but then changed its vote at the last minute. In a proxy vote, shareholders can fill out and submit multiple ballots, or proxies. Only the latest-dated one counts.

Over the course of the proxy battle, shareholders received multiple proxy cards from both sides. HP sent out white ones. Hewlett's were green.

|

|

| Walter Hewlett is seeking to block HP's proposed buyout of Compaq Computer. |

Hewlett's lawsuit claims that prior to March 15, Deutsche Asset Management's proxy committee had decided to vote all its shares against the proposed merger and had returned the green proxy cards to Hewlett's camp.

The suit alleges that Deutsche Asset Management's decision to vote as many as 17 million of its shares in favor of the deal at the last minute was made because HP executives had threatened to lock Deutsche Bank, its parent corporation, out of future HP investment-banking business if it had voted against it.

"Based upon HP's report that the margin of victory was extremely slim ... HP's clandestine use of corporate assets to induce or coerce votes in favor of the proposed merger tainted more than enough votes to swing the election in favor of the proposed merger," Hewlett's complaint says.

Deutsche Bank has no comment on the lawsuit.

The suit also claims that HP management "repeatedly made numerous materially false and misleading public statements" regarding the potential financial benefits of the proposed deal as well as issues related to the task of integrating the two companies' vast operations.

HP called the suit "completely without merit" and said it planned to vigorously defend it. However, the company said it had not received a copy of the complaint and therefore could offer no comment on any specific claims.

"We find it regrettable that Mr. Hewlett has chosen to resort to baseless claims without regard to the impact of his false accusations on HP's business reputation and employees," HP said in a statement. "We continue our progress in planning for a successful integration of our merger with Compaq. We look forward to the receipt of the certified vote result from the HP shareowner meeting, which we expect within a few weeks."

Compaq shareholders overwhelmingly supported the deal, approving it by a margin of 9-to-1. It generally was expected that the deal would breeze through the vote by Compaq shareholders because of the premium HP has agreed to pay for the company and the fact that the deal was unopposed.

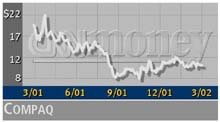

Shares of HP (HWP: up $0.10 to $17.87, Research, Estimates) were up about 1.1 percent in early afternoon trade Thursday. Compaq (CPQ: down $0.42 to $10.18, Research, Estimates) were down about 3 percent.

|