NEW YORK (CNN/Money) -

Tech stocks fell Tuesday after wary brokerage notes on leaders Microsoft and Sun Microsystems, and a profit warning from PeopleSoft, sparked fears about the timeline of a corporate profit recovery. Those fears were exacerbated by increased violence in the Middle East and its impact on global oil prices.

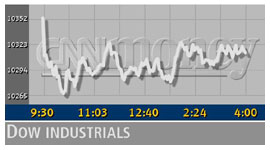

The Nasdaq composite fell 58.22 to 1,804.40. The Dow Jones industrial average lost 48.99 to 10,313.71. The Standard & Poor's 500 index pulled back 9.78 to 1,136.76.

Business software maker PeopleSoft (PSFT: down $12.21 to $25.16, Research, Estimates) was among the names warning that first-quarter results will miss previous forecasts, citing a weak spending environment. Goldman Sachs and Credit Suisse First Boston cut their earnings-per-share estimates for PeopleSoft, and Goldman trimmed its estimates for Sun Microsystems and Microsoft.

"While PeopleSoft didn't help tech, it's actually somewhat of a positive sign that there haven't been more profit warnings yet," Patrick Boyle, head financial trader at Credit Suisse First Boston, told CNNfn's Street Sweep. "There are still a lot of people on the sidelines waiting to get in, and with nothing but negative news today (Tuesday), you're gonna see some selling ... oil will continue to have an impact, but as more companies start reporting, that will be the catalyst."

Wednesday brings quarterly results from retailer Bed Bath and Beyond, expected to show a profit, and a monthly report on the services sector, expected to show a slight pull-back from the previous month.

In the latest developments in the Middle East, the Israeli military has intensified its attacks on the security headquarters in Ramallah of Palestinian Authority leader Yasser Arafat. Israeli Prime Minister Ariel Sharon has made an offer of exile to Arafat, which was promptly rejected.

The attacks also pushed the price of oil to its highest levels in six months, with Brent crude prices rising above $26 a barrel in London after Iraq called on Arab nations and Iran to use oil as a weapon against the West. In New York, light crude oil futures rose 83 cents to $27.71 a barrel. The impact was also felt by the Dow Jones transportation index, a measure of some of the biggest transportation names, which lost 2.7 percent on the day.

"There's a lot of skittishness about the Middle East, with crude prices up above $27," said Matt Ruane, director of listed trading at Gerard Klauer Mattison. "We're not going to see the situation get as dire as it did in the '70s, because we get oil from more sources now, but you will see prices continue to rise and markets will keep feeling the effects."

European markets mostly closed lower after having been closed for the Easter break, while Asian markets closed higher. The dollar was higher against the euro and mostly flat versus the yen.

Treasurys closed higher, with the 10-year note yield down to 5.34 percent.

Market breadth was negative. On the New York Stock Exchange, losers edged winners as 1.16 billion shares traded. On the Nasdaq composite, decliners topped advancers 3-to-2 as 1.67 billion shares changed hands.

Software drags down techs

A broad range of technology stocks were down, with losses in telecom, networking and software the biggest decliners.

Fellow business software maker Siebel Systems (SEBL: down $2.38 to $31.82, Research, Estimates) felt the pressure from PeopleSoft, but was also under duress after brokerage house Goldman Sachs cut its 2002 and 2003 profit expectations.

Goldman Sachs also cut third-quarter revenue and fourth-quarter earnings per share estimates for Unix server maker Sun Microsystems (SUNW: down $0.58 to $8.94, Research, Estimates), first-quarter revenue estimates on IBM (IBM: down $1.91 to $100.95, Research, Estimates) and third-quarter earnings per share estimates on software leader Microsoft (MSFT: down $3.08 to $57.30, Research, Estimates), saying that the recovery in tech is lagging a broader recovery.

Goldman Sachs also cut its first-quarter results estimates for data storage maker EMC (EMC: down $0.38 to $11.82, Research, Estimates).

The Goldman Sachs software index fell more than 5 percent.

Outside of technology, airline stocks were lower after Continental Airlines (CAL: down $1.05 to $26.60, Research, Estimates) warned that it expects to post a sharp first-quarter loss and said its expected return to profitability in the second quarter is now in question.

No. 2 automaker Ford (F: down $0.36 to $15.37, Research, Estimates) said overall sales fell 11.7 percent in March on declines in a variety of models, while General Motors (GM: up $0.28 to $59.98, Research, Estimates) sales fell 2 percent.

CIBC World Markets and Salomon Smith Barney downgraded shares of Gemstar-TV Guide (GMST: down $5.35 to $9.01, Research, Estimates) after the company filed a 10(k) late Monday that the firms say showed aggressive accounting treatment that could affect the company's results going forward.

The Redbook Retail Sales Average fell 1.1 percent in March from the previous month as Easter sales at discount, chain and department stores failed to meet expectations.

However, electronics retailer Best Buy (BBY: down $4.47 to $75.01, Research, Estimates) posted better-than-expected fourth-quarter results, while rival Circuit City (CC: up $1.03 to $19.15, Research, Estimates) saw earnings in line with expectations.

On an up note, shares of Unilab (ULAB: up $1.13 to $26.13, Research, Estimates) rose on news that the company has agreed to a buyout from Quest Diagnostics (DGX: down $3.35 to $79.44, Research, Estimates) for $1.1 billion.

Defense names traded higher on the Mideast concerns, including Dow component Boeing (BA: up $1.17 to $49.09, Research, Estimates).

In the day's economic news, orders for goods made in factories fell 0.1 percent in February after a revised 1.1 percent gain in January, the government said. The report missed the 1.0 percent rise economists were expecting and appeared to contradict recent signs of growth in the sector.

|