NEW YORK (CNN/Money) - Microsoft Corp. on Thursday logged a fiscal third-quarter profit that missed Wall Street's expectations and said its fourth-quarter revenue and earnings will fall short of recent forecasts.

At the same time, executives of the world's largest software maker said the PC industry appears to have turned a corner and is poised for a long-awaited upturn.

"While we think that it is still premature to describe the current trend as a full-scale recovery, our expectations for the June quarter and fiscal 2003 reflect some guarded optimism in the direction the market is taking," John Connors, Microsoft's chief financial officer, told analysts during a teleconference Thursday evening.

Connors made those comments shortly after Microsoft released its fiscal third-quarter results.

After the closing bell, Microsoft said it earned 49 cents per share during the quarter ended March 31. That's better than the 44 cents per share it logged during the same quarter a year ago but was 2 pennies shy of the 51 cents per share most analysts had expected, according to earnings tracker First Call.

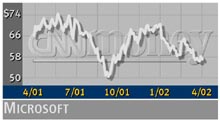

That news prompted a flurry of selling in extended-hours trade. Microsoft (MSFT: Research, Estimates) shares fell $1.48 to $54.89 on Instinet after falling modestly on Nasdaq ahead of the earnings release.

At $7.3 billion, Microsoft's revenue for the quarter rose 12.3 percent from the year-ago period. But Connors warned that revenue in the current quarter would fall to a range between $7 billion and $7.1 billion

By First Call's count, most analysts had expected Microsoft's fourth-quarter revenue to be nearer $7.7 billion.

Fiscal fourth-quarter earnings are likely to come in between 41 cents and 42 cents per share, Connors said. That's below the 44 cents per share analysts generally had expected.

Microsoft is the world's largest supplier of computer software and is the dominant supplier of operating systems with its various version of Windows.

During the quarter, the company's platforms business, which includes Windows products, had total revenue of $2.3 billion, up slightly from $2.1 billion in the year-ago quarter.

Microsoft's desktop applications business, which includes its Office productivity programs such as Word and Excel, logged $2.4 billion in revenue, essentially flat with the year-ago quarter.

Meanwhile, revenue from enterprise software and services, at $1.3 billion, also was flat with the year-ago period.

Although it has businesses in other areas, Microsoft's fortunes are tied closely to the PC industry, and the company's forecast for PC unit growth is closely watched by tech-industry observers.

During the fiscal third quarter, Microsoft estimates that total PC unit shipments declined about 3 percent, which was a more modest decline that the company had expected at the outset of the quarter.

For the current quarter, Connors said Microsoft is forecasting PC shipments that are flat-to-down slightly, which is a little bit better than the company's prior guidance in January.

"We also think that the PC market could see growth in the low single digits for fiscal 2003 compared to the low single digit declines we are expecting to see for our full-year fiscal-year with 2002," Connors said.

Xbox sales forecast lowered

Microsoft's consumer software, services and devices business, which includes its new Xbox video-game console, showed the strongest year-over-year revenue gains in the fiscal third-quarter, rising to $1.1 billion from $460 million a year ago.

Some analysts recently have expressed concerns about the pace of Xbox sales, which the company introduced in November and is positioning as a competitor to more established offerings from Sony and Nintendo.

Earlier Wednesday, Merrill Lynch said it was expecting Microsoft's consumer division to show revenue of $1.2 billion, although it said it had some concerns about the company hitting that target, given a tough start to sales of the new products in Asia and Europe.

Separately on Thursday, Microsoft said it has cut the retail prices by as much as 38.5 percent on Xbox game consoles in Australia and Europe in an effort to boost sales.

During Thursday's call, Connors acknowledged that Xbox sales have not been as robust as Microsoft had hoped, and he reined in the company's unit shipment forecast for the current fiscal year.

Noting that Japan -- the stronghold of Sony and Nintendo -- has been an especially difficult market to crack, Connors backed off the company's previous target of shipping between 4.5 million and 6 million consoles by the end of June.

"Based on our current view of the business we believe that Xbox shipments through June will likely be in the 3.5 million-to-four million range," Connors said.

Even so, Connors stressed that Microsoft will continue to invest in the Xbox endeavor. "If we execute well, we can end fiscal 2003 with an installed base of between nine and 11 million consoles," he said.

For all of fiscal 2003, Microsoft is forecasting revenue ranging between $31.5 billion and $32.4 billion. Earnings for the coming fiscal year are expected to range between $1.89 per share and $1.92 per share, Connors said.

At last count, analysts surveyed by First Call had expected Microsoft's fiscal 2003 revenue to be nearer $32.6 billion and its earnings per share for the year to come in at $2.01.

|