NEW YORK (CNN/Money) -

Alfred Taubman, the former chairman of auction house Sotheby's Holdings Inc., was sentenced to a year in prison and fined $7.5 million Monday for his role in a price-fixing scandal that rocked the art world.

Taubman, 78, was convicted of price-fixing in December by an eight-man, four-woman jury that found him guilty after two days of deliberations. The criminal fine comes on top of more than $150 million in civil penalties he had already paid.

While prosecutors had asked for a three-year sentence, Taubman's attorneys argued for probation, citing his ill health and his history of charitable giving. Taubman has suffered from a stroke and heart ailments.

The court's probation office also had recommended no jail time, and more than 90 prominent people in business, politics and education had written letters on Taubman's behalf, including former President Gerald Ford, former Secretary of State Henry Kissinger, Jordan's Queen Noor, and network anchor Barbara Walters.

U.S. District Court Judge George Daniels acknowledged Taubman's accomplishments, but said that price fixing is a crime whether the victims are the poor or the rich and mighty. He said Taubman had acted with impunity and had shown no remorse for his actions.

"No one is above the law," he said.

Prosecutors charged that Sotheby's and London-based rival Christie's International PLC conspired to set prices and commissions for six years beginning in 1993. The prosecutors charged the scheme netted the auction houses about $43.8 million in additional commissions.

During the trial former Sotheby's CEO Diana Brooks testified that Taubman asked her to collude with Christie's to fix prices. Brooks, who pleaded guilty in October 2000 to price-fixing charges, agreed to testify in hopes of avoiding prison.

Taubman's attorneys sought to place the blame on Brooks, saying she ran the New York-based auction house without consulting Taubman or the board on numerous decisions.

Taubman's sentencing comes three days after the European Commission started its own price-fixing investigation into the Sotheby's and Christie's. The two companies may face large fines in Europe but no jail time, because the European Union has no criminal anti-cartel rules.

| |

Related stories

Related stories

| |

| | |

| | |

|

"There are quite considerable differences between the two systems," said European Commission spokeswoman Amelia Torres at a press conference Friday.

The commission's 50-page "Statement of Objections'' issued on Friday, which remains secret, outlines in detail the commission's preliminary findings. Under European laws, the commission could fine the companies up to 10 percent of their annual revenue. Sotheby's agreed in early 2001 to pay $45 million in criminal fines in the United States, which was slightly more than 10 percent of its 2000 sales of $397.8 million.

Anthony Tennant, 71, the former chairman of Christie's, was indicted along with Taubman but refused to come to the United States and cannot be extradited from England to face the antitrust charges.

Besides his position with Sotheby's, Taubman had been chairman of Bloomfield Hills, Mich.-based Taubman Centers Inc. (TCO: down $0.17 to $14.95, Research, Estimates), a real estate investment trust that develops, owns and operates shopping malls. He resigned from that position shortly after his conviction. He still owns about 23 percent of Sotheby's stock.

An active philanthropist, Taubman's name is on the college of architecture and urban planning and the health-care center at the University of Michigan as well as the Center for Public Policy and American Institutions at Brown University.

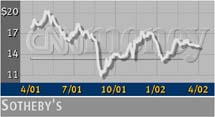

Shares of Sotheby's (BID: down $0.42 to $14.60, Research, Estimates) were off about 2 percent in late afternoon trading.

--Reuters contributed to this story.

|