NEW YORK (CNN/Money) -

Investors have been waiting impatiently for the growth that executives of AOL and Time Warner promised when the two companies merged in January 2001. They'll have to wait at least until the end of this year and possibly into 2003.

After posting a staggering net loss for the first quarter, the world's largest media company on Wednesday lowered its profit target for the year, citing ongoing weakness in online advertising sales at its America Online unit.

Richard Parsons, the company's CEO designate, said AOL Time Warner's earnings before interest, taxes, depreciation and amortization, or EBITDA, would rise between 5 percent and 9 percent this year. When the company reported its fourth-quarter results in January, executives had targeted EBITDA growth for 2002 ranging between 8 percent and 12 percent.

Most analysts focus on EBITDA when assessing AOL Time Warner and other media companies.

Parsons reiterated the company's revenue growth target of between 5 percent and 8 percent.

Parsons, who will officially take the reins of AOL Time Warner when Jerry Levin retires next month, blamed the first-quarter shortfall entirely on weakness in online advertising at America Online, which he said has performed even more poorly than expected since January.

"As we move through this year and into the next, we expect America Online to turn the corner on its advertising business and thereafter become a key driver of growth for the company," Parsons said.

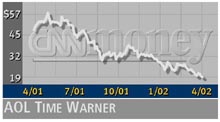

But shares of AOL Time Warner (AOL: Research, Estimates) rose to $20 in after-hours trading after closing at $19.30 on the New York Stock Exchange as investors, who had been bracing for the worst, found some encouragement in the company's latest results.

Shortly after the market closed Wednesday, the company reported a net loss of $54.2 billion for its first quarter -- one of the biggest losses in corporate history -- mostly from a one-time charge of $54 billion.

The charge reflects a decline in value of AOL's purchase of Time Warner and was recorded in accordance with a new accounting rule requiring companies to record declines in the value of acquired assets.

On an EBITDA basis, AOL Time Warner logged a profit of $2.05 billion, which compares with $1.9 billion a year earlier and was slightly above most forecasts by Wall Street analysts, who generally had expected earnings to be flat with the year-ago period.

At $9.8 billion, AOL Time Warner's first-quarter revenues rose 4 percent from $9.1 billion a year earlier and were in line with expectations. AOL Time Warner is the parent company of CNN/Money.

As expected, the company's America Online Internet service business was the weak point during the quarter.

That unit's earnings declined 15 percent on essentially flat revenue, AOL Time Warner said.

America Online, the world's largest Internet service provider, was put forward as a major selling point when executives pitched the merger to Wall Street in 2000.

But a sharp decline in online advertising spending, a substantial slowdown in new subscriber growth and difficulty in shifting customers to more lucrative high-speed connections have made the unit something of a liability to the merged company.

Earlier this month, Robert Pittman, chief operating officer of the parent company, took over as CEO of the America Online unit as well, replacing Barry Schuler, who had run it since January 2001.

Advertising and e-commerce revenue at America Online decreased by 31 percent in the first quarter, the company said.

During Wednesday's call, Pittman said he expects online advertising sales at America Online to be "in the growth mode" by the second half of this year and then gain momentum in 2003.

Other parts of the America Online business had somepositive news to report.

The company said it added 1.4 million new members worldwide in the quarter, ending it with a total of 34.6 million. That growth was a source of encouragement to some AOL shareholders.

Bill Fries, who manages the Thornburg Value Fund with $2.3 billion in assets, said he wasn't anticipating anything positive in the quarter but was pleasantly surprised by the subscription growth at America Online.

"The evidence on this call is that the growth is continuing," Fries said. "I'm not really focused quarter-to-quarter. I'm really focused on the secular trends. And I'm encouraged that the AOL subscription business looks like it's holding together and they're keeping their market share."

Meanwhile, AOL Time Warner's media businesses -- which run the gamut from movies, music and magazines to cable television operations and networks including CNN and HBO -- performed relatively strongly during the quarter.

Cash earnings from cable television operations was up 10 percent in the first quarter on a 19 percent increase in revenue .The company's film business logged a 60 percent increase in earnings on a revenue decline of roughly 3 percent.

AOL Time Warner's television networks business logged a 4 percent decline in earnings as revenue rose 5 percent. The company's publishing business -- which includes magazine titles such as Time, People and Money -- logged a 14 percent rise in earnings and a revenue gain of 3 percent.

At the same time, AOL Time Warner's music business showed a 2 percent increase in earnings on a 5 percent gain in revenue.

Executives of AOL Time Warner also said they have been seeing signs of firming in the market for advertising outside of the America Online business, especially in television.

"We are not being Pollyana-ish here or suggesting that we see the sun peaking over the horizon," Parsons said. "We do see the light at the end of the tunnel."

Shares of AOL Time Warner have plunged nearly 60 percent from $47.23, where they stood when the merger was completed on Jan. 11, 2001.

|