NEW YORK (CNN/Money) -

The price of gold surged to $308.70 an ounce Thursday morning -- its highest level since February 2000, when it touched $319 -- on worries over the situation in the Middle East and continued weakness in the dollar.

Gold broke through its long-standing range of resistance between $305 and $308 in early trading although it slipped off its morning high of $309 an ounce.

"If it can sustain this, then prices can hit $310 and even $315. But if it doesn't hold $307 it will be a disappointment," a trader said.

Already buoyed by worries about the Middle East and Japanese banking concerns, gold took flight as the dollar faded on concerns over the pace of a U.S. economic recovery, traders said.

"The situation in the Middle East has been supportive of the gold prices in the last couple of months. There's talk that Saudi Arabia, which has been friendly with the United States, may be toughening its position and hinting that the friendly ties between the two countries could become strained unless the U.S. does more to control the situation in the Middle East," Amaury de Barros Conti, gold analyst with US Investors, said.

"The dollar has seen weakness over the last few days as investors digest the slew of corporate earnings that have raised concern about a corporate profit recovery. You're looking at double-digit losses for the Nasdaq year-to-date, so people are looking for an alternative asset class. All this has supported gold prices," Conti added.

Concern that U.S. assets are overvalued -- heightened by a string of disappointing corporate earnings -- and signs that economic growth in the second quarter will not be as strong as in the first -- caused the greenback to slide lower against the euro and the yen Wednesday.

"The dollar has been sliding all day and this has simply triggered stop-loss buying all the way up," one trader said.

Worries over the pace of the U.S. recovery and corporate profitability gained ground after yesterday's weak U.S. durable goods data," Shahab Jalinoos, currency strategist at UBS Warburg, said.

"Our feeling is that we could see further dollar weakness near term," Jalinoos added.

Around 10:15 a.m. ET, the dollar was quoted at �128.47, down from �129.67 late Wednesday and hitting a six-week low against the yen.

The euro bought 89.81 U.S. cents, up from 89.23 cents late Wednesday, with the dollar reaching an almost 3-1/2 month low against the euro

Gold prices have gained more than 10 percent so far this year, largely on the Middle East tensions.

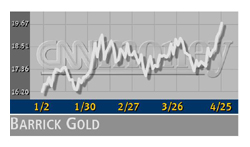

The Philadelphia Gold and Silver index was up 1.3 percent Thursday morning, while shares of a select gold stocks including Barrick Gold (ABX: up $0.49 to $19.69, Research, Estimates), Newmont Mining, (NEM: up $0.23 to $29.47, Research, Estimates) and Anglogold (AU: up $0.87 to $26.85, Research, Estimates) gained.

--from staff and wire reports

|