NEW YORK (CNN/Money) -

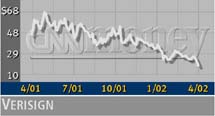

VeriSign Inc. stock got clobbered Friday after the Internet security company missed first-quarter revenue forecasts and lowered its guidance for the second quarter, prompting a host of Wall Street analysts to cut their ratings on the stock.

VeriSign (VRSN: down $8.35 to $9.89, Research, Estimates) tumbled 46 percent on 10 times its average daily trading volume, enough to make it the second most active issue on the Nasdaq.

At least a dozen Wall Street analysts downgraded the Mountain View, Calif.-based company, which assigns Internet domain names and provides products for secured transactions over the Web.

After the market closed Thursday, Verisign reported earnings of $47 million, or 20 cents a share, excluding special items and stock-based compensation. That was in line with average Wall Street forecasts, according to First Call, and up from the 14 cents a share a year earlier.

But the company's revenue came in at $328 million, up from $213 million a year earlier but well below the $342 million forecast by analysts.

Company executives also told analysts they expect VeriSign to earn 18 to 20 cents a share in the second quarter, excluding items, short of the average forecast of 23 cents, according to First Call. They also said they expect second-quarter revenue ranging from $320 million to $330 million, rather than First Call's consensus forecast of $360 million. First Call said the company earned 15 cents a share on revenue of $231.2 million in the second quarter of 2001.

"Clearly, our first-quarter results were not up to our expectations as we encountered significant spending delays in our information technology and telecom customer bases, particularly in the last few weeks of March, as well as more severe challenges in our mass markets domain name business," CEO Stratton Sclavos said.

The company said it will cut about 10 percent of its staff as part of its reorganization following the recent acquisitions of Illuminet Holdings and H.O. Systems.

The new, lower guidance produced a harsh change in outlook from many of the analysts who followed the stock.

"We believe the company's core business could shrink for the next two years," Bear Stearns analyst Chris Kwak wrote in a note to clients Friday in which he lowered the company's stock rating to unattractive from attractive. "As expected, domain names continued to weaken and [password protected transactions] experienced a slowdown."

Kwak cut his annual per share and sales forecasts to 78 cents and $1.3 billion from $1.12 and $1.5 billion, and slashed his 12-month price target for the stock to $10 from $37.

Click here to look at Internet stocks

Even those analysts who were more positive about the company did not see any immediate prospects for the stock.

"We continue to believe VeriSign is a long-term survivor. However, we believe fundamentals are not likely to improve for two to three quarters," wrote A.G. Edwards analyst Mark Jordan. "We are thus downgrading the shares to Hold from Buy and will revisit the rating as fundamentals improve."

|