NEW YORK (CNN/Money) -

A lot has happened in the last three years, but you wouldn't know it from the stock market.

The major indexes are about where they were when Bill Clinton was president, Amazon.com fetched $100 a share and people worried that Y2K computer glitches would knock the world to its knees.

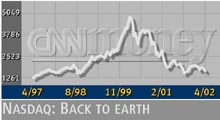

So much for progress. With the year four months old, the Dow Jones industrial average, Nasdaq composite index and Standard & Poor's 500 index are all lower in 2002 following two straight annual declines.

But will this year's market resemble 1982, when stocks began a string of nearly 19 uninterrupted annual gains? Or will it look more like 1975, when the market, following two years of losses, rose and fell in fits and starts until 1982.

Many analysts are cautious. Expensive stock valuations and cloudy profit outlooks could keep a lid on share prices. Investor distrust born of Enron's collapse and fueled by widening investigations into Wall Street's conflicts of interest may worsen. And analysts weigh the possibility of a Middle East war that could disrupt oil exports, sending energy prices higher.

Chris Wolfe, equity market strategist at J.P. Morgan Private Bank, with about $274 billion under management, tells clients to lower expectations.

"We are going into a rate-hike cycle," said Wolfe, referring to expectations the Federal Reserve will raise short-term borrowing costs this year after cutting them 11 times in 2001.

With most results in, corporate profits registered their fifth straight quarter of declines, down 11.5 percent during the first three months of the year, according to earnings tracker First Call. This is the worst stretch of corporate profit declines since 1970.

Current-quarter profits are forecast to rise 6.9 percent before gaining 27.1 percent in the third quarter and 40.3 percent in the fourth. But the risk is that these forecasts will be revised downward as the year progresses.

Wolfe sees the S&P 500 ending slightly below the 1,148-level where it began the year.

Going nowhere -- slowly

The Dow industrials first closed above 10,000 in March, 1999. After surging above 11,700 ten months later, the blue chip index fell below 9,000 when markets re-opened following the Sept. 11 attacks. It's worse for the Nasdaq, which stands at levels first hit in Sept., 1997.

Stocks haven't recorded three straight losing years since 1941. But historical precedent may be unable to keep that from happening this year.

"Prices coming down aren't the same as earnings coming up," Donald Luskin, chief investment officer at TrendMacroLytics, told CNNfn's Market Call.

Companies in the Standard & Poor's 500 trade at 19.6 times earnings forecasts for the next 12 months, on average. Fred Sears, portfolio manager at Investor Capital Funds, calls those levels pricey. "Fifteen would be normal and 10 to 12 would be correction territory," Sears said of P/E ratios.

Investors, Sears said, haven't given up on the technology and large capitalization stocks that fueled the bull market of the 1990s. That, he said, bodes for more losses ahead.

"The problem I'm having is that the Dow stocks haven't rolled over, so I'm not convinced we have a bottom," Sears said. "People are going to buy these rallies and they are going to fail and they will get hurt. The slide is not over."

Rick Campagna, managing director at Shaker Investment, with about $2.2 billion under management, says it will take time, perhaps a year, for the market to get past its range.

"It feels like the fundamentals are improving, but the stock prices are not reacting," Campagna said

With the economy uncertain, the companies Campagna says he speaks to are not confident enough to spend money on new equipment and job creation.

Economic data shows that consumer confidence in the United States, one of the few strongholds in the economy during the past year's recession, slipped in April. Still, first-quarter gross domestic product, the broadest measure of the economy's health, recorded it best showing in more than two years.

Such uncertainty has sent investors piling into gold this year. House prices have stayed high as consumers encouraged by low mortgage rates put money into tangible assets. Treasury securities have held steady following two years of gains.

"There's just no confidence out there," said Campagna. "There are probably more shoes to fall."

In another threat, U.S. stocks face competition from overseas equities. Since the end of January, international equities have outperformed the U.S. market by around 10 percent, according to Merrill Lynch

"Put simply, the U.S. equity market is perceived as expensive both in absolute and relative terms," David Bower, chief global investment strategist at Merrill Lynch, told clients. "The more the U.S. corporate sector disappoints, the less willing international investors are going to be to add to their positions in U.S. stocks - certainly at these valuations."

Investor Capital's Sears said he is bearish on the market, but could list a few scenarios that would make him wrong.

The price of "oil goes way down, the Middle East (stabilizes) and they kill (Osama) bin Laden," Sears said.

For investors facing a possible third year of stock market losses, those scenarios might be good news.

|