NEW YORK (CNN/Money) -

A late-day surge Wednesday in telecom and consumer names pushed the Dow Jones industrial average to its second day of triple-digit gains, wiping out earlier losses, but weakness in techs such as Sun Microsystems and Oracle kept the Nasdaq under pressure.

The Dow Jones industrial average rose 113.41 to 10,059.63, after being down as much as 115 points earlier in the session.

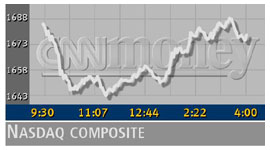

The Nasdaq composite index lost 10.70 to 1,677.53, paring its earlier losses. The Standard & Poor's 500 index gained 9.54 to 1,086.46.

"This is an oversold bounce. But we've held at the lower end of our trading range on some negative news, which is encouraging," David Briggs, head of equity trading at Federated Investors, told CNNfn's Street Sweep. "Now that we've gotten two back-to-back days of gains, we're hopeful that we can move to the middle of that range."

The major indexes had sold off in early trade following the release of some discouraging economic data, as well as negative news from tech leaders. But momentum turned positive at midday as the selling pressure abated.

The telecom sector has been beaten down in recent weeks, and WorldCom (WCOM: down $0.18 to $2.03, Research, Estimates) remained under pressure -- a day after CEO Bernard Ebbers' resignation -- after ratings agency Standard & Poor's threatened to downgrade the company's short-term credit to "junk" status.

But Dow component AT&T (T: down $0.29 to $13.67, Research, Estimates) got a boost when Comcast (CMCSK: down $0.92 to $28.87, Research, Estimates), which is buying the company's cable TV assets, posted better-than-expected quarterly results. SBC Communications (SBC: down $0.22 to $32.43, Research, Estimates) also boosted the blue-chip indicator.

Goldman Sachs reiterated its Recommended List rating and $65 price target on Dow component Coca-Cola (KO: up $0.02 to $57.64, Research, Estimates). Gains in shares of the beverage maker highlighted the other big trend in the Dow's recovery -- strength in consumer products names.

Market breadth was mixed in active trading. On the New York Stock Exchange, winners beat losers by 3-to-2 as 1.37 billion shares traded. On the Nasdaq, decliners beat advancers by 9-to-8 as 2.09 billion shares changed hands.

Sun, Oracle weakness hurts Nasdaq

The Nasdaq composite didn't fare as well as the Dow.

Shares of Sun Microsystems (SUNW: down $0.52 to $6.45, Research, Estimates) fell after the largest maker of Unix servers said that its president and chief operating officer, Edward Zander, is retiring, handing over his duties to CEO Scott McNealy. Morgan Stanley issued a negative note on the stock following the news, saying Zander was a big driver of the company's success over the last four years and that his departure is an incremental negative to the company.

Shares of Oracle (ORCL: down $0.90 to $8.55, Research, Estimates) were sharply lower after brokerage house Lehman Brothers cut its fourth-quarter and fiscal 2003 estimates for the business software maker. The firm said Oracle's chances of meeting current-quarter estimates are slim, due to a tough microenvironment and price pressure.

Hewlett-Packard's (HWP: up $0.23 to $17.09, Research, Estimates) proposed $18 billion purchase of Compaq Computer (CPQ: up $0.11 to $10.76, Research, Estimates) looks near completion after a Delaware judge dismissed shareholder Walter Hewlett's legal challenge to the merger. After the ruling, Hewlett issued a statement saying he would not appeal the decision.

"What we're gonna see now and probably for the next few days is what we saw yesterday, a little technical bounce from oversold conditions," said John Hughes, market analyst at Shields & Co.

Pace of manufacturing growth slows

The Institute of Supply Management's April report on manufacturing activity showed a larger decline than expected. The index fell to 53.9 from 55.6 the previous month, missing estimates for a decline to 55. However, a reading above 50 still indicates expansion in the sector.

Separately, the government said March construction spending was weaker than expected, showing a 0.9 percent drop versus expectations of a decline of 0.1 percent. February's increase was revised down to 0.7 percent from 1.1 percent.

"With earnings winding down and not as much to focus on, you're getting very volatile reactions to economic numbers that are actually pretty close to estimates. You're also seeing some of the defensive names that are dependent on an economic recovery trading lower," said Donald Selkin, director of equity research at Joseph Stevens.

"The market is adjusting to the fact that corporate profits may not be as high as was previously thought and that the economic recovery may move at a slower pace than it did in the first quarter," Selkin added.

In international trade, European markets closed lower. Tokyo and Sydney stocks closed higher, while other Asian markets were closed for the International May Day holiday. The dollar was stronger versus the euro and a little weaker against the yen.

Treasurys were higher, pushing the 10-year note yield down to 5.06 percent. Light crude oil futures fell 51 cents to $26.78. Gold rose to $309.40 an ounce.

|