NEW YORK (CNN/Money) - Cisco Systems Inc. Tuesday logged a fiscal third-quarter profit that improved over the same period last year and beat Wall Street's consensus estimate.

At the same time, executives of the top supplier of the hardware that links computer networks and powers the Internet said business conditions remain difficult and warned that revenue in the current quarter might be lower than most analysts expected.

During a conference call after Cisco released its latest earnings results, CEO John Chambers said the company expects revenue in the fiscal fourth quarter to be "flat with a slight upward bias" compared with $4.8 billion the company just reported for the fiscal third quarter.

Analysts on average had been expecting revenue in the June quarter to be nearer $5 billion, suggesting a 4 percent increase, according to a survey conducted by earnings tracker First Call.

"Visibility remains limited, and this should come as no surprise, given that our customers' visibility is limited," Chambers said.

He did not provide a per-share earnings estimate for the fiscal fourth quarter.

Chambers, considered by some to be the "Alan Greenspan" of the high-tech industry, also declined to provide a forecast for growth in the overall networking business, citing continuing economic uncertainties.

"In the short term, there are just too many variables in this 'show me' economy," he said.

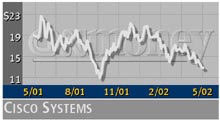

Even so, Cisco's shares rose sharply on the heels of the widely anticipated report, trading at $14.65 in extended-hours action after closing at $13.08 on Nasdaq.

After the close of trading, Cisco said it earned 11 cents per share during its third quarter ended April 27. That excludes one-time items and compares with a profit of 3 cents per share in the same quarter last year.

Analysts on average were expecting Cisco to report a profit of 9 cents per share, according to a survey conducted by earnings tracker First Call.

Accounting for one-time charges, Cisco's net income for the quarter was $729 million, or 10 cents per share, compared with a net loss of $2.7 billion, or 37 cents per share, during the year-ago quarter.

At $4.8 billion, Cisco's fiscal third-quarter revenue matched the $4.8 billion it logged a year earlier and was modestly lower than the $4.9 billion most analysts had expected, according to the First Call survey.

The latest period marked the first time Cisco showed an improvement on its bottom line in more than a year.

During Tuesday's conference call, Cisco executives said they were especially pleased with improvements in the company's gross margin, the percentage of sales remaining after subtracting product costs, which came in at 63.1 percent.

They also stressed the company's cash flows, which totaled $1.6 billion during the quarter, and its inventory turns of 7.5 times, which they said exceeded their internal goals.

"From an operational perspective, this quarter was a home run," Chambers said.

In recent years, as the dot.com balloon inflated, so did Cisco's growth rate. But when the U.S. economy stalled, the dot.com bubble burst and companies slashed technology spending, the once mighty Cisco found itself in the company of many other high-tech outfits, struggling to remain profitable.

In response to a harsh market environment, Cisco has cut jobs and shaken up its business structure, realigning its operations around core technologies rather than customer segments. During the most recent quarter, Cisco reported total operating expenses of $2.2 billion, down from $4.1 billion during the year-ago period.

Executives also have backed off of their previously aggressive growth forecast of 30 to 50 percent, saying instead that they will focus on the available market.

Chambers said the company's actions over the past several quarters have been part of a broader effort to put it in a position to take advantage of the rebound in the market.

He also sounded a word of caution about reading too much into the latest quarter's stronger-than-expected results as they relate to the broader networking industry.

"It is unclear whether our growth is due totally to market share gains or an early indicator of a potential turn in the market," he said.

Cisco derives the bulk of its revenue, roughly 65 percent, from enterprise customers and about 35 percent from service providers.

Although enterprise spending has remained under pressure as executives continue to defer technology spending despite apparent improvements in the U.S. economy, it has recovered more than spending among service providers.

Telecom carriers have slashed their capital spending over the past year, which has had a big impact on some of Cisco's rivals in that market, such as Nortel Networks and Lucent Technologies.

During the fiscal third quarter, Cisco said its sales to service providers was down "in double digits" in the United States, with particularly weak demand for fiber-optic networking equipment.

Extreme Networks Inc. and Foundry Networks Inc., smaller Cisco competitors in the enterprise sector, recently have made positive comments regarding growth in corporate demand.

|