NEW YORK (CNN/Money) -

U.S. Treasurys dropped sharply Friday but moved above daily lows set after U.S. consumer sentiment surged to its highest level in 1-1/2 years in May, prompting market players to bet the Federal Reserve will raise interest rates in August.

Two-year notes fell 6/32 of a point to 100 even, yielding 3.36 percent. Five-year notes dipped 9/32 to 99-3/32, yielding 4.57 percent.

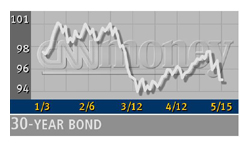

Benchmark 10-year notes shed 15/32 to 97-9/32, yielding 5.23 percent, up from 5.18 percent late Thursday, and 30-year bonds tumbled 25/32 to 94-26/32 to yield 5.74 percent, up from 5.69 percent Thursday.

The University of Michigan's preliminary consumer sentiment survey for May rose to 96.0 from 93.0 in April, beating forecasts for a slight drop and sending yields on two-year notes, the most sensitive to expectations of Fed policy, to their highest levels in a month.

The rise in the gauge of consumer confidence came after data on April retail sales earlier in the week showed a much stronger jump than economists had expected and raised hopes for a turnaround in corporate profits and capital spending. Consumers fuel two-thirds of U.S. economic growth.

"The Street can't ignore the strong economy and the stock market, and that is going to put pressure on the Fed sooner rather than later" to raise benchmark interest rates, said Dave Winter, trader at Zions First National Bank Capital Markets.

Treasurys erased all of their gains in the past three sessions scored on data showing a still stagnant labor market, a sharp drop in housing starts and mixed U.S. stocks.

"We'll probably go toward the lows for the week in Treasurys as stocks have had a good move over the past five days," Winter said. "There is still some event risk keeping Treasurys bid, but the market is still under pressure."

In recent weeks, Treasury prices have traded inversely to stocks, as investors have vacillated between safe government assets and the riskier equity market.

The sentiment data added to an already mixed view on economic performance this week, with the Treasury market knocked down Tuesday by strong retail sales numbers only to bounce back Thursday following weaker jobless claims, housing starts and regional manufacturing data.

"People are coming around to the realization that the economy has been stronger than expected and that the Fed will eventually have to raise rates, regardless of (how) the equity markets perform," said Kurt Harrison, head of U.S. government bond trading at Banc of America Securities in New York.

Technical analysts said Friday's sharp losses proved that gains from the bond market rally earlier in the week were only temporary.

In the currency market, the dollar tumbled to seven-month lows against the euro but fought back against the yen on the strong consumer sentiment report. The yen earlier had soared by 1.5 percent to its highest levels this year against the dollar after comments from a Japanese official reduced wariness of intervention to cap the currency's strength.

The euro purchased 92.14 cents, up from 91.19 cents late Thursday. The dollar bought ¥125.73, down from ¥128.17 Thursday.

-- from staff and wire reports

|