NEW YORK (CNN/Money) - Gains in U.S. tech stocks pushed the Nasdaq composite to a fifth session of gains Friday, while the Dow Jones industrial average managed to overcome early weakness to close higher, as investors closed out a strong week with a quiet day of trade.

Positive quarterly results and a forecast from Dell Computer, signs of a pick-up in chip orders and a report showing consumer confidence has held up were among the data affecting trade Friday.

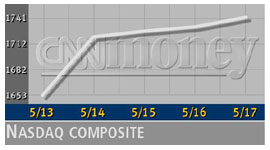

The Nasdaq composite rose 10.95 to 1,741.39; it was the composite's fifth consecutive session of gains and the first time the composite has pulled that off in seven months. On the week, the Nasdaq added more than 141 points, or around 9 percent, seeing its largest one-week rise in more than 13 months.

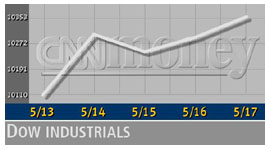

The Dow Jones industrial average added 63.87 to 10,353.08, closing above 10,300, which some traders consider to be a relevant technical level. On the week, the Dow added more than 414 points, or around 4.2 percent, its biggest weekly gain in 13 months.

The Standard & Poor's 500 index rose 8.36 to 1,106.59. For the week, it rose 51.5 points, or close to 4.9 percent, its best gain on a weekly basis since late September.

"It was a really impressive week. We were waffling a little earlier today [Friday], but I like how it closed," Kenneth Polcari, analyst at Polcari/Weicker told CNNfn's Street Sweep. "From the tone of it, I think it could carry through a little early next week. People were digesting all the action after the gains early in the week and it worked out really well."

Next week brings quarterly results from retailer and Dow component Home Depot, as well as economic reports on durable goods orders and new home sales in April, and a piece of forward-looking data, the April report on Leading Economic Indicators.

Late Thursday, No. 1 personal computer maker Dell (DELL: up $0.10 to $27.95, Research, Estimates) reported fiscal first-quarter earnings of 17 cents a share, even with the same quarter one year earlier but a penny better than estimates. Looking forward, the company expects to earn 18 cents per share in its second quarter, a penny better than current forecasts.

Following the news, brokerage firms Deutsche Bank and Credit Suisse First Boston both raised estimates on the company, but A.G. Edwards was more cautious, maintaining its "hold" rating and encouraging investors to remain on the sidelines.

"Dell had some very good numbers in what has been a weak quarter for tech, but the results are more indicative of their success in gaining market share," said Walter Winnitzki, a technology analyst who covers Dell for First Albany. "There is nothing in their statement that implies IT (information technology) spending has picked up."

Market breadth was positive on light volume. On the New York Stock Exchange, advancers beat decliners by more than 8-to-7 as nearly 1.25 billion shares traded. On the Nasdaq, winners beat losers 8-to-7 as nearly 1.62 billion shares changed hands.

Qualcomm, Network Associates among actives

Generally good market breadth rather than any stock-specific stories lifted the Dow industrials.

Johnson & Johnson (JNJ: up $1.13 to $61.47, Research, Estimates), Merck (MRK: up $1.53 to $58.13, Research, Estimates) and General Electric (GE: up $1.45 to $33.45, Research, Estimates) were among the biggest movers.

Shares of Dow component General Motors (GM: down $0.41 to $65.99, Research, Estimates) were a little weaker after the No. 1 automaker filed with the Securities and Exchange Commission to periodically sell up to $5 billion in debt securities and common and preferred stock.

US Bancorp Piper Jaffray upgraded wireless technology firm Qualcomm (QCOM: up $0.15 to $32.49, Research, Estimates) to "outperform" from "market perform," saying that the stock is attractive at current levels. The firm also raised its price target on the stock to $38 from $34.

Shares of Internet security firm Network Associates (NET: up $1.33 to $21.62, Research, Estimates) rose after the company said it is near the end of its internal probe of accounting and tax issues and it will restate results for 1998 through 2000. J.P. Morgan also upgraded the stock to "long-term buy" from "market perform."

On a positive note for semiconductors, a report that tracks North American chip equipment orders showed a rise in April for the fifth consecutive month, making the case that the sector may finally have bottomed. Orders rose 17 percent in April. The data represent a book-to-bill ratio of 1.20, which means that $120 worth of new orders were received for every $100 of products shipped.

"After the run we've had this week, I think the action today [Friday] is fine," said Jack Baker, head of equities at Putnam Lovell Securities.

In the day's economic news, the latest reading on consumer confidence from the University of Michigan showed a rise to 96.0 in May, when analysts were expecting a reading of 93.0, unchanged from the prior month, according to Reuters.

Treasurys were weaker, pushing the yield on the 10-year note to 5.25 percent.

European bourses erased early gains to close lower. Asian markets closed higher. The dollar was a little weaker versus the euro and much weaker against the yen. Light crude oil futures rose 7 cents to $27.15.

|