NEW YORK (CNN/Money) -

The stocks of some companies that specialize in technology used to enhance security at airports and other public places bucked a broader downturn Monday, extending their gains from what has been a significant run-up since Sept. 11.

Most stocks succumbed to selling pressure Monday, which traders attributed in part to comments U.S. Vice President Dick Cheney made Sunday on NBC's "Meet the Press."

The vice president said that the likelihood of another terrorist attack against the U.S. is "almost certain," saying it's "not a matter of if, but when."

Those comments, combined with a report indicating that the U.S. economic recovery may not be as robust as previously thought, led to sharp declines in all the major market indexes.

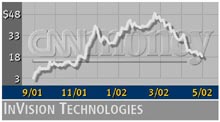

Among those standing out from the crowd was InVision Technologies (INVN: up $1.53 to $19.76, Research, Estimates), whose shares were trading more than 8 percent higher early Monday afternoon. The Newark, Calif.-based company makes explosives detection systems used at airports for screening checked passenger baggage.

Since the Sept. 11 terrorist attacks on the U.S. -- which were carried out in hijacked commercial airliners -- shares of InVision have risen more than 531 percent.

InVision is one of two companies that have been certified by the Federal Aviation Administration to supply U.S. airports with explosives detection systems.

Under the federal Aviation and Transportation Security Act, which mandates 100 percent screening of checked baggage by the end of 2002, it is estimated that more than 2,000 such machines will need to be installed by year's end.

"We're talking about a significant deployment of these machines, which sell for close to $1 million per machine," said James Ricchiuti, an analyst at Needham & Co.

As for Monday's run-up, Ricchiuti pointed out that the stock has fallen pretty sharply in recent sessions, making it an attractive buy. "Our view is that it probably got oversold, and now you're seeing some people coming back to it because there's some value there," he said.

InVision shares currently are trading at a multiple of about 10.5, based on estimated 2002 earnings of $1.87 per share. A company's multiple, or price-to-earnings ratio, gives investors an idea of how much they're paying for its earning power.

Shares of L3-Communications (LLL: down $1.17 to $126.13, Research, Estimates), the only other FAA-certified explosives detection systems supplier, trade at a multiple of 28.1, assuming 2002 earnings of $4.47 per share.

That stock has risen 99.7 percent since Sept. 11. L-3 Communications, also makes a range of other products, including flight recorders, display systems and wireless telecom gear.

Other airport security systems specialists that have seen their stocks rise sharply since Sept. 11 include ICTS International N.V (ICTS: up $0.29 to $8.04, Research, Estimates)., Based in the Netherlands, and Magal Security Inc. (MAGS: up $0.65 to $10.30, Research, Estimates) of Israel.

The stocks of companies that specialize in technology used to verify people's identities also have been on the rise since the Sept. 11 terrorist attacks.

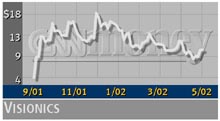

Two such firms, Identix Inc. (IDNX: down $0.21 to $7.53, Research, Estimates) and Visionics Corp., have decided to merge in the face of surging demand for their products. The merger is still subject to regulatory and shareholder approval.

Identix is the top supplier of fingerprint scanning equipment used to secure buildings and computer networks, authorize financial transactions and perform criminal background checks. Its shares have risen 79 percent since the Sept. 11 attacks.

Visionics (VSNX: down $0.28 to $10.01, Research, Estimates), which specializes in systems that key in on unique facial characteristics and compare them against a database of known criminals or terrorists, has seen its shares rise 136 percent since the attacks.

Meanwhile, facial-recognition technology specialist Viisage Technology Inc. (VISG: up $0.48 to $5.10, Research, Estimates) has seen its shares rise more than 162 percent.

Viisage's customers include 15 U.S. states which use its products in their motor vehicle departments and other agencies, as well as the U.S. Immigration and Naturalization Service.

|