NEW YORK (CNN/Money) -

U.S. Treasurys relinquished early gains and lost ground Thursday as stocks inched into positive territory after posting losses earlier in the session.

Two-year notes fell 2/32 to 100-14/32, yielding 3.22 percent. Five-year notes slid 2/32 to 99-21/32 even, yielding 4.45 percent.

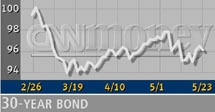

The Benchmark 10-year note lost 5/32 to 97-31/32, yielding 5.13 percent, up from 5.12 percent at Wednesday's close, and 30-year bonds dropped 8/32 to 95-30/32 to yield 5.66 percent, up from 5.64 percent late Wednesday.

"There's a lot of uncertainty about what's going to happen over the weekend," said John Roberts, head of government bond trading at Barclays Capital.

The demand for Treasurys overshadowed economic data showing a robust rise in durable goods orders during April that raised hopes capital spending is finally starting to improve and could help sustain the economy's nascent recovery later in the year.

Treasurys, particularly short-term issues, have rallied all week on new attack warnings that sent U.S. stocks sliding as investors eschewed risk and sought safety. Yields on two-year notes hit two-week lows of 3.15 percent, while prices on June 10-year futures hit their highest level since mid-November. When prices of fixed-income investments rise, yields fall.

"It's kind of the fear factor being built in here," said one floor broker at the Chicago Board of Trade.

Some investors scrambled to reverse positions betting against the market before Friday's session, expected to be very slow with many participants leaving early for the weekend. The bond market will close at 2 p.m. Friday and remain closed Monday for the U.S. Memorial Day holiday.

U.S. officials warned Tuesday of possible threats to New York's Statue of Liberty and Brooklyn Bridge during the holiday weekend, while the mounting military tensions between nuclear rivals India and Pakistan have also caught the attention of the financial markets.

After this week's rally, an uneventful weekend could prompt investors to reverse some of their bond purchases when trading resumes Tuesday, some traders said.

On the economic front, the U.S. Commerce Department said April durable good orders rose 1.1 percent, more than double forecasts for a 0.4 percent rise. Excluding defense-related orders, which strips out some of the distortions in the headline number, durable goods orders jumped 3.4 percent.

The data provided new optimism that business investment may be improving and could help power a stronger recovery later this year - something Federal Reserve officials have said they want to see before considering raising benchmark rates from four-decade lows.

"If this continues, another impediment to Fed tightening has been removed," said Carey Leahey, senior U.S. economist at Deutsche Bank.

Separately, the Labor Department said jobless claims fell slightly to 416,000 in the week ended May 18 from 425,000 the prior week. But economists have said that any figure above 400,000 suggests little new hiring in the economy. Continuing claims rose to 3.87 million, a 19-year high.

But Dallas Fed President Robert McTeer said Thursday that he doesn't expect the unemployment rate to rise above 6 percent in the near term. Last month the jobless rate jumped to 6 percent, its highest level in 7-1/2 years.

The upbeat durable goods data initially buoyed U.S. shares before the persistent attack fears erased the small gains. The Dow Jones industrial average fell 0.6 percent, while the Nasdaq Composite Index shed 1.2 percent.

In the currency market, the dollar rose against the euro and the yen. The euro bought 92.14 cents, down from 92.57 cents at Wednesday's close. The dollar purchased ¥124.98, up from ¥124.17 late Wednesday.

-- from staff and wire reports

|