NEW YORK (CNN/Money) -

Financial disappointments in the technology sector sent the Nasdaq composite index lower Thursday morning.

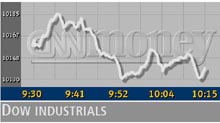

At 11:20 a.m. ET, the Nasdaq composite index slipped 18.92 to 1,654.53, while the Dow Jones industrial average lost 25.53 to 10,132.35. The Standard & Poor's 500 index fell 2.12 to 1,083.90.

Among the tech companies causing investor frowns was Ciena (CIEN: down $0.46 to $5.98, Research, Estimates). It said its quarterly net loss widened to $612.2 million, or $1.86 a share, compared with a year-earlier net loss of $50.7 million, or 17 cents a share, as the optical networking company faced a big slowdown in orders.

Sun Microsystems (SUNW: down $0.20 to $7.14, Research, Estimates) also slipped. The server maker is holding a mid-quarter business update with analysts after the close of trading Thursday.

Qwest Communications (Q: down $0.23 to $4.80, Research, Estimates), the most actively traded issue on the New York Stock Exchange, became the latest telecom to face stepper borrowing costs after Standard & Poor's cut Qwest's $26.5 billion in debt to "junk" status.

Boeing (BA: down $0.76 to $43.65, Research, Estimates) was one of the biggest losers among Dow issues. The aerospace manufacturer said Wednesday it may have to take more writedowns at its satellite unit because of product delays and repairs.

The Dow's biggest gainer was 3M (MMM: up $1.32 to $128.86, Research, Estimates). The maker of Post-it Notes and Scotch Tape said it's on track to meet 2002 earnings targets.

Offering some support to the markets: the government said durable goods orders rose 1.1 percent in April, more than twice forecasts, as factories enjoyed rising demand for a fifth straight month. Orders for computers, electrical equipment and machinery were particularly strong.

"The report should be viewed as a solid one," said Mike Moran, chief economist at Daiwa Securities.

Separate economic data showed that the number of Americans filing for first-time jobless claims fell by 9,000 to 416,000 last week as fewer people sought unemployment benefits.

Market breadth was negative. On the New York Stock Exchange, declining issues edged advancing ones as 379 million shares traded. Nasdaq losers beat winners 8-to-5 as 633 million shares traded.

Overseas, Asia's stock markets finished mixed while Europe's rose. The dollar rose against the euro and yen. Treasury securities slipped. Gold retreated from its recent highs.

Stocks on Wednesday snapped a two-day losing streak that wiped out more than half of last week's big gains. The Nasdaq began the day down 14.2 percent on the year while the Dow started up 1.4 percent in 2002.

|