NEW YORK (CNN/Money) -

The unstoppable U.S. dollar looks like it's finally been stopped, which should help the nation's troubled manufacturers but may hurt average Americans if the currency drops too far too fast.

Threats of further terror attacks in the United States, continuing weakness in U.S. stock markets and uncertainty about the U.S. economic recovery have made U.S. assets less attractive, and the dollar has been in gradual decline for much of the year.

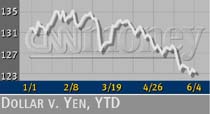

Since early February, it's down about 8 percent against the Japanese yen -- before the impact of Tuesday's intervention by the Bank of Japan to weaken the yen -- and about 9 percent against the euro.

Estimates vary widely about how far the dollar will fall. Many analysts are expecting something like a 10 to 15 percent decline in the value of the dollar against a basket of other currencies in the next two years, but the drop could be more drastic.

"Right now, it doesn't appear that the dollar is going to crash, but there are forces at work that will continue to make it weaker," said Paresh Upadhyaya, a currency strategist at Putnam Investments.

Though dollar weakness could weigh on already sickly U.S. stock prices, companies doing business overseas and those that rely on exports stand to gain.

Winners: U.S. manufacturers and exporters

U.S. exporters despise dollar strength because it makes their goods less competitive abroad and makes non-U.S. goods cheaper here, hurting their sales and earnings. Minnesota Mining & Manufacturing Co. (MMM: Research, Estimates), for example, said unfavorable currency exchange rates cut its first-quarter earnings by 3 cents a share.

"From a manufacturer's point of view, the dollar was 25 to 30 percent overvalued," said Frank Vargo, international vice president at the National Association of Manufacturers. "It's cost us a lot in exports, which have fallen $140 billion [on an annual basis], largely as result of the dollar."

U.S. manufacturers, who fell into a deep recession after businesses abruptly stopped spending money last year, have cried long and loud for policy makers to intervene and bring the dollar down.

They haven't had much luck getting the U.S. Treasury Department to act against the dollar, but other forces may now be doing the job, which will tend to push their sales and earnings higher.

Manufacturers and some analysts have said a weaker dollar will spur greater production, hiring and business spending, which Federal Reserve Chairman Alan Greenspan has called crucial to the broader U.S. economic recovery.

"Manufacturing has begun to turn around, but it's pulled down by the export sector," Vargo said. "We've never had a robust recovery without exports pulling it out, and we can't do that with an overvalued dollar."

Winners: Other U.S. firms with global exposure

In March, fast-food chain McDonald's Corp. (MCD: Research, Estimates) warned that its quarterly and annual earnings would miss Wall Street expectations, in part because of a stronger U.S. dollar.

The Oak Brook, Ill.-based chain operates about 30,000 stores in 121 countries. A falling dollar will increase the value of its overseas revenues, thus boosting overall sales and earnings.

Other large U.S. non-manufacturing companies with significant exposure abroad include consumer-products maker Procter & Gamble Co. (PG: Research, Estimates), soft-drink maker Coca-Cola Co. (KO: Research, Estimates) and cigarette maker Philip Morris Cos. (MO: Research, Estimates)

Losers: Overseas exporters

Overseas exporters, on the other hand, could suffer. Japan, especially, is relying on exports to the United States to support its recovery from a long recession.

"Japan definitely would like to stop this trend of a rising yen," Merrill Lynch senior financial strategist David Horner told CNNfn's Street Sweep program.

But the pain could also encourage Europe, Japan and other economies to make what analysts say are much-needed reforms to make them more competitive and help them shoulder more of the burden of the global economy.

"A soft landing [by the dollar] would be just what the doctor ordered. It would go a long way in facilitating the rebalancing that a U.S.-centric global economy so desperately needs," Morgan Stanley chief economist Stanley Roach said in a recent research report.

A dollar crash -- an unlikely event, most analysts believe -- would be a different story, immediately hitting U.S. equity markets and sapping U.S. consumer confidence while also hurting non-U.S. exporters all at once.

"If the dollar crashes, the global economy could be in serious trouble," Roach said.

Loser: The Fed

If the dollar's value drops sharply, then it will take more dollars to buy U.S. assets and goods, flooding the market with dollars. Meanwhile, Americans will pay more for imported goods. The result would be the return of that long-forgotten beast, inflation, which Greenspan and central bankers have kept in check for several years.

Though most economists doubt there's much danger of a return to the roaring inflation of, say, the 1970s, even a slightly weaker dollar, combined with an expected economic resurgence in the United States, could put upward pressure on prices, however mild.

That, in turn could force the Fed to start raising interest rates sooner.

Winner: TIPS

The possibility of higher U.S. inflation means a corollary winner in a weak-dollar scenario could be Treasury Inflation-Indexed Securities (TIPS), U.S. Treasury bonds with an interest rate tied to inflation.

| |

Related links

Related links

| |

| | |

| | |

|

"Our accounts are maximized to TIPS exposure. Where we can do it within a client's investment objective, we are 100 percent in TIPS and have been there for 6 months," said David Kotok, President and Chief Investment Officer at Cumberland Advisors in Vineland, N.J. "It doesn't take much inflation for TIPS to have very superior returns. If the dollar weakens, they will only be higher."

Winner: ECB, Bank of Japan, other overseas central banks

During the synchronized global economic downturn that began early in 2001 and intensified after the Sept. 11 terror attacks, central banks around the world were often criticized as being hopelessly unresponsive to economic weakness and too slow to cut interest rates. A weaker dollar could do their work for them.

"In all countries, the inflation outlook will be brigher, and central banks will keep policies looser," said Rory Robertson, interest rate strategist at Macquarie Equities (USA).

Losers: U.S. consumers

While the Fed is raising short-term rates, U.S. corporate and government bond prices would also likely fall if investors moved money overseas, leading to higher longer-term interest rates, since bond yields move higher when prices fall.

Lower short-term rates would make the cost of borrowing higher for consumers. Lower longer-term rates would push mortgage rates higher, finally undercutting the red-hot housing market. Both would weaken consumer spending, which fuels about two-thirds of the U.S. economy.

Winners: Overseas stock and bond prices

Weakness in U.S. equity markets has encouraged non-U.S. investors to keep more of their money at home. Meanwhile, several U.S. money managers have been moving money into overseas markets in recent months, and others are just waiting for the right moment to do so.

"We've had a bias to buy international equities, but we haven't acted on it yet," said Art Micheletti, chief investment strategist at Bailard Biehl & Kaiser in Foster City, Calif., who is waiting for economic reforms in Japan -- coming this fall, he thinks -- to sink stocks on the Nikkei index, presenting a buying opportunity.

|