NEW YORK (CNN/Money) -

Chip stocks were pummeled Friday following an after-the-bell revenue and profit warning from industry leader Intel the day before.

Although there were some exceptions, particularly among computer software makers, most other technology stocks ended Friday's session lower as well. The Nasdaq composite index, which is weighted heavily with technology names, fell 19.40 points to 1,535.48, a 1.3 percent decline on the day.

Shares of Intel (INTC: down $5.00 to $22.00, Research, Estimates) were among the most-active and biggest decliners on Nasdaq, tumbling more than 18 percent as investors fretted over the company's latest financial guidance.

During a regularly scheduled mid-quarter update after the close of trading Thursday, Intel's chief financial officer lowered the company's targeted revenue range, citing particularly weak demand in Europe. He also warned that Intel's gross margin, a key measure of profitability, would fall below expectations as well.

Intel is now aiming for revenue ranging between $6.2 billion and $6.5 billion, according to Andy Bryant, the company's CFO. Intel had entered the quarter targeting revenue in a range between $6.4 billion and $7 billion.

Most company watchers had expected Intel to rein in its revenue estimates, but the magnitude of the adjustment the company announced was much greater than had been expected.

What raised more alarm bells was the company's new forecast for its second-quarter gross margin, which is the percentage of sales remaining after subtracting product costs. Bryant said Intel's gross margin during the period will be roughly 49 percent, where the company's previous goal was for a gross margin nearer 53 percent.

Merrill Lynch, which downgraded its rating on Intel to "neutral" from "strong buy" on Thursday ahead of the company's update, called it a "shocker."

On Friday, the firm, which recently had been among the more bullish on Intel's prospects, cut its earnings estimate for the company in the second quarter to 12 cents per share from 17 cents per share.

"We'd love to tell investors that we anticipated Intel's problems, but we did not," Merrill Lynch analyst Joe Osha wrote in a research note to clients.

"What we can say, however, is that expensively valued stocks are poorly prepared for surprises like the one Intel delivered yesterday," Osha added.

The company's announcement also prompted further brokerage downgrades. J.P. Morgan cut its rating on the stock to "buy" from "market perform." CIBC World Markets downgraded Intel's shares to "buy" from "strong buy."

During Thursday's conference call, Intel's Bryant said the company remains optimistic that there will be a seasonally stronger second half, as is typical for the company. The second half of the year typically is stronger for Intel as sales of PCs and other electronics increase during the back-to-school and holiday buying seasons.

But Bryant failed to provide any concrete evidence proving that the second half would show the same kind of business improvements in historically has, rekindling investor fears about slack demand for PCs and a protracted downturn in technology spending across the board.

Advanced Micro Devices (AMD: down $0.80 to $9.81, Research, Estimates), which ranks a distant second to Intel in worldwide PC processor sales, fell in sympathy, ending Friday's session more than 7 percent lower.

Robertson Stephens on Friday downgraded its rating on AMD's shares to "market perform" from "buy," tying the rating change in large part to Intel's announcement.

At the same time, J.P. Morgan downgraded AMD's shares to "market performer" from "buy." The firm said a lack of any major product introductions planned and customers' apparent reluctance to react to additional price cuts are likely to result in a relatively weak second half of the year.

Shares of computer memory-chip maker Micron Technology (MU: down $0.15 to $22.15, Research, Estimates) also fell.

Elsewhere, shares of RF Micro Devices (RFMD: down $5.12 to $10.12, Research, Estimates), which specializes in chips used in wireless communications devices, tumbled more than 33 percent after it also warned of a quarterly shortfall. The company early Friday said it expects to break even in the current quarter, where previously the company had said it was aiming for earnings ranging between 2 cents and 3 cents per share.

Other chip stocks ending Friday's session sharply lower included: Texas Instruments (TXN: down $1.29 to $26.40, Research, Estimates); LSI Logic (LSI: down $0.29 to $10.31, Research, Estimates); Xilinx (XLNX: down $0.44 to $30.49, Research, Estimates); Lattice Semiconductor (LSCC: down $0.28 to $9.57, Research, Estimates); Novellus Systems (NVLS: down $0.90 to $40.00, Research, Estimates); and Teradyne (TER: down $0.76 to $26.08, Research, Estimates).

Meanwhile, shares of nVidia (NVDA: down $0.31 to $32.30, Research, Estimates), the top supplier of graphics accelerator chips for PCs, took back some of their earlier losses, ending the session modestly lower after falling sharply earlier in the session. J.P. Morgan cut its rating on that stock to "market performer" from "buy," citing lackluster PC demand among the reasons for the lowered expectations.

The Philadelphia Stock Exchange's semiconductor index, a key chip-industry barometer, ended the session 12.6 points lower at 440.96, a 2.8 percent decline on the day.

Shares of PC makers Dell Computer (DELL: down $0.19 to $26.28, Research, Estimates) and Gateway (GTW: down $0.09 to $5.01, Research, Estimates) also finished lower.

At the same time, shares of Hewlett-Packard (HPQ: up $0.34 to $18.69, Research, Estimates), now the world's largest supplier of PCs since it purchased Compaq Computer last month, ended Friday's session higher.

But for the most part, computer hardware stocks ended lower. The Goldman Sachs computer hardware index, which lists the stocks of companies that make a wide range of computer hardware products, fell 1.33 points to 199.52.

Meanwhile, sharp gains among some select names helped buoy the computer software segment.

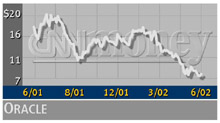

Shares of Oracle (ORCL: up $0.21 to $8.36, Research, Estimates), which have been pressured recently amid concerns about the quality of its forecasted quarterly earnings, were among those ending Friday's session comfortably in the plus column. The company on Friday dismissed as "untrue" an analyst report that said it will lay off as many as 600 more workers.

Last week, Oracle cut 200 positions that it said became redundant after the company restructured its struggling applications business.

Other computer hardware makers' shares ending Friday's session higher included: BEA Systems (BEAS: up $0.83 to $11.26, Research, Estimates); Micromuse (MUSE: up $0.24 to $6.74, Research, Estimates); Symantec (SYMC: up $1.32 to $31.72, Research, Estimates); Tibco (TIBX: up $0.34 to $5.49, Research, Estimates) ; and Sybase (SY: up $0.27 to $12.52, Research, Estimates).

The Goldman Sachs computer software index ended Friday's session a fraction of a point higher at 117.98.

|