NEW YORK (CNN/Money) -

The black clouds look likely to remain over U.S. stock markets this week, with market watchers saying things may have to get even worse before they can start to rally.

"You can not pick up a newspaper and not read about a variety of situations, any one of which could blow up in our face at any time," said Jeffrey Benton, a New York Stock Exchange trader with Performance Specialist Group. "And when you overlay that with the lousy earnings and seeing CEOs being taken away in handcuffs, it just leads to a very bad sentiment."

Worries about international conflict persisted last week with bomb explosions in Israel and Pakistan, while corporate governance also seized the spotlight with the arrest of former ImClone Systems (IMCL: Research, Estimates) CEO Sam Waksal for alleged insider trading.

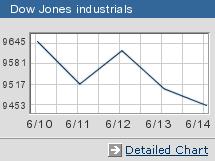

The Dow Jones industrial average finished the week down 1.2 percent at 9,474.21, its lowest level since November 5. The Nasdaq composite index fell 2 percent for the week to close at 1,504.74, continuing to approach its lows of Sept. 21, which were 1423.19. The Standard & Poor's 500 index lost 2 percent for the week to close at 1,007.27.

Douglas Altabef, managing director of Matrix Asset Advisors, said that for things to get better in the stock markets, they first may simply have to get worse.

"There's way too much of a disconnect between economic news and market sentiment," Altabef said. "No one likes to endure things getting worse before they get better but maybe that's what has to happen. It could shake out the sellers."

Economic news was less than encouraging toward the end of last week, with disappointing retail sales and consumer sentiment numbers. But economists and market strategists insist that doesn't alter the fact that we're in the midst of an economic recovery. The key is whether the markets continue to ignore that fact.

"It's hard to interpret that what the market is doing is primarily driven by the economy in any way," said Bill Cheney, chief economist at John Hancock Financial Services. "It's the front page news stories rather than the business page news stories that are driving things."

Cheney said this week's economic news, highlighted by the Consumer Price Index and housing numbers on Tuesday, are barely even a story, given that there's little concern about inflation and that the strong housing market being "old hat."

He added that economic growth should eventually become evident in corporate profits, but when that happens is anybody's guess.

"What's going on in the economy is that we've got a bit of a recovery going and almost no increase in costs," Cheney said. "Most of the growth should be dropping to the bottom line sooner rather than later."

Can profits bring some sunshine?

On the earnings calendar this week are four major brokerage houses. Lehman Brothers (LEH: up $1.82 to $59.84, Research, Estimates) kicks off the week Tuesday, expected to earn $1.05 per share in the second quarter, down from $1.38 per share in the year-ago period.

Two financial players report Wednesday. Morgan Stanley (MWD: Research, Estimates) is expected to earn 72 cents per share in the quarter compared with 82 cents per share earned in the same period of 2001. Bear Stearns (BSC: Research, Estimates) is expected to earn $1.20 per share in the quarter compared with $1.18 per share for the same period in 2001. Goldman Sachs (GS: Research, Estimates) reports its results Thursday; it expects to earn 99 cents per share, down from $1.06 per share earned in the second quarter of 2001.

Two big electronics retailers, Best Buy (BBY: Research, Estimates) and Circuit City (CC: Research, Estimates), are also on the cards. Analysts are predicting earnings of 21 cents for Best Buy's first quarter of fiscal 2003, up from 17 cents in the year-ago period. Circuit City is expected to earn 7 cents per share for the first quarter, up from 5 cents per share in the same quarter a year ago.

Tech investors will be watching after the bell Tuesday as Oracle (ORCL: Research, Estimates) reports. The software firm is expected to report fourth-quarter earnings of 12 cents per share, down from 15 cents per share, on revenues of about $2.58 billion, lower than the $3.26 billion it reported in the same quarter last year.

"People are no longer going to believe that earnings are going to pick up until they actually see it," Performance Specialist's Benton said. "Until those earnings numbers are actually produced, people are going to be pretty skeptical."

Matrix's Altabef said bellwethers, earnings guidance, and industry reports will be the most important factors in driving the markets higher next week.

But Timothy Ghriskey, president of Ghriskey Capital Partners, said earnings are always going to be mixed in an economic recovery and that other underlying issues need to be addressed for the markets to pick themselves up off the mat.

"If you're talking longer term the real issues are geopolitics and corporate governance," Ghriskey said.

He said those issues could only be solved with the passage of time, however looking just at this week he said there is a definite possibility of the markets coming off their lows.

"We could easily see, in a one-week period, a relief rally from oversold conditions," Ghriskey said. "In a way that's what we (saw Friday) when the market opened down so severely on somewhat limited bad news and saw an intraday relief rally."

But the specter of bad news still hovers, and Altabef said any number of things could trigger another selloff this week.

"Everything is grist for the mill right now," he said. "Market sentiment tends to run past the point of rationality good or bad, and right now its bad."

|