NEW YORK (CNN/Money) -

U.S. stocks closed out a brutal week with more losses Friday, with the Dow Jones industrial average falling sharply on a brokerage downgrade of retailer Home Depot and a negative report on the mindset of the consumer.

On Friday, the Dow Jones industrial average fell 117 to 8,684.53. The Nasdaq fell 0.93 to 1,373.50. The Standard & Poor's 500 index lost 5.98 to 921.39.

For the week, the Dow lost 694 points, or 7.4 percent, its biggest weekly decline since the week of Sept. 21, the first week of trade after the markets were closed amid the attacks of Sept. 11. It was also the fourth-biggest weekly point loss ever for the Dow, according to Ned Davis Research. For the year, the Dow is down more than 13 percent.

The S&P 500 index lost 6.8 percent for the week, also its worst week since Sept. 21st. Year-to-date it has lost nearly 20 percent.

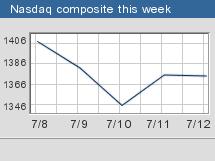

For the week, the Nasdaq lost almost 5.2 percent, its worst weekly drop in about three months. It is down nearly 30 percent year-to-date.

"It's a brutal market. I've been doing this for more than 30 years and I've never seen anything like this," Peter Mancuso, a New York Stock Exchange member of Performance Specialist Group, told CNNfn's Street Sweep.

Next week brings the heaviest period of reporting results for the just-completed second quarter. Software maker Microsoft (MSFT: down $1.05 to $51.86, Research, Estimates), chipmaker Intel (INTC: down $0.26 to $17.99, Research, Estimates), automaker General Motors (GM: down $1.12 to $46.60, Research, Estimates), beverage maker Coca-Cola (KO: down $2.06 to $51.05, Research, Estimates), Unix server maker Sun Microsystems (SUNW: down $0.13 to $5.27, Research, Estimates) and drugmaker Merck (MRK: up $1.27 to $45.55, Research, Estimates) are among the many influential companies due to report.

The University of Michigan's preliminary reading of consumer sentiment fell to 86.5 in July from a 92.4 reading in June, according to a Reuters report. Economists surveyed by Briefing.com were expecting a reading of 93.

The data unnerved some market watchers on concerns that these results could indicate a slowdown in consumer spending. Such spending fuels about two-thirds of the economy and has largely held up throughout the stock market's recent declines.

Computer hardware leader Dell Computer (DELL: up $1.10 to $25.03, Research, Estimates) said late Thursday that sales and profit in its quarter ending Aug. 2 should come in higher than previously forecast, thanks to growth in its U.S. education, government and consumer business segments.

Dow component and diversified manufacturer General Electric (GE: up $1.25 to $28.60, Research, Estimates) posted second-quarter earnings of 44 cents a share that were in line with expectations and higher than the 39 cents per share earned a year earlier.

But Home Depot (HD: down $2.31 to $29.09, Research, Estimates) fell after Merrill Lynch downgraded the retailer to "neutral" from "strong buy," citing sluggish sales, depleted inventories and more competition. The news dragged down the Dow's other retailer, Wal-Mart Stores (WMT: down $1.33 to $52.85, Research, Estimates).

Other big decliners included Procter & Gamble (PG: down $2.32 to $83.63, Research, Estimates) and Coca-Cola (KO: down $2.06 to $51.05, Research, Estimates), consumer products companies that would be affected should consumer spending slow down.

After the close of trade, FleetBoston Financial (FBF: down $0.26 to $29.04, Research, Estimates) announced that it was shutting down its Robertson Stephens investment bank.

"Clearly, we're not out of the woods yet," said Peter Cardillo, director of research at Global Partners Securities.

Tech losses countered by Juniper

Techs were spared worse losses thanks to Dell and a pair of positive quarterly results from two heavily traded companies.

"The Nasdaq stocks that have been the most beaten up are rallying, and that's a positive," said John Hughes, market analyst at Shields & Co.

Shares of network gear maker Juniper Networks (JNPR: up $0.48 to $7.70, Research, Estimates) rose after the company said late Thursday that it posted a small profit in its second quarter due to cost cutting. On a per-share basis, the company reported breakeven results, excluding items, down from the 9 cents earned a year earlier. Analysts were expecting a loss of a penny per share. The company also said it will cut about 10 percent of its work force, due to an acquisition.

Juniper rival Cisco Systems (CSCO: up $0.33 to $14.38, Research, Estimates) also rallied on the news, as well as Nextel Communications (NXTL: up $1.08 to $4.40, Research, Estimates) and others in related sectors.

Memory chipmaker Rambus (RMBS: up $0.38 to $5.05, Research, Estimates) reported fiscal third-quarter earnings late Thursday of 6 cents a share, in line with estimates but better than the 4 cents per share earned a year earlier. The company cited a reduction in litigation costs as the reason for the profit growth.

Also helping techs was a deal in the semiconductor sector. Veeco Instruments (VECO: down $4.44 to $18.05, Research, Estimates), which makes micromanufacturing gear, has agreed to buy FEI (FEIC: up $1.95 to $24.01, Research, Estimates), a chip gear maker, for $1 billion in stock.

"The action is pretty good considering everything. If we can basically hold up through the close, that may confirm for some people that we have set a temporary bottom that could hold up for the next week or two," Shields & Co.'s Hughes said.

In other economic news, June retail sales rose 1.1 percent last month, topping expectations, the Commerce Department said.

Treasury prices rose as the stock selling picked up, pushing the 10-year note yield down to 4.59 percent. The dollar fell versus the yen and the euro. Light crude oil futures rose 65 cents to $27.48 a barrel in New York. Gold and silver fell in U.S. trading.

European markets and Asian stocks finished mostly higher.

Market breadth was negative. On the New York Stock Exchange, losers beat winners by almost 4-to-3 as 1.54 billion shares changed hands. On the Nasdaq, decliners edged advancers 9-to-8 as 1.95 billion shares traded.

|