NEW YORK (CNN/Money) -

Treasury bonds jumped Friday as investors again sought shelter as stocks tumbled further, while the dollar fell yet again against the euro and the yen.

Meanwhile, gold prices jumped to a three-week high, as investors sought other safe havens for their money. Gold for August delivery rose $6.80 to $323.90 an ounce on the New York Mercantile Exchange, its highest level since June 26.

Two-year Treasury notes rose 3/32 of a point to 100-25/32 to yield 2.45 percent, while five-year notes rose 8/32 of a point to 102-31/32, yielding 3.69 percent.

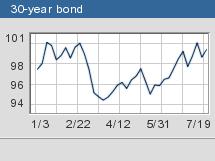

The benchmark 10-year notes gained 12/32 of a point to 102-13/32 to yield 4.55 percent, while 30-year bonds jumped 1-6/32, more than a full point, to yield 5.33 percent.

Ten-, five- and two-year Treasury note yields, which move in the opposite direction of prices, pushed to fresh eight-month lows, taking back a rise in yields from earlier this week.

Traders said people were flocking to bonds as stocks tumbled.

"We're getting a flight-to-quality bid on equities," said John Angelos, first vice president of Salomon Smith Barney and a Eurodollar broker at the Chicago Mercantile Exchange. "Our bid is definitely coming off of stocks."

The Dow Jones industrials sank 390 points Friday -- its seventh worst one-day point loss -- to close at its lowest in more than four years. Accounting scandals, worries about the economy and corporate profits, and global tensions have combined to sap investor confidence.

On the economic front, consumer prices in the United States rose slightly in June as inflation remained a distant threat to the economy but separate data showed the country's trade balance worsened.

The Labor Department said its consumer price index, which measures retail prices paid by consumers, rose 0.1 percent in June after holding steady in May. Economists expected a 0.1 percent rise in the CPI, according to Briefing.com.

Separately, the Commerce Department said the U.S. trade deficit jumped to $37.6 billion in May, a record, from a revised $36.1 billion in April. Economists expected the deficit to fall to $35.3 billion, Briefing.com said.

The so-called "core CPI," which excludes often-volatile food and energy prices, rose 0.1 percent in June after rising 0.2 percent in May. Economists expected core CPI to rise 0.2 percent, according to Briefing.com.

Dollar weakens against euro, yen

In the currency market, the dollar weakened early Friday on news of the widening U.S. trade deficit in May, sinking to its lowest level against the euro in 2-1/2 years, troubled by the prospect of further losses on Wall Street.

"The market is focusing on the negatives when it comes to U.S. corporate earnings and this is keeping the dollar under pressure," said Neal Kimberley, senior foreign exchange manager at Bank of Tokyo-Mitsubishi.

The dollar also slid back toward 17-month lows against the yen, raising concerns that Japan could intervene to curtail its currency's export-damaging strength.

At 3:35 p.m. ET, the euro bought $1.01, slightly changed from late Thursday

The dollar purchased ¥115.77, down from ¥116.57 late Thursday.

Dealers said the dollar still was reeling after the Federal Reserve Bank of Philadelphia said Thursday its business conditions index fell in July to its lowest level since December 2001.

"The worry is that weak stocks will spill over into the real economy, creating a vicious spiral," said Shahab Jalinoos, currency strategist at UBS Warburg.

Dealers remained uncertain whether Japanese authorities would return to the market to stem the yen's rise.

Japan sold yen for dollars on at least seven days in the past two months but has been absent in recent weeks, even as the dollar has continued its decline.

"From Japan there have been plenty of verbal warnings but, frankly, actions speak louder than words and the market is looking for clear direction now," said Mark Henry, currency strategist at GNI.

Some traders predicted Japan would only be stirred into action if the dollar were to fall below 115 yen -- a level that Japan's finance minister, Masajuro Shiokawa, said he wanted to protect earlier this month.

--from staff and wire reports

|