NEW YORK (CNN/Money) -

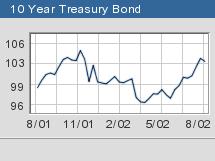

Yields on two-year U.S. Treasury notes fell to a record low Friday after weaker-than-expected U.S. employment data hammered hopes for a U.S. economic recovery and bolstered arguments that the Federal Reserve might have to resume cutting interest rates.

Around 3:30 p.m. ET, two-year notes were 9/32 higher at 100-17/32, taking their yield to 1.98 percent from 2.13 percent late Thursday. The five-year note jumped 22/32 to 105-5/32 to yield 3.19 percent against 3.35 percent Thursday.

The benchmark 10-year note leapt 30/32 to 104-21/32, leaving its yield at four-decade lows of 4.28 percent, while the 30-year cash climbed 1-8/32 to 102-16/32, sending its yield to eight-month lows at 5.21 percent, down from 5.29 percent on Thursday.

As prices of Treasurys rose, yields on two-year notes dropped below 2.0 percent for the first time ever, breaking the previous intraday trough of 2.02 percent and bringing the fall for the last three sessions to a huge 49 basis points, nearly one-half percentage point.

"They're anticipating another rate cut. And as a result, shorter-term maturities seem to be getting the benefit of the money going into the bonds right now," said George de Marcilla, head bond trader at Alaron Trading.

"Just hold on tight. As long as the stock market is selling, people will want to be in bonds," de Marcilla added.

U.S. July employment data released on Friday showed U.S. payrolls grew by just 6,000 jobs, well below analysts' forecasts of a still-modest 69,000 new jobs. June payrolls growth was revised upward to 66,000 from 36,000.

While the July unemployment rate held steady at 5.9 percent, as expected, the average workweek suffered an unexpected 0.6 percent decline and manufacturing hours plunged 1.0 percent.

"These figures were horrific," said Ifty Islam, head of fixed income strategy at Deutsche Bank Securities. "The drop in hours worked was a shocker and might force the Street to revise down its expectations for third-quarter growth."

The weak employment report was only the most recent of the soft economic data investors have had to absorb lately. It followed hard upon a 5.7 point plunge in the July manufacturing ISM/NAPM index, reported on Thursday, a drop that Goldman Sachs & Co. economist Jan Hatzius termed a bad omen.

Since 1960, Hatzius said, the ISM/NAPM index has experienced only 13 month-to-month declines of more than 5 points and all but three of those drops came either during or shortly before a recession, as defined by the National Bureau of Economic Research. Hatzius called the July ISM/NAPM survey of the manufacturing sector "shockingly weak," and said it signaled real losses in economic activity, not just a temporary deterioration in the atmosphere.

As a consequence of recent weak economic data, Goldman trimmed its economic growth forecast to an annual 2.5 percent rate in the third quarter and 2.0 percent in both the fourth quarter of this year and in the first quarter of 2003.

Goldman also predicted the Fed would chop 75 basis points from the 1.75 percent benchmark fed funds rate by year-end. Fed funds are already at 40-year lows after 11 rate cuts last year.

Other support for the safe-haven bond market came from talk that a European financial institution was in trouble, though traders were unsure what to believe as numerous rumors swept across the market.

David Horner, senior economist and fixed-income strategist at Merrill Lynch Government Securities, said it was most improbable the Fed would raise rates in the foreseeable future. He said the big debate is over whether the Federal Reserve will cut interest rates again.

"Merrill's official opinion is that the Fed will hang in there and leave rates steady, but it's a close call," he said.

Dollar slips against the euro, yen

In the currency market, the dollar fell across the board Friday on a soft U.S. jobs report after a slew of sluggish economic data in recent days cast doubt on the pace of the U.S. recovery.

Around 3:30 p.m. ET, the euro bought 98.64 U.S. cents, slightly higher from 98.36 cents late Thursday, while the dollar bought ¥118.96, down from ¥119.28 late Thursday.

After tracking global equity markets higher at the start of the week, the dollar resumed its downward path Thursday as a shock slide in a key U.S. manufacturing index fueled concern the economy could slow down again in the second half of the year.

"The market is now highly sensitive to weak economic data and has already started to position for a disappointing U.S. jobs report," said Ian Stannard, currency strategist at BNP Paribas.

-- from staff and wire reports

|