NEW YORK (CNN/Money) -

Stocks wrapped up their sixth consecutive losing week with a down session Friday that saw investor confidence shot by the latest round of corporate profit warnings.

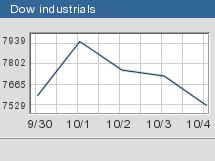

The Dow Jones industrial average (down 188.79 to 7528.40, Charts) sank 2.5 percent, bringing the world's most widely watched stock index to its lowest close since mid-November 1997, during the Asian financial crisis.

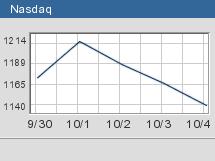

The Nasdaq Composite (down 25.66 to 1139.90, Charts) lost 2.2 percent to hit another six-year low, while the Standard & Poor's 500 index (down 18.37 to 800.58, Charts) also fell 2.2 percent.

For the week, the Dow lost 2.2 percent, the Nasdaq fell 4.9 percent and the S&P dropped 3.2 percent.

A government report that showed unemployment fell in September sparked a short-lived rally early in the session. The unemployment rate dipped to 5.6 percent from 5.7 percent in August, below economists' forecasts of 5.9 percent. But the economy lost 43,000 jobs in September compared with an upwardly revised 107,000 gain the previous month.

An earnings warning from Schering-Plough bruised the drug sector, while Boeing's warning and a multibillion-dollar judgment against Philip Morris took apart the blue-chip index.

Meanwhile, EMC's warning and weakness in chip stocks tormented the Nasdaq.

Stocks suffered some huge swings early in the week. On Monday, stocks closed the book on the most abysmal September and third quarter since the Great Depression. Tuesday's session marked the only up day for the indexes this week, while a growing list of warnings from techs and financials stifled any attempts to sustain a rally.

|

| |

|

|

|

|

Friday's trading session ended with sharp losses; the Dow declined 188 points and the Nasdaq lost 25 points. Friday's trading session ended with sharp losses; the Dow declined 188 points and the Nasdaq lost 25 points.

|

|

Play video

(QuickTime, Real or Windows Media)

|

|

|

|

|

In another gauge of the markets' vulnerability, the Wilshire 5000 Total Market Index, which tracks all U.S. stocks trading on the major indexes, closed at a five-year low of 7,598.66. It last closed below 7600 on May 1, 1997.

But next week could start with a volatile session Monday, according to some market watchers, as investors await President Bush's address to the nation on the situation in Iraq scheduled for later in the day.

"All eyes will be on Monday evening, when the president speaks on Iraq. It certainly should be a volatile day and the rest of the week could be the same as we get the earnings numbers later in the week," Mike Murphy, head of equity trading with Wachovia Securities, told CNNfn's Street Sweep.

Philip Morris, drugs puncture Dow

Cigarette maker Philip Morris (MO: down $2.91 to $36.59, Research, Estimates) has been ordered to pay $28 billion in punitive damages by a California jury.

A hefty warning from pharmaceutical firm Schering-Plough (SGP: down $0.34 to $17.30, Research, Estimates) late Thursday rattled drug stocks, pulling shares of Merck (MRK: down $2.03 to $44.26, Research, Estimates), a Dow component, and Eli Lilly (LLY: down $1.93 to $55.42, Research, Estimates) lower. Schering-Plough lowered its third-quarter, 2002 and 2003 estimates, citing an expected loss of sales for its key allergy drug Claritin.

Also weighing on the broader market, aerospace firm Boeing (BA: down $2.30 to $32.01, Research, Estimates) warned about its third quarter, saying it expects net income to be cut by 20 cents a share, or $158 million, after a non-cash charge of $250 million.

In addition, credit rating agency Standard & Poor's downgraded its long-term corporate credit rating on Walt Disney (DIS: down $0.95 to $15.05, Research, Estimates) to "BBB+" from "A-."

Chip equipment makers drag Nasdaq

More disappointing news in the semiconductor and data storage sectors depressed the Nasdaq.

Morgan Stanley cut its 2002, 2003 and 2004 estimates for a slew of chip-equipment makers, saying it expects a muted seasonal uptick in demand, increasing equipment cancellations and a slump in capital spending to continue in the third quarter of 2002. Applied Materials (AMAT: down $0.17 to $11.33, Research, Estimates), KLA-Tencor (KLAC: down $0.52 to $26.90, Research, Estimates) and Novellus Systems (NVLS: down $0.20 to $20.25, Research, Estimates) were among the names featured in the brokerage firm's note.

"The market is plagued by warnings. There have been over 500 negative preannouncements in the last four to five weeks," said Larry Wachtel, market analyst with Prudential Financial.

"The bottom line is really the bottom line [on income statements] in the stock market and earnings just don't look good. The jobs data wasn't terrible but the economy has run into a wall. Basically, there's nothing to churn the market to the upside. And another 800-pound gorilla in the room is Iraq," Wachtel added.

Data storage systems maker EMC (EMC: down $1.18 to $3.83, Research, Estimates) was the other blip on the tech radar. The stock hit a five-year low after it late said late Thursday that its third-quarter revenue would miss expectations, citing weakness in information technology spending. The company also said it plans to cut 7 percent of its work force. Credit Suisse First Boston lowered its 2003 revenue estimate for the company. Merrill Lynch slashed its fourth-quarter and 2003 revenue estimates for NYSE-traded EMC.

Shares of Nasdaq-listed sector mates QLogic (QLGC: down $3.65 to $20.95, Research, Estimates), Network Appliance (NTAP: down $0.38 to $6.27, Research, Estimates) and Brocade Communications (BRCD: down $0.70 to $5.82, Research, Estimates) lost value.

European markets finished lower on weakness in financial services stocks. Asian-Pacific stocks ended higher, with Tokyo's Nikkei index up 1 percent.

Treasury prices rose with the 10-year note yield at 3.66 percent. The dollar was stronger against the yen and the euro.

Light crude oil futures lost 14 cents to $29.62 a barrel in U.S. trading. Gold was higher.

Market breadth was negative. On the New York Stock Exchange, decliners beat advancers by about 3-to-1 as 1.8 billion shares were traded. On the Nasdaq, losers topped winners better than 2-to-1 as nearly 1.6 billion shares changed hands.

|