NEW YORK (CNN/Money) -

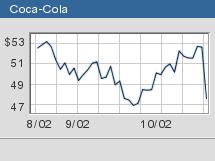

Shares of Coca-Cola Co. tumbled Wednesday after the world's biggest soft-drink maker warned its annual earnings could fall short of Wall Street expectations.

While reporting its third-quarter earnings, Coke said its full-year 2002 earnings per share could fall 1 or 2 cents shy of the $1.78 consensus forecast of Wall Street analysts surveyed by earnings tracker First Call.

Atlanta-based Coke blamed the likely shortfall on bad weather in Europe and Asia and the company's recent decision to count stock option awards as expenses, effective in October.

"While growth in North America was very strong, our worldwide results were below our internal projections due to extremely poor weather conditions in parts of Europe and Asia," CEO Doug Daft said in a statement. "As economic conditions are not expected to improve in the fourth quarter, we may not recoup the earnings impact of factors beyond our control that affected our business in the third quarter."

Coke (KO: down $4.42 to $48.06, Research, Estimates) shares fell about 9 percent after the announcement.

Coke reported third-quarter earnings of $1.16 billion, or 47 cents per share, compared with $1.07 billion, or 43 cents per share, a year ago.

Excluding a one-time charge of a penny per share related to the impact of currency fluctuations in troubled Latin American economies, Coke's earnings matched consensus expectations of 48 cents per share, according to First Call.

Coke warned that currency fluctuations would continue to hurt its earnings in the fourth quarter.

Coke's revenue rose to $5.3 billion in the quarter from $4.7 billion a year ago. Global unit case volume, a key measure of a soft-drink maker's performance, rose more than 5 percent, driven by 9 percent growth in North America, Coke's biggest market.

Separately, Coca-Cola's biggest bottler, Coca-Cola Enterprises Inc. (CCE: down $1.32 to $21.95, Research, Estimates), said it earned 41 cents per share, excluding a one-time charge, in the quarter, compared with 10 cents per share a year ago. Wall Street analysts, on average, expected the company to earn 33 cents per share, according to First Call.

The Atlanta-based bottler, which is about 40 percent owned by Coca-Cola, raised its earnings outlook for 2002 to a range of $1.00 to $1.03 per share from a previous range of 91 cents to 96 cents a share. Analysts, on average, expect the bottler to earn 93 cents, according to First Call.

|