NEW YORK (CNN/Money) -

Computer Associates said Tuesday that it posted operating earnings that topped Wall Street forecasts as the software maker recovered from a year-ago loss.

Net losses narrowed and the company, under investigation by federal regulators, upped its financial guidance going forward.

Computer Associates, which makes software for mainframe and networked systems, said operating profits in its second quarter ending Sept 30 were 4 cents a share, compared to a 16-cent per share loss in the year-ago quarter. Analysts expected Islandia, New York-based Computer Associates to earn 2 cents a share from operations.

On a net basis, Computer Associates lost $52 million, or 9 cents a share, compared with a $291 million, or 50 cent per share loss in the year-ago period. Revenue rose 5 percent to $772 million in the quarter.

Probes into the company's accounting have taken a toll. The Justice Department and Securities and Exchange Commission are investigating how Computer Associates (CA: Research, Estimates) recorded revenue ahead of a $1.1 billion compensation package it awarded its three top executives in 1998.

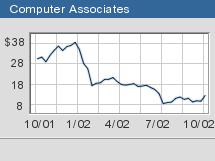

CA stock is down 64 percent this year. But company shares rose $1, or 8.3 percent, to $13.10 in after-hours trading following the earnings news, which was released following the stock market's regular close.

Looking ahead, the company said fiscal 2003 operating profits will range from 14 cents to 16 cents a share, up from the 10 cents to 13 cents originally forecast. Diluted operating earnings in the third quarter are expected to be 4 cents to 5 cents per share, slightly higher than previously anticipated.

In the latest quarter, the company recorded $394 million in new deferred subscription revenue, which represents future revenue from subscriptions and other contracts already signed and is commonly referred to as "bookings." By the end of the quarter, the company's total deferred subscription revenue balance -- the value of customers' contractual commitments to be recognized in the future on its earnings statement as revenue -- reached about $3.3 billion.

"Including our effective management of costs across the entire company, our results reflect continued challenges to our professional services business, which has been pressured by further reductions of spending for consultant services by IT (information technology) managers, Computer Associates Chief Executive Sanjay Kumar said in a statement.

During the second quarter, the company generated $202 million in cash from operations, compared to $164 million for the comparable period last year, and redeemed $134 million in debt during the period.

-- Reuters contributed to this report

|