NEW YORK (CNN/Money) - Electronic Data Systems Corp. on Wednesday logged a third-quarter profit that fell sharply from the same period last year and announced a series of job cuts that will begin by the end of this year.

The information technology services provider said it earned $86 million, or 18 cents per share in the most recent quarter. That compares with $212 million, or 44 cents per share, during last year's third quarter. The figures topped lowered analysts' expectations of 12 cents per share, according to First Call, which tracks profit forecasts.

EDS' third-quarter revenue fell 3 percent to $5.41 billion versus $5.56 billion a year ago.

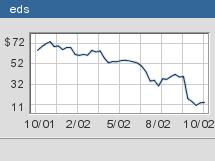

After the announcement, shares rose $1.50, or 11 percent, to $15.25 in after-hours trading, narrowing their year-to-date loss to 77 percent.

"It's really relief at no more downsides: the fact that the numbers were in line with their pre-announcement and that there were no other skeletons that fell out," Prakash Parthasarathy, an analyst with Banc of America Securities, told Reuters.

Last month, EDS lowered its financial targets for the third quarter, telling investors it was expecting third-quarter revenue to be down 2 to 5 percent, rather than up as EDS executives had previously forecast. The company began the quarter forecasting a profit of about 74 cents per share.

EDS' third-quarter new contract signings were $3 billion, less than half the $6.8 billion it reported a year ago.

The company blamed the weaker-than-expected quarter on reduced discretionary spending by customers with whom it has existing contracts, fewer new sales and higher sales marketing expenses.

Additionally, the company said results were hampered by deals it had with US Airways and WorldCom, both of which have filed for Chapter 11 bankruptcy protection. In its bankruptcy filing, US Airways listed EDS as one of its largest unsecured creditors.

"There's no sugarcoating these results. They are the by-product of a difficult market and our own decisions," EDS Chairman and CEO Dick Brown said on a conference call Wednesday evening.

He said EDS is trying to align its business with current market conditions to improve profits. Toward that end, Brown outlined a series of steps he said the company is taking.

Chief among them is cutting between 3 and 4 percent of its global workforce over the next several quarters, beginning with 800 to 1,000 positions by year-end. Two weeks ago, Brown had warned employees that the company would cut an undisclosed number of jobs to cope with a slowdown in business.

Additionally, he said EDS is reducing other corporate overhead expenses by $75 million in 2003; selling some of its assets; and shifting 1,500 jobs to regions where the cost of labor is lower.

Also on the conference call, Jim Daley, the chief financial officer, predicted that EDS will keep its investment grade credit rating after talks with the three major rating agencies in recent weeks.

Both Moody's Investors Service and Standard & Poor's had threatened to cut the company's credit rating.

Brown, the CEO, said EDS' balance sheet remains strong, and the company has the resources it needs from its operations to serve current clients and pursue new business.

He added that the company is focusing its efforts on winning large contracts that generate near-term revenue, earnings and cash flow.

Looking ahead, Brown said EDS does not expect much improvement in discretionary spending until at least the second half of 2003. But at the same time, he reaffirmed the company's most recent forecast for annual profits this year, forecasting earnings in a range between $2.05 and $2.10 per share.

The Securities and Exchange Commission started an informal inquiry into the details that led up the company's stunning profit warning, EDS said earlier this month.

-- Reuters contributed to this report

|