NEW YORK (CNN/Money) - U.S. Treasury prices swung into positive territory Wednesday as a hesitant performance from equities helped offset news Iraq had accepted United Nations demands to disarm.

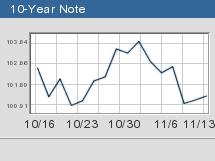

Around 4:00 p.m. ET, the benchmark 10-year note rose 4/32 of a point to 101-11/32 to yield 3.84 percent. The 30-year bond inched up 3/32 of a point to 108-30/32 to yield 4.79 percent.

The two-year note rose 3/32 of a point to 100-24/32, yielding 1.73 percent, and the five-year note climbed 3/32 of a point to 100-26/32, yielding 2.82 percent. Treasury prices and yields move in opposite directions.

Equities moved sharply higher at first as the risk of imminent war seemed to fade, but by midafternoon the Dow had given up most of its gains, perhaps in the realization that hostilities had merely been postponed.

Short-dated debt had already been underpinned when Federal Reserve Chairman Alan Greenspan struck a less optimistic tone on the economy than many in the bond market had feared.

In testimony to Congress, Greenspan said the Fed hoped last week's rate cut would be enough to help the economy through its soft patch but also conceded that if the assessment proved wrong, the central bank would not hesitate to ease again.

"The consensus was Greenspan would try and drum up confidence by being really upbeat, but in the event he was more sober than the market expected," said Michael Cloherty, a fixed-income strategist at Credit Suisse First Boston.

"In any case, the market suspects that monetary policy can only do so much to fix what ails this economy, and that goes for the latest easing too," he said.

"The overall bias is still for lower yields, barring any upside shocks from coming economic data," he added.

The market finally has some substantial figures to digest on Thursday with the release of retail sales for October.

Dollar unchanged vs. euro, up against yen

In the currency market, the dollar edged further away from recent multi-month lows on Wednesday, after Greenspan delivered his cautiously hopeful assessment of the U.S. economy and Iraq moved to ease fears that a new Gulf War was imminent.

Around 4:00 p.m. ET, the euro bought $1.01, virtually unchanged from late Tuesday. The dollar bought ¥120.17, up from ¥119.67 Tuesday.

-- from staff and wire reports

|