NEW YORK (CNN/Money) -

Signs that Iraq will accept a U.N. resolution on weapons inspections and a hint that the Fed could cut interest rates even further helped spur a late-morning turnaround for U.S. stocks.

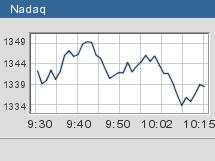

Around 11:15 a.m. ET, the Dow Jones industrial average (up 35.93 to 8421.93, Charts), the Nasdaq Composite (up 5.64 to 1355.20, Charts) and the Standard & Poor's 500 (up 0.80 to 883.75, Charts) index all advanced, erasing earlier declines.

Wire reports indicate that Iraq has accepted a U.N. resolution on weapons inspections, according to diplomats. The Associate Press reported that the acceptance letter was being delivered to Secretary-General Kofi Annan's office by Iraqi Ambassador Mohammed Al-Douri, an Arab diplomat said.

In testimony before the Congressional Joint Economic Committee, Fed chairman Alan Greenspan hinted that the Fed could cut rates further if the economy doesn't turn around. The Fed surprised the markets last week with a dramatic half-point cut that put rates at a 41-year low.

Greenspan's earlier comments were a reason the markets sold off, telling of a current "soft patch" in the recovery as a result of shocks from falling stock prices and a possible war with Iraq.

In corporate news, shares of Citigroup (C: down $1.17 to $35.22, Research, Estimates) led the Dow decliners in early trade. The company's stock dropped after the Wall Street Journal reported that former Salomon Smith Barney analyst Jack Grubman was pushed by Citigroup CEO Sanford Weill to upgrade AT&T (T: down $0.35 to $13.51, Research, Estimates)'s stock in a bid to get AT&T CEO C. Michael Armstrong to back him in his power struggle with Citigroup's former co-chairman, John Reed.

Citigroup issued a statement denying the allegations, while Grubman, in a statement of his own, said he had made up the story to impress a friend.

Weakness in Schering -Plough (SGP: down $0.81 to $20.72, Research, Estimates) dragged on the broader market. The maker of pharmaceutical products said late Tuesday it that had received two additional grand jury subpoenas from the United States Attorney for Massachusetts probing its sales and marketing practices related to several of its products. The company is already under investigation for its relationship with insurers and doctors.

Shares of IBM (IBM: up $0.55 to $79.70, Research, Estimates) offered some resistance to the blue-chip selloff. According to a published report, a blockbuster 7-year technology deal worth $5 billion may be nearing completion between J.P. Morgan Chase and IBM. Shares of IBM's rival bidder Electronic Data Systems (EDS: up $0.08 to $14.27, Research, Estimates) fell on the news.

IBM also will hold an analysts' meeting later in the day.

Technology stocks reversed course after leading Tuesday's robust rally. Shares of online travel services provider Expedia (EXPE: down $3.73 to $68.62, Research, Estimates) dented the Nasdaq, plunging on a report that the U.S. Transportation Department rejected a proposal to regulate online air fares, thereby giving airlines more flexibility in choosing how they distribute tickets.

European markets fell at midday after British telecom Cable & Wireless announced it was slashing about 3,500 jobs as it retreats from its U.S. and continental European markets. Asian-Pacific stocks closed lower Wednesday after Tokyo's Nikkei index slumped to a 19-year low.

Treasury prices were mostly lower, sending the 10-year note yield down to 3.86 percent from 3.85 percent late Tuesday. The dollar gained against the yen and euro.

Light crude oil futures fell 4 cents to $25.90 a barrel in U.S. trading. Gold fell in early trade.

|