NEW YORK (CNN/Money) -

Want to crash a stock? Maybe plunge the company itself into bankruptcy? Take it out to the ol' ball game.

The stadium sponsorship curse was alive and kicking in 2002, and it was the sponsors' shareholders who ended up with the bruises. The curse is a simple one: If you have the hubris to put your name on a major North American sports venue, you and your stockholders will pay.

When financial services firm Conseco Inc. filed for bankruptcy protection last month, it joined WorldCom, United Airlines (UAL: Research, Estimates), Adelphia Communications and US Airways as the victims of the curse last year alone.

|

|

| Conseco was the fifth stadium or arena sponsor to go bankrupt in 2002. |

After the collapse of Enron, PSINet, Trans World Airlines and National Car Rental parent ANC in 2001, that means that nine of 63 stadium sponsors, or 14 percent, have filed for bankruptcy in the last 19 months.

But it didn't take a visit to bankruptcy court to trash a stock, just a trip to the nearest stadium or arena. Of the 45 non-bankrupt companies on the index for the full year, 16, or more than a third, saw their stocks fall 30 percent or more last year, with mobile phone equipment maker Ericsson (ERICY: Research, Estimates), electric company Reliant Resources (RRI: Research, Estimates), and airlines American Airlines (AMR: Research, Estimates) and Continental Airlines (CAL: Research, Estimates) all tumbling at least 70 percent during the year.

Another 20 percent of those stocks saw declines in the 20 percent range. Only five of the stocks on the index for the full year posted gains, or almost as many as went bankrupt. And only five others kept their annual declines in single digits. All in all, another bad year for what I like to call the Stadium Sponsor Stock Index, or SSSI.

The index is something I created last year as energy trader and Houston Astros baseball stadium sponsor Enron was on the cusp of a bankruptcy filing.

The 2002 index includes 59 companies with U.S.-traded shares that had their names or a subsidiary's name on major North American sports facilities. Together, the companies lost a total $321 billion in market value this year, with an average decline of 33 percent, about twice the Dow's decline for the year or almost 50 percent more than the decline in the S&P 500.

Finding strong performers on the index is roughly akin to finding a reasonably priced beer or hot dog in one of the stadiums. There were only a handful of winners, and the gains were pretty modest.

Given the power of the curse, perhaps it's not surprising that the best performing stock was the one company that changed its name away from the name on the stadium. The former First Union Corp., which still uses that name on the Philadelphia basketball and hockey arena, changed the name of the bank holding company to Wachovia Corp. (WB: Research, Estimates), the moniker of the company it acquired. It was rewarded with a 16 percent rise in stock value.

It's not the cost of the stadium deals causing financial problems. In fact, most of the deals cost less per year than the $2.1 million price tag for a simple 30-second commercial on this year's Super Bowl.

Part of the problem is that it's companies in difficult, competitive industries, such as airlines, phones and financial services, that feel the need to step up and sign the sponsorship deals to build brand identity. Seven airlines had their names on eight facilities until the US Air Arena in Landover, Md., came down in mid-December, several years after it lost its teams to a new facility in Washington D.C., the MCI Center, another 2002 bankruptcy victim.

Click here for the 2002 Stadium Sponsor Stock Index

But there's also a sense among some investors that the corporate ego that leads to such a rights deal is a bad sign for future performance.

Vic Niederhoffer, an author and stock speculator for Manchester Trading, said in addition to the poor performance of the stadium stock index, his studies have shown companies that put their names on skyscrapers or repeatedly use the world "greatest" in describing their accomplishments regularly trail their competitors in the market.

"When someone tells you they're greatest and their competitors stink, stay away," he said.

New deals still being signed

Yet despite the curse, two companies have already signed deals in 2003, following the eight companies that signed new naming rights deals last year.

|

|

| Coca-Cola's stock fell after its Minute Maid brand replaced Enron as the sponsor of Houston's baseball stadium. |

Pet supply retailer Petco Animal Supplies Inc. (PETC: Research, Estimates) signed a deal for the new San Diego baseball stadium in a deal announced Jan. 22. Its shares are down a little more than 1 percent in the first 10 days as a sponsor.

US Cellular (USM: Research, Estimates) announced Friday it would pay $68 million for 23 years worth of naming rights for the formerly-named Comiskey Park, home of the Chicago White Sox. Its stock actually gained the day of the announcement, and company spokeswoman Michelle Merrell said the company isn't concerned about any curse.

"We're one of the more profitable wireless companies with a strong balance sheet," she said.

But Merrell and her bosses may be tempting fate. Of the eight 2002 entries to the index, seven paid the price in their stock value, some ignoring the karma of a bankrupt predecessor's name on the facility.

|

|

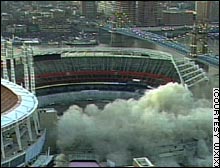

| Cinergy Field's demolition may have helped make the stock one of the few winners on the index in 2002. |

Soft drink maker Coca-Cola (KO: Research, Estimates) had seen its stock gain 12.6 percent year-to-date in 2002 when it signed a deal June 5 to put its Minute Maid brand on the former Enron Field in Houston. Its stock lost 19 percent of its value between that signing and the end of the year, giving it an annual rate of decline of 33 percent while on the index.

Only Office Depot (ODP: Research, Estimates), which stepped in for bankrupt National Car Rental as the sponsor of the NHL's Florida Panthers home, saw its stock post a gain after signing a sponsorship deal. Its stock climbed 12 percent in the weeks after it signed the deal in mid-September.

| Related stories and columns

|

|

|

|

|

Even with Office Depot bucking the trend, the new entries to the SSSI saw an average annual decline rate of about 26 percent this past year, when adjusted for market capitalization and time on the index, which was worse than the overall 21 percent decline in market value for the entire SSSI.

The one place to find some winners on the stadium stock index is to look at the companies that were fortunate enough to get off the index.

Take the New England Patriots' new stadium in Foxboro, Mass., as an example. Internet holding company CMGI (CMGI: Research, Estimates) signed to be the sponsor of the stadium before the Internet bubble burst, when the new facility was still in the planning stages. As construction drew to a close this past summer, it was clear a new, healthier sponsor was needed for the facility.

On Aug. 5, consumer products company Gillette (G: Research, Estimates) signed on as the new sponsor. Through the rest of the year Gillette's stock lost 7 percent, equal to an annual rate of decline of 17 percent. CMGI, whose stock had lost 75 percent from the beginning of 2001 through Aug. 5, saw its battered shares rebound 145 percent once it got out from under the stadium deal.

Philip Morris, which sold its Miller Brewing unit in July, and Cinergy, which saw its stadium demolished with explosives this past Sunday, were two more "winners" on the index.

Some companies did their best to shake the SSSI but couldn't. 3Com (COMS: Research, Estimates) let its naming rights deal for the San Francisco football stadium expire at the end of 2001. But when the city couldn't find a new sponsor, it kept the 3Com name on the stadium while changing the official name back to the original Candlestick. 3Com stock took a 29 percent hit on the year.

Team owners even worse off

The performance might have been worse if I had included the three stadiums -- Wrigley Field in Chicago, Busch Stadium in St. Louis, and Turner Field in Atlanta, which were named for a team owner, not a company that shared the same name. While William Wrigley Jr. Co. (WWY: Research, Estimates) and Anheuser-Busch Cos. both posted gains on the year, the problems at Turner Broadcasting (and CNN/Money) parent AOL Time Warner (AOL: Research, Estimates) would have more than outweighed the gains.

| SportsBiz

|

|

|

|

|

Of course, there is one sports curse that is even worse for stocks than the SSSI. That's the team ownership curse. A market-cap weight index of the 10 publicly traded companies that are partial or total owners of major sports teams saw a 42 percent decline in value this past year.

The problems on the team owner index were led by the bankruptcy of Adelphia Communications, also a member of the SSSI. Adelphia wasn't officially the owner of the Buffalo Sabres hockey team -- its founding family owned the team, But federal prosecutors charge company funds were being used to cover the team's losses, even if investors didn't realize it, qualifying its stock for this index as well.

Other big hits came at Cablevision Systems (CVC: Research, Estimates), owner of the equally disappointing New York Knicks and Rangers, which saw shares fall by nearly two-thirds, and a 59 percent decline at AOL Time Warner, owner of the Atlanta Braves, Hawks and Thrashers.

So if there's anything worse than having your name on a sports facility, it's having your name on the team's paychecks.

|