NEW YORK (CNN/Money) -

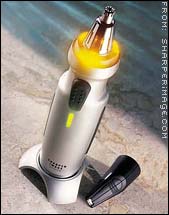

Many retailers are probably scratching their heads and wondering where that elusive dollar disappeared to this past Christmas. Here's an answer, folks: Looks like the greenback probably bought you a "turbo nose hair trimmer," a "talking pictures photo album," or even a "hands-free flashlight" as your stocking stuffer.

Analysts say these are the "unique" and "feel-good" kind of products -- instead of the usual sweaters and socks -- that the U.S. consumer appeared to seek out during the past holiday shopping season.

For example, two of the more recognizable names in the retail space for specialty gadgets and gizmos -- Sharper Image and Brookstone -- Tuesday posted strong December sales numbers that highlighted that trend and defied the general forecasts for dour holiday retail sales results.

|

|

| Sharper Image turbo nose hair trimmer. |

Consumer trend experts said both companies bucked the retail downtrend because they've stuck to their strategy of backing product differentiation and innovation, while most of the nation's retailers continue to shy away from taking risks amid a weak economy and shaky consumer spending.

"These two companies gave a must-have lesson for all retailers," said Kurt Barnard, president of Barnard's Retail Consulting Group. While most retailers sold indistinguishable products, "Sharper Image combed the globe for unusual and exciting products that weren't run-off-the-mill ... Retailers made the mistake of taking customers for granted and the payoff came two weeks ago in much weaker Christmas sales because of ho-hum kind of merchandise."

Barnard added: "Sharper Image products also evoke the desire in customers to buy them. Granted that a $1,800 massage chair may not appeal to someone who just lost their job, but one reason that these kinds of high-end gadgets are in demand is exactly because some people want to pamper themselves and take their mind away from that kind of reality."

San Francisco-based Sharper Image (SHRP: up $0.36 to $18.05, Research, Estimates), which sells "unusual" high-tech personal and home electronic gadgets, said its December same-store sales -- or sales at stores open at least a year -- rose 8 percent. The company, which operates 127 stores, also raised its fourth-quarter earnings estimate to between $1.15 and $1.18 per share, from a previous range of $1.12-to-$1.16, and upped its 2003 guidance to between $1.06 and $1.09 a share, up from a previous forecast of $1.03-to-$1.07 per share, citing the sales boost.

Wall Street expects the company to earn $1.16 a share in the fourth quarter and $1.06 a share for the year, according to earnings tracker First Call. Sharper Image's Internet sales were especially strong with a 68 percent increase.

|

|

| Sharper Image talking pictures photo album. |

"Sharper Image's stereo systems and message chairs have done extremely well this year," said Kristine Koerber, analyst with WR Hambrecht. "The company offers merchandise that is perceived as unique, higher-quality and functional. In fact, its proprietary offering covers 70 percent of its merchandise, so it's mostly branded goods."

In addition, Brookstone (BKST: up $0.45 to $15.45, Research, Estimates), another gadget retailer with about 250 store nationwide, said holiday sales for the combined November and December period at stores open at least a year rose a better-than-expected 7.8 percent, with new products leading the way, and should fuel a higher profit than previously expected. The Nashua, N.H.-based company also raised its 2002 earnings estimate to between $1.00 and $1.05 per share, citing "a combination of higher than previously anticipated sales and margins."

The upper end of its previous range of estimates was 67 percent higher than its fiscal 2002 profit of 63 cents per share. Analysts currently expect the company to earn $1.06 a share in year, according to First Call.

Sales without discounts

Now here's the kicker -- the robust holiday sales for both Sharper Image and Brookstone came without the companies resorting to the heavy discounting that has stymied profits for most retailers. And their "quirky" products aren't exactly low-end. Both companies position themselves as upscale specialty retailers. Brookstone's high-quality items range from a $15 digital tire gauge to a $3,200 Shiatsu vibrating chair, while Sharper Image sells its gadgets mostly priced from $20 to $500.

|

|

| Brookstone's grill alert remote talking thermometer. |

"Brookstone has a long-standing policy that its brand is worth something and it won't discount it," said Maribeth Holland, analyst with Goldsmith & Harris. "I think it's the uniqueness of their products combined with a good in-store experience for customers, with the company's knowledgeable sales staff, that had generated a lot of foot traffic for the company."

Although Brookstone has so far geared its products primarily toward men -- the car-wash gun, grill alert talking remote thermometer -- Holland says the company is now focused on widening its appeal to women. Hence a range of health and fitness products, including the Tempur-Pedic ergonomically-designed sleep pillows.

Even though both Sharper Image and Brookstone pulled off stellar results in hard times, their combined holiday sales of $346.7 million for the month of November and December is only a tiny part of the total retail holiday sales, which stands at about $200 billion.

Industry watchers say the focus of investors is likely to be on the avalanche of December sales results Thursday from the retail bigwigs, including Wal-Mart (WMT: up $0.22 to $50.41, Research, Estimates), Target (TGT: down $0.18 to $30.07, Research, Estimates), and J.C. Penney (JCP: up $0.15 to $23.54, Research, Estimates).

Kurt Barnard of Barnard's Retail Consulting Group predicts a 2 percent increase in holiday season sales over last year, which would be the worst holiday season in more than a decade. Sharper Image's rival Circuit City (CC: up $0.27 to $7.57, Research, Estimates) is a case in point. The No. 2 U.S. consumer electronics chain Tuesday reported a 6 percent drop in December same-store sales as discounts on DVD players, digital cameras and TVs failed to spark sales. Perhaps none of those were the "gadget" of choice this time around for consumers.

|