NEW YORK (CNN/Money) -

They agreed to pay nearly half of the $1.4 billion required to end a probe into allegations of tainted stock market research. Their executives were called before Congress to explain deals with Enron.

So when Citigroup, Merrill Lynch and J.P. Morgan Chase report fourth-quarter and 2002 financial results this week, expect a trio of humbled firms.

The New York-based companies have cut tens of thousands of jobs to save money during a three-year stock market slump that has kept companies from going public and doing deals. And the shrinking size of assets under management reduced another source of fees.

Looking ahead, the banking team at UBS Warburg, which covers Citigroup and J.P. Morgan, told clients that the new year already is setting up to be a difficult one.

"As far as forward-looking statements are concerned, we believe the early commentary on 2003 will be guarded, based on the sluggish economy, uncertainty over war, and jittery market conditions," the UBS banking team wrote.

The first report came Tuesday when Citigroup (C: Research, Estimates) said its fourth-quarter profits fell 37 percent as the company set aside money to pay for lawsuits, loan losses and a settlement with securities regulators. Citigroup shares fell 30 percent in 2002.

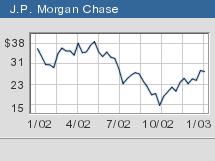

On Wednesday, J.P. Morgan Chase (JPM: Research, Estimates) is forecast to lose money -- 9 cents a share's worth, following a 12-cent-per-share profit in the year-ago quarter. The company's stock lost 33 percent last year.

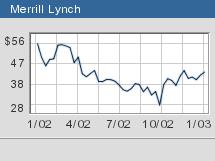

Also Wednesday, Merrill Lynch (MER: Research, Estimates) is expected to report that fourth-quarter profit rose to 63 cents a share, up from 48 cents a year ago. Relative to Citigroup and Morgan, Merrill was last year's stock market out-performer. Its stock dropped 28 percent.

When it comes to 2003, investors can only hope business improves for Citigroup, Morgan and Merrill, all companies that had more than just a bad economy to deal with in 2002.

The trio was among nine firms that last month agreed to pay $1.4 billion to settle charges brought by securities regulators that the companies put investment-banking clients ahead of investors.

Citigroup's Salomon Smith Barney unit suffered the biggest hit, $400 million. Merrill agreed to pay $200 million and J.P. Morgan paid $80 million.

The companies admitted no wrongdoing. But federal and state regulators accused them of enabling the stock market bubble of the 1990s by hyping shares of companies that also were investing-banking clients.

Partially because of the settlement, Citigroup last month said it would take a $1.5 billion after-tax charge in the fourth quarter.

A week later, J.P. Morgan said it was setting aside $900 million to pay for lawsuits over the bank's dealings with Enron and to settle the conflict of interest charges.

Merrill Lynch did not cut fourth-quarter guidance.

Elsewhere, executives of J.P. Morgan, Merrill and Citigroup were brought before Congress last summer and accused of creating financial transactions that enabled now-bankrupt Enron to disguise its true financial condition. They denied wrongdoing.

But that didn't keep the Permanent Subcommittee on Investigations from calling last month for a larger government role in overseeing the kind of financial transactions that the companies engaged in.

|