NEW YORK (CNN/Money) -

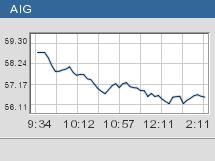

Shares of American International Group, the No. 1 insurer by market value, tumbled 8 percent Friday afternoon after Morgan Stanley said the property and casualty business will have a tough time raising prices amid an uncertain economy.

Morgan Stanley downgraded seven insurers, but none took a bigger hit than AIG, which began the session with a market capitalization above $158 billion.

Its shares fell $4.89, or 8 percent, to $56.04 Friday on the New York Stock Exchange, shaving $12.714 billion from its market value. More than 15.5 million shares changed hands, about three times AIG's average trading volume.

"We believe these stocks are less likely to outperform, given recent economic news suggesting an upturn in mid-2003 is not as certain," said the note, written by Morgan's Stanley's Alice Schroeder, Viney Saqi and William Wilt.

AIG (AIG: down $4.89 to $56.04, Research, Estimates) was cut to "equal weight" from "overweight." So too were Marsh & McLennan Cos. (MMC: Research, Estimates), which fell 5.4 percent, XL Capital Ltd. (XL: Research, Estimates), which lost 4.2 percent, Max Re Capital Ltd. (MXRE: Research, Estimates), which fell 1.1 percent, and Allstate (ALL: Research, Estimates), which lost 3.6 percent.

PartnerRe (PRE: Research, Estimates), down 5.8 percent, and MBIA (MBI: Research, Estimates), off 3.6 percent, were downgraded to "underweight" from "equal-weight."

Morgan Stanley said a consumer backlash against the industry may be developing. Insurance rates, the brokerage said, appear to have peaked, "raising the question of what positive news investors might not already know about the cycle."

Insurance firms have broadened their business over the years, becoming more like financial services companies by adding units such as money management. This means new risks for companies once considered insulated from the business cycle, Morgan Stanley said.

The day's losses for AIG mask a great run; its shares are up 101 percent over the last five years. AIG is rarely discussed without a mention of its CEO, Maurice "Hank" Greenberg, who took over the firm in 1967 and is the longest-standing chief executive of a Fortune 500 company.

Morgan Stanley upgraded Everest Re Group (RE: down $0.14 to $50.60, Research, Estimates), Progressive Corp. (PRE: down $3.07 to $50.01, Research, Estimates), and Travelers Group (TAP.B: down $0.44 to $16.03, Research, Estimates) to "overweight" from "equal-weight." The brokerage cited "valuation" for the Everest Re and Progressive upgrade. Morgan said Travelers is a way for investors to play primary insurance.

|