NEW YORK (CNN/Money) -

Fears over a protracted war with Iraq sent investors fleeing to the perceived safety of Treasury bonds Monday, while the dollar fell against other major currencies.

Elsewhere, stock prices tumbled and oil snapped back after falling sharply last week. Gold rose.

"The 100-hour war isn't going to happen," Peter McTeague, Treasury market strategist at RBC Greenwich Capital Markets, told Reuters. "While the outcome is still quite certain, the timing isn't, and that could change people's assumptions about the growth rebound."

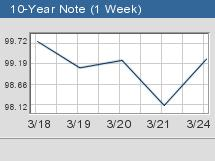

At around 4:15 p.m. ET, the benchmark 10-year note gained 1-1/8 in price to 99-8/32, taking yields down to 3.97 percent from 4.10 percent late Friday. The latter had been the highest close in more than two months and followed a relentless rise from 3.55 percent the week before. Yields move inversely to prices.

The super-liquid two-year note jumped 8/32 of a point in price to 99-22/32 for a yield of 1.67 percent. Five-year notes climbed 20/32 of a point to 100-9/32, yielding 2.94 percent, while 30-year bonds gained 1-23/32 to 106-22/32, yielding 4.93 percent, down from 5.04 percent.

Meanwhile, the dollar fell against major currencies after tougher-than-expected Iraqi resistance against U.S.-led forces over the weekend shook markets' confidence of a speedy end to Saddam Hussein's reign in Iraq.

The dollar, which hit two-month highs on the euro on Friday, slid to $1.0638 per euro. It also shed roughly half a percent to ¥120.80, off its three-month high of ¥121.87 Friday.

Bond prices had suffered their worst plunge in more than a year last week as investors sold in anticipation of a brief war and a subsequent recovery for the U.S. economy.

But the market's euphoria proved premature, as U.S. and British troops suffered their heaviest casualties yet after encountering stiff resistance at the cities of Nassiriya, Najaf, Basra and Umm Qasr.

"The market just had to make a quantum adjustment this morning based on the war news. It made that adjustment, and we're just sitting here waiting for more news on the war," said Dana Johnson, head of research at Banc One Capital Markets.

"I think just a general sense that it wasn't going to be a walkover is what got the market going this morning," he said.

That prompted a pause in the mass rush out of safe-havens and boosted oil and gold while subduing the dollar and slamming equities.

Many commentators, including Federal Reserve Chairman Alan Greenspan, have been assuming that once the war ended the economy would swiftly revive. Federal Reserve Bank of Atlanta President Jack Guynn echoed the sentiment Monday, saying the economy was set for a solid recovery once the war uncertainty passed.

There were no U.S. economic data Monday to divert attention from the war, but Tuesday has the Conference Board measure of consumer confidence as well as figures on existing home sales.

The Conference Board survey is taken in the first half of the month and is likely to reflect anxiety in the runup to the war, so analysts expect a dip to 62.4 in March from 64.0 the month before.

-- from staff and wire reports

|