NEW YORK (CNN/Money) -

The war with Iraq may not have been about oil, but the post-war rebuilding period sure will be. Iraq has the capability of being an oil producer to rival Saudi Arabia, but getting there could take many years, billions of dollars and a little bit of bickering.

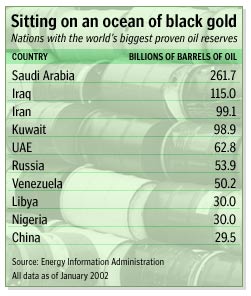

Iraq has 112.5 billion barrels in proven reserves, the second-largest in the world, and possibly 200 billion barrels more in unexplored regions, according to some estimates.

And Iraq's oil also is more easily accessible than in some regions of the world. No need for tricky deep-sea drilling, no worries about the habitats of Arctic caribou -- Iraq's oil is close to the surface of flat, featureless terrain.

Though this wealth of oil has never been fully tapped -- the Western desert has hardly been explored, only 15 of Iraq's 73 oil fields have been developed, and only about 2,000 wells have been drilled, compared with about 1 million in Texas -- the country was able to produce about 3.5 million barrels of oil a day before the Gulf War in 1991.

But much of Iraq's infrastructure was damaged during the war, and the economic sanctions that followed kept Iraq from getting the latest technology, spare parts and investment for its oil fields throughout the 1990s.

"Oil experts acknowledge that Iraq's oil sector is being held together by 'Band-Aids,'" said a recent study by the James A. Baker III Institute for Public Policy of Rice University.

As a result, Iraq's production capacity has been steadily shrinking, from about 3.5 million barrels a day in 1990 to about 2 million barrels a day in 2002.

And some of the methods used to keep the oil flowing -- including "water flooding," in which lighter, refined oil products are pumped into oil reservoirs to push the crude oil to the surface -- may have done long-term damage to the oil reservoirs, according to Saybolt International, a Dutch consulting firm that has monitored Iraq's oil infrastructure for the United Nations.

Additionally, the Baker Institute study warned that sudden production shutdowns -- which might have occurred at many fields during the latest war -- could do even more damage to oil reservoirs.

6 million barrels a day could be a pipe dream

Simply returning Iraq's production capacity to the pre-1991 level of 3.5 million barrels a day will take an initial investment of $5 billion and cost another $3 billion per year for every year after that, according to the Baker Institute study.

|

| |

|

|

|

|

Among the key post-war issues facing the U.S. is what will become of Iraq's greatest asset, its oil. Allan Chernoff reports how Iraqi oil at the moment is tied up in a tangle of legal, diplomatic and business problems. Among the key post-war issues facing the U.S. is what will become of Iraq's greatest asset, its oil. Allan Chernoff reports how Iraqi oil at the moment is tied up in a tangle of legal, diplomatic and business problems.

|

|

Play video

(QuickTime, Real or Windows Media)

|

|

|

|

|

Before the war, Iraq had high hopes for tripling its production capacity to more than 6 million barrels a day, which is entirely possible, and would make Iraq the world's third-largest oil producer after Saudi Arabia and Russia.

But don't hold your breath waiting for that to happen any time soon.

"To get to 6 million barrels a day will require $30 billion to $40 billion in investment, and it assumes a bull market for oil," said Rachel Bronson, director of Middle East studies at the Council on Foreign Relations, a Washington think tank. "If you just start doubling production, but demand stays the same, that's wasteful."

What's more, Iraq is a founding member of the Organization of the Petroleum Exporting Countries (OPEC), the cartel that controls much of the world's oil production. OPEC sets a limit on Iraq's production at 3.2 million barrels a day, and Iraq likely would have to leave OPEC to produce more.

Leaving OPEC could make exporting oil more difficult, since other OPEC nations in the region, such as Saudi Arabia, could punish Iraq by refusing to allow oil to be piped or transported through their territory.

Post-war fallout

The war also has made Iraqi oil production more difficult. The Wall Street Journal reported recently that Iraqi workers at the Rumaila oil field, the nation's biggest, are only slowly coming back to work, at the invitation of the U.S. Army Corps of Engineers and Halliburton Co.'s Kellogg Brown & Root unit, which is helping the Army repair the oil infrastructure.

What's more, looters have run off with much of the property of Iraq's state-run Southern Oil Co. (SOC), which runs the Rumaila field -- including the buses used to transport workers.

Before the war, Iraq's entire oil industry -- including exploration, oil-field construction and repair and exportation -- was handled by state-run companies such as SOC, under the umbrella of Iraq National Oil Co. (INOC), a state agency.

All official oil sales were made through the United Nations "oil-for-food" program, and the proceeds went to buy food and humanitarian relief and compensate victims of the first Gulf War.

In the long run, a new Iraqi government could end up controlling Iraq's oil production again, with some assistance from private companies, and oil revenue could be handled by the government, if international sanctions are lifted. But in the months and years immediately following the war, it's unclear who will end up controlling Iraq's oil.

The U.N. hasn't yet weighed in on whether or not it will renew the oil-for-food program, and it has made no effort to take control of the oil rebuilding. The U.S. government, which could argue it's responsible under the Geneva Convention for restoring Iraq's oil production to pay for humanitarian relief, already has said it intends to take bids for the short-term work of rebuilding Iraq's oil fields.

Halliburton (HAL: Research, Estimates) -- which already is working on the oil fields, thanks to a controversial early contract awarded without competitive bidding -- is in a prime position to win the next job, as are other U.S. oilfield services companies. After all, U.S. tax dollars will be paying for this early work, at least until the oil starts flowing again, so it seems unlikely the Bush administration will send that money overseas.

Left out in the cold could be companies from France, Russia, China and other nations, which had up to $20 billion in pre-war development deals with the Iraqi government.

French oil company TotalFinaElf, which has contracts worth up to $4 billion to develop Iraq's Majnoon oil field, has said it's confident its contract will be honored -- but that could depend on who controls Iraq's oil production in the future.

|