NEW YORK (CNN/Money) -

Not everyone cheered the return of power this weekend after last week's massive outage. In particular: providers of so-called alternative energy, which saw their shares go from must-haves in the middle of the crisis to maybe-should-have-hads by Monday.

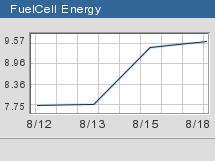

Providers of renewable energy as well as fuel cell makers, saw a surge Friday following Thursday's mass blackout along the eastern United States and parts of Canada as well. Stocks of companies such as Ballard Power (BLDP: up $0.70 to $13.55, Research, Estimates), FuelCell Energy (FCEL: up $0.08 to $9.48, Research, Estimates), Capstone Turbine (CPST: up $0.11 to $1.85, Research, Estimates), Plug Power (PLUG: up $0.02 to $5.18, Research, Estimates) and American Superconductor (AMSC: down $1.10 to $12.10, Research, Estimates) all gained sharply. The sector remained hot Monday, but it also saw profit taking, making investors wonder whether the alternative energy wave may have crested already.

"In the short-run, the psychology about the group has changed, and there are certainly some good names to consider," said W. Neal McAtee, an energy analyst at Morgan Keegan, who covers the sector. "But I think you want to wait a little bit before jumping in and see how these companies do when the press dies down about them." McAtee does not own any shares of the stocks in the sector, nor does his firm have investment banking relationships with the companies.

Renewable energy currently accounts for less than 7 percent of overall energy usage, seeming to limit the potential returns for these companies. On the other hand, the alternative market has the potential to grow in the aftermath of the blackout, as investors demand other options and as more traditional companies face a likely period of review and regulatory investigations and a new energy bill from Congress.

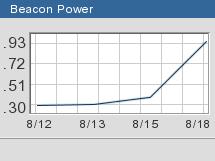

In the zest to buy up the sector, companies that are particularly strong have rallied right along with those that are untested. On Monday, the Nasdaq's most actively-traded issue was Beacon Power (BCON: up $0.54 to $0.92, Research, Estimates), a maker of energy storage systems that provide power for computers and other technology systems. The penny stock rallied 170 percent to trade at just over one dollar in the afternoon, but the move was largely one of sentiment rather than sustenance.

A game for the choosy

First Albany analyst Sanjay Shrestha said in a note early Monday that it is too early to really tell what the impact of the blackout will be on the energy sector but that, at least in the near-term, the companies that stand to benefit the most are those with products already available on the market and with competitive price points.

He highlighted C&D Technologies (CHP: up $0.57 to $18.06, Research, Estimates) -- which makes large format lead acid batteries for telecom and other markets -- saying that it is equipped to deal with both quality and reliability needs and should see a gain in stock price in the near term in direct response to the blackout. He also highlighted Evergreen Solar (ESLR: up $0.19 to $1.74, Research, Estimates) and FuelCell Energy. First Albany has an investment banking relationship with FuelCell Energy, but not the others. Shrestha does not personally own shares of any of the companies.

On Monday, TD Newcrest analyst Chris Kwan upgraded FuelCell to "buy" from "reduce," and Ballard Power to "buy" from "hold," saying the fuel cell stocks are likely to benefit from more spending on backup power, following the blackout. The fuel cell sector was also mentioned positively in a Wall Street Journal article and in notes from RBC Capital Markets and other brokerages over the weekend and early Monday.

Morgan Keegan's McAtee also likes FuelCell energy, saying that specifically insofar as companies that are able to deal with events like the recent blackout, the carbonate fuel developer offers a good solution. However, with the share price up 23 percent since Thursday's close, he sees no reason for investors to jump in just yet amid all the hoopla, advising patience for the time being.

|