NEW YORK (CNN/Money) -

The job market should have started getting better by now. But it hasn't.

The latest weekly jobless claims report was just another reminder of that unsettling fact. In the week ended Sept. 6, 422,000 people filed for employment benefits -- more than the 400,000 economists expected and the worst reading since early summer.

This comes on top of last week's lousy employment report, which showed the economy lost another 93,000 jobs in August, instead of gaining some back like economists thought it would. All this in the midst of an economy that is growing at something like a 4.5 percent pace in the current quarter.

On Wall Street, there has been a tendency lately to look past the bad job news. Yes, it is worrisome, because it could be an eventual drag on consumer spending, but since everything else is going gangbusters we need not worry too much.

"Right now, investors feel like we're on the cusp of something," said Miller Tabak strategist Pete Boockvar. "Historically, employment's been a lagging indicator. Other areas of the economy point to growth, suggesting that at some point employment is going to pick up."

Out of the blue

But the problem is that while employment has always been a lagging indicator, it has never lagged by so much. Up until the 1990-91 recession, jobs tended to start bouncing back right around when the economy bottomed out. And even during the "jobless recovery" of the early 1990s employment began bouncing back sooner than it has this time around.

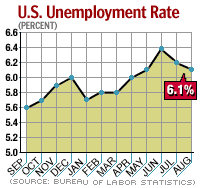

For economists this is a surprise. Consider: At the end of last year economists polled by the Philadelphia Fed thought that the economy would grow by 2.6 percent this year -- right where the latest survey by Blue Chip Economic Forecasts puts it. But at the end of last year economists thought that the jobless rate would finish out the year at 5.6 percent. The current rate is 6.1 percent and nobody expects it to drop by too much by year-end.

So something very different is happening, and nobody is quite sure exactly what. Many are quick to place blame on the loss of U.S. jobs to workers overseas, for example, but while this is certainly an element of what's going on, it's hardly a new dynamic. Remember U.S. auto workers taking sledge hammers to Toyotas in the early 1980s?

In a recent report, economists at the New York Fed suggest that what is happening is structural. In past recessions job losses were far more cyclical: The economy turned down, your company laid you off, but as soon as things got better you got hired back. Much of this was because manufacturing was a greater part of the economy, and manufacturers are less likely to sever their relationship with an employee than service industries are. And of course, service workers are far less likely to have a union representing them than manufacturing workers, making it easier for an employer to restructure and drop them permanently from the rolls.

Another possibility: Growth in productivity is making it so that companies simply aren't going to need to hire until the economy has been growing at a strong clip for some time. Thanks in part to improved technologies, companies have found that they are able to do more with less.

"Productivity gains have been strong in the current period, allowing the economy to recover without creating jobs," said Don Fine, president of Fine Financial Forecasting.

Or maybe, suggests Deutsche Bank economist Cary Leahey, it's that firms are far more gun shy than in the past. They have been treated to a number of false economic starts, after all, and many are still licking their wounds from overreaching in the late 1990s and from the accounting scandals that hit last year.

So while in past cycles some companies were quick to hire, because this was seen as a way to get a leg up on competition and grab market share during the next expansion, now they're milling around, waiting.

All the seasick sailors

"Companies aren't afraid of being left in the dust; they're afraid that if they go first they'll be eaten by sharks," said Leahey. "Everybody is standing in front of the turnstile, and nobody wants to go through."

For Goldman Sachs chief U.S. economist Bill Dudley, it mostly comes down to growth. In the past the economy was much more cyclical and used to really rocket when it came out of recessions. This time has been different, partly because of changes in the makeup of the economy, but also because working off the excesses of the late 1990s has taken time.

"I don't think it's so much that the labor market is different so much as it is the difficulty policymakers have had in generating fast enough growth," he said. "We're only getting rapid growth now, almost two years into the recovery."

Most economists think that the growth spurt we're seeing now is so strong that it will be able to beat back whatever it is that's inhibiting job creation. Productivity alone won't be enough to meet the surge in demand. Companies will come to see upping their payrolls as an asset rather than a liability and new jobs will be created, replacing the ones that have disappeared. But while it all seems to work out on paper, there's still a fair amount of worry in the economics community. So far the job market doesn't seem to have been listening to its forecasts.

|