NEW YORK (CNN/Money) -

Treasury prices fell Monday after data showed U.S. manufacturing stayed strong in February and factory job creation hit a 17-year peak, suggesting Friday's employment report could be a robust one.

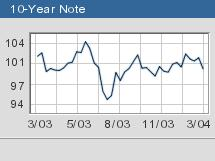

At around 3:30 p.m. ET, the benchmark 10-year note lost 5/32 of a point to 100-2/30, with a 3.99 percent yield, up from 3.97 percent from late Friday. The 30-year bond fell 7/32 of a point to 107-24/32 to yield 4.86, up from 4.84 percent late Friday.

The two-year Treasury held steady at 99-30/32 with a yield of 1.66 percent, while the five-year note shed 6/32 of a point at 100-5/32 with a yield of 2.96 percent. Bond prices and yields move in opposite directions.

In the currency market, the euro bought $1.2445, down from $1.2495 late Friday. The dollar was quoted at ¥108.97, barely moved from late last week.

The Institute for Supply Management index of manufacturing conditions eased to 61.4 in February from 63.6 in January. Analysts polled by Reuters had expected a reading of 62.0.

The ISM's employment component rose to 56.3 from 52.9 in January, its highest since 1987.

The prices paid index, a gauge of inflationary pressure, shot up to 81.5 from 75.5, which weighed on the Treasurys market, where the feeling grew that burgeoning inflation could trigger a rise in interest rates sooner than many expected.

Federal Reserve chairman Alan Greenspan has used a series of appearances over the past month to express optimism that hiring will pick up soon. Fed officials have said there is no need for preemptive interest rate tightening as in previous upturns since inflation is starting from such a low point.

"The two together kind of make an evil witches' brew for Greenspan: employment growth and price pressure. And there's the thought that 'what if the Fed is behind the curve,'" said Sadakichi Robbins, head of global fixed-income trading at Bank Julius Baer.

On Friday the Labor Department will release its February employment report, which is expected to show a rise of 125,000 in non-farm payrolls, but the rise in both the ISM jobs index and last week's increase in hiring in the Chicago area could force the hand of the bond bulls.

"I would say the market has been a bit sanguine about Friday's employment report, the consensus being 125,000, with a number of big shops looking for softer numbers than consensus than in the previous two months," Robbins said.

--Reuters contributed to this report.

|