NEW YORK (CNN/Money) -

U.S. stock markets closed mixed on the session Friday and for the week, with the Dow posting some gains and the Nasdaq seeing declines.

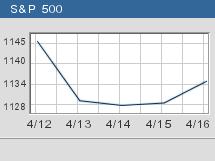

The Dow Jones industrial average (up 54.51 to 10451.97, Charts) and the Standard & Poor's 500 (up 5.77 to 1134.61, Charts) index both added 0.5 percent, while the Nasdaq composite (down 6.43 to 1995.74, Charts) lost 0.3 percent, after trading flat to lower throughout the session.

For the week, the Dow gained 0.1 percent, the S&P 500 lost 0.4 percent and the Nasdaq lost 2.8 percent.

The major indexes gained Monday, fell hard Tuesday and Wednesday, then split directions Thursday and Friday, with the Nasdaq falling, while the other two managed gains.

All of this occurred despite solid quarterly earnings as investors kept an eye on the geopolitical situation and signs of inflation in the recent economic news.

Earnings for the quarter have been pretty positive so far, and overall, expectations remain high. Analysts surveyed by First Call expect results to rise nearly 19 percent from a year earlier.

But with Middle East tensions and interest rate concerns in play, not to mention some caution after the stock market's huge rally in 2003 and early 2004, investors have mostly opted to take profits on the results.

In addition, Friday's earnings news and forecasts were surprisingly negative, with investors showing disappointment about news out of IBM, Sun Microsystems and a number of chip makers.

"I think we need to get through all the earnings of the next two weeks before we can determine where the market is headed," said Brian Bensch, an investment manager at Melhado, Flynn & Associates. "I think the market is going to be hard-pressed to make new highs with the overhang of geopolitical issues and concerns about interest rates."

"I think in order for the market to take risks we need blowout numbers," he added. Even just meeting expectations, or barely exceeding them will keep us in this trading range."

Next week is the S&P 500's biggest week of releasing earnings reports, with around 179 companies expected. General Motors, Microsoft, Lucent and Amazon.com are among the most influential. (For a look at these and other reports due next week, click here.)

Dow component 3M (MMM: Research, Estimates), as well as Eli Lilly (LLY: Research, Estimates), Fannie Mae (FNM: Research, Estimates), Hasbro (HAS: Research, Estimates) and Lexmark International (LXK: Research, Estimates) are all due to report results before the start of trading Monday.

Next week is pretty light on economic news. Monday's one expected report is the index of leading economic indicators (LIE), due shortly after the open. LIE for March is expected to have risen 0.3 percent from an unchanged read in February.

What moved?

The Dow was supported by strength in a number of issues, led by gains in Caterpillar (CAT: up $1.17 to $81.97, Research, Estimates), Alcoa (AA: up $0.99 to $33.99, Research, Estimates), McDonald's (MCD: up $0.53 to $27.46, Research, Estimates), American Express (AXP: up $0.83 to $50.58, Research, Estimates) and General Motors (GM: up $0.78 to $46.17, Research, Estimates).

The Dow's biggest negative was IBM (IBM: down $1.69 to $92.28, Research, Estimates), down 2 percent after issuing its quarterly report and forecast late Thursday. Investors focused on the lighter-than-hoped-for profit margins in its services operations rather than its in-line earnings that rose from a year earlier.

The impact of IBM and other tech and telecom earnings kept those sectors in the red.

Early Friday, Nokia (NOK: down $1.44 to $14.61, Research, Estimates) warned that second-quarter sales and earnings would miss estimates due to a tough handset portfolio and increased competition. The company also reported fiscal first-quarter results that were roughly in line with the warning it issued last week, which had sent the stock reeling.

Sun Microsystems (SUNW: down $0.16 to $4.26, Research, Estimates) posted a large quarterly loss late Thursday versus a profit a year earlier. The loss was steeper than analysts were expecting, due to a big restructuring charge.

Shares of DoubleClick (DCLK: down $2.95 to $8.99, Research, Estimates) fell almost 25 percent after the Web ad firm posted quarterly revenue that missed estimates and warned that 2004 earnings would be impacted by a recent acquisition.

Lexar Media (LEXR: down $5.03 to $10.42, Research, Estimates), a memory chip maker, dropped 33 percent in active Nasdaq trade after reporting a big jump in first-quarter profit that was nonetheless short of estimates, and also warned that second-quarter results would miss expectations.

Chip gear maker PMC-Sierra (PMCS: down $0.98 to $15.64, Research, Estimates) tumbled nearly 6 percent in active Nasdaq trade despite reporting earnings of 6 cents a share, that topped estimates and reversed a year-earlier loss.

Market breadth was positive. Advancers beat decliners by more than twelve to five on the New York Stock Exchange as 1.48 billion shares traded. Winners edged losers by a narrow margin on the Nasdaq as 1.85 billion shares changed hands.

The morning's economic news was mixed.

The University of Michigan's first read on its index of consumer sentiment for April showed a surprise slip, falling to 93.2 versus 95.8 in March. Economists surveyed by Briefing.com expected the index to have risen to 97.0.

Other reports showed that the housing market remains strong, with building permits and housing starts rising in March, topping expectations. But other reports showed that manufacturing continues to struggle, with both industrial production and capacity utilization slipping in March from February levels, and missing analysts' estimates.

Treasury prices rallied, after falling for several sessions. The 10-year note added 15/32 of a point in price, pushing its yield down to 4.34 percent from 4.40 late Thursday. The dollar gained modestly against the euro and yen.

Among commodities markets, light crude oil futures fell 11 cents to settle at $36.99 a barrel. COMEX gold gained $3.30 to settle at $401.60 per ounce.

|