NEW YORK (CNN/Money) -

Treasury prices ticked mostly higher Wednesday after Federal Reserve Chairman Alan Greenspan said the threat of falling prices has faded, but inflationary pressures are still at bay.

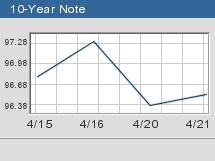

At about 3:55 p.m. ET, the benchmark 10-year note gained 7/32 of a point to 96-17/32, for a yield of 4.44 percent, down from 4.47 percent late Tuesday. The 30-year bond added 13/32 of a point to 102-1/32 to yield 5.23 percent, down from 5.27 percent late Tuesday.

The two-year note was little changed at 98-23/32 to yield 2.17 percent and the five-year note climbed 3/32 of a point to 98-7/32 to yield 3.51 percent. Yields and prices move in opposite directions.

Testifying before the congressional Joint Economic Committee, Greenspan characterized growth as vigorous but said there were no signs of broad-based inflationary pressures.

"Still-significant productivity growth and a sizable margin of underutilized resources, to date, have checked any sustained acceleration of the general price level and should continue to do so for a time," Greenspan told the Congressional committee.

Wednesday's buying was a reprieve for bonds after Greenspan's comments Tuesday sent prices tumbling and yields soaring.

"[Greenspan] seems to be a little more sanguine about inflation today than he was on Tuesday," Steven Wood, chief economist at Insight Economics, told Reuters. "Since there is no red flag of an early tightening by the Fed, it's almost a relief trade."

Speaking before the Senate Banking Committee Tuesday, Greenspan said corporate pricing power was "gradually being restored," after a long stretch in which economists worried about the prospect for falling prices, or deflation, which could cripple corporate profits and hurt the economy.

Greenspan's comments Wednesday helped the dollar fend off the euro, but the U.S. currency remained weak versus the yen.

The euro bought $1.1836 in late afternoon trade after having briefly touched a near five-month low of $1.1815 earlier in the session. The single European currency purchased $1.1860 late Tuesday.

The dollar, meanwhile, bought ¥109.46, down from ¥109.66 late yesterday.

--from staff and wire reports

|