NEW YORK (CNN/Money) -

There's a great scene in the movie "Swingers" where a bunch of guys are playing a version of Electronic Arts' NHL hockey game. They were marvelling over Jeremy Roenick's character, because the former Chicago Blackhawk was inhumanly good.

As a game-addict in college, I can relate -- Roenick was insane and the obvious glitch was the cause of many dorm room fights.

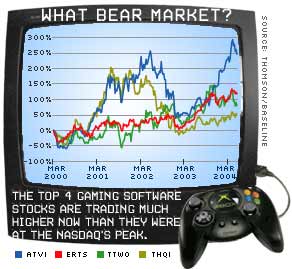

The quality of games has increased substantially since the early 1990s, but the stock prices of the major video game software publishers have shown some Roenick-like moves of their own.

The Nasdaq is still trading about 62 percent below its March 10, 2000 all-time high, but shares of the four big video game software firms -- -- EA, Activision, THQ and Take-Two Interactive - are all substantially higher than where they were at the peak.

What's more, the stocks are all up year-to-date, despite the tech sector's sell-off. And as video game aficionados soak up the sun at the industry's big E3 trade show in Los Angeles this week, several fund managers say they see no reason why the gaming software stocks shouldn't continue to soar. (For more CNN/Money coverage of E3, click here.)

EA is by far the best bet...

EA (ERTS: Research, Estimates), the industry leader, is widely viewed as the top pick in the sector. The company is behind the wildly popular Sims franchise, games tied to the "Harry Potter" characters and movies, as well as several sports games, including the aforementioned NHL titles and the Madden NFL series of football games.

|

|

| Electronic Arts is wild about Harry...Potter, that is. |

Sports have been a key reason why EA has been able to post strong sales, year-in and year-out, even during sluggish economic times. Fans of these games are always ready to buy the latest version, thanks to new features and updated statistics.

"Looking through the rubble of video games recently in my house, not only was there Madden 2004, but 2003, 2002, 2001," said Henry Hewitt, a father of three teenage sons and manager of the Light Revolution fund, which owns shares of EA. "And there's no question we won't buy Madden 2005."

Hewitt describes EA as one of his top long-term core investments in his fund, saying that it's the type of stock you could almost buy at any price and hold.

| |

|

Click here for more coverage of E3

|

|

Though EA stock is the most expensive of the major four, it's not exorbitant. Its P/E is 26 times (based on calendar 2004 earnings estimates), but profits are expected to grow at a clip of 18 percent annually for the next few years.

Matthew Kelmon, manager of the Kelmoore Strategy Eagle fund, which also owns EA, said he likes the stock at its current levels and adds that EA should keep turning in consistent results with its customer loyalty and pricing power.

"Whether new games are $49.95 or $59.95, it makes no difference," said Kelmon, also speaking from experience as the father of two young sons.

...but valuations are for the other three are compelling

The other three video game software companies, while not as strong financially as EA, also have solid earnings growth prospects. And they're trading at a discount to EA, which makes them attractive, said Bob Straus, manager of the Icon Information Technology fund, which owns shares of Activision, THQ and Take-Two, but not EA.

All three stocks are expected to post earnings gains of 15 percent annually for the next three to five years.

Take-Two (TTWO: Research, Estimates), which makes the controversial Grand Theft Auto video games, has been hit with some accounting problems in the past, but Straus thinks the stock's valuation of just 12 times calendar 2004 earnings estimates more than prices in any future risks.

|

|

| Peter Parker gets in the swing of things in Activision's Spider-Man 2 game. |

Activision (ATVI: Research, Estimates) has had success with several games tied to hit movies in the past few years and hopes to repeat that with its new Spider-Man 2 game. And THQ (THQI: Research, Estimates), mainly known for games geared towards young children, recently raised its fiscal 2005 outlook.

Activision and THQ both trade at about 20 times calendar 2004 earnings projections.

Both stocks have had a solid 2004, gaining about 20 percent but Straus is sticking with them. "We are not in a hurry to get out of the industry," he said.

The stocks of all four companies can be volatile. Shares tend to move wildly at times on news or speculation about what the major hardware makers -- Sony, Microsoft and Nintendo -- are doing with the prices of their consoles or plans about new versions of the hardware.

But the video game software companies have already proven that over the long-haul, as long as there are good games to play, people will buy them.

And the industry is no longer just something that can be dismissed as a market for kids. Many young adults of my generation who were big gaming fans back when the Atari 2600 was cutting edge are now owners of the PlayStation 2, Xbox or GameCube -- if not all three.

"The overall industry is a boom industry. It has demographics and favorable growth prospects on its side," said Dan Ahrens, co-manager of the Vice fund, which owns EA. "Valuations may get ahead of themselves sometimes but that's only a concern for the short term."

Sign up to receive the Tech Investor column by e-mail.

Plus, see more tech commentary and get the latest tech news.

|