NEW YORK (CNN/Money) -

The Nasdaq composite rallied Thursday, bouncing off multi-month lows hit in the morning. But Friday's market open looked tough, to say the least, following after-hours earnings and forecasts from Microsoft and others that proved disappointing.

The Nasdaq composite (up 14.69 to 1,889.06, Charts) rose 0.8 percent, after closing Wednesday's session at a fresh 7-month low and hitting a 9-month low in the early morning Thursday.

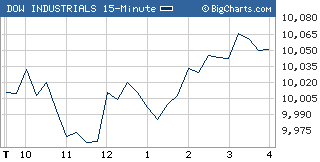

The Standard & Poor's 500 index (up 2.96 to 1,096.84, Charts) added 0.25 percent, and the Dow Jones industrial average (up 4.20 to 10,050.33, Charts) closed nearly unchanged.

Stocks had tumbled sharply Wednesday, with investors bailing out of a number of sectors despite some strong second-quarter earnings reports. That trend continued Thursday morning, and despite the afternoon turnaround, there is concern that the strong earnings in the first half of this year had already been anticipated and factored into stock prices by the sharp rally in 2003.

Now there is concern that earnings in the second half of the year won't be strong enough to provide a catalyst to boost stocks anew.

"I think there are a lot of cross currents here and that's creating jitters," said Bill Roe, a portfolio manager at Melhado, Flynn & Associates.

Roe said that some stocks and sectors have gotten so oversold that a bounce is inevitable. But he said that any bounce is likely to be just 5 percent or 6 percent, which would bring the market closer to the high end of the six-month trading range in which it's stuck.

After the close Thursday, a number of big companies reported earnings and issued forecasts. Some were upbeat, some less so, but almost all the companies saw their stocks decline.

The most influential by far was Microsoft (MSFT: Research, Estimates), which reported earnings of 28 cents a share, up from a year ago, but a penny shy of First Call estimates. Revenue was 9.29 billion, up from a year ago and above expectations. The tech leader also forecast first-quarter earnings that are short of current estimates and revenue that is higher. Shares declined after the bell.

Also after the close, Amazon.com (AMZN: Research, Estimates) said it earned 18 cents per share, up from 11 cents a year ago and a penny shy of expectations. Shares tumbled in after-hours trade.

Foundry Networks (FDRY: Research, Estimates) reported earnings of 11 cents per share, 3 cents short of estimates and

2 cents less than it earned a year earlier. The company also boosted third-quarter earnings estimates to a range that surpasses analysts' estimates, but investors ignored that, sending shares lower after-hours.

Outside of the tech world, Coca-Cola (KO: Research, Estimates) said it earned 64 cents a share, up from 55 cents a year earlier and a penny more than expected.

Amgen (AMGN: Research, Estimates) reported earnings and revenue that rose from a year earlier and topped estimates. The company also issued fiscal-year 2004 earnings per share guidance that could miss estimates, saying it expects to earn between $2.30 and $2.40 per share, when a consensus of analysts currently expect $2.40. Shares declined after the bell.

Finally, trucking firm Yellow Roadway (YELL: Research, Estimates) reported earnings of 97 cents a share, up from 62 cents a year earlier and 7 cents more than what analysts are expecting. Shares gained in after-hours trade.

Thursday's movers

The Nasdaq led the charge, with some of the chips and biotechs that tumbled Wednesday rising Thursday.

Among the session's gainers, Intel (INTC: up $0.71 to $23.27, Research, Estimates) rose 3 percent and Yahoo! (YHOO: up $1.13 to $29.26, Research, Estimates) rose 4 percent.

Lam Research (LRCX: up $3.92 to $23.72, Research, Estimates) rallied almost 20 percent after the chip-gear maker reported earnings and revenue late Wednesday that rose from a year earlier and beat expectations.

eBay (EBAY: up $0.79 to $77.39, Research, Estimates) reported second-quarter earnings late Wednesday that rose from a year earlier and topped expectations. The online auctioneer also issued guidance for the third quarter and full year that was short of Wall Street estimates. Initially the stock shed more than 5 percent before recovering with the broader market Thursday afternoon.

Caterpillar (CAT: down $3.42 to $73.53, Research, Estimates) was the Dow's biggest problem, losing 3.4 percent after reporting earnings Thursday morning that disappointed. The heavy-equipment maker said it earned $1.55 per share, up from $1.15 a year ago, but far shy of the $1.71 per share analysts were looking for. Caterpillar also boosted its 2004 revenue guidance to a level above what analysts are expecting.

Market breadth was negative. On the New York Stock Exchange, where more than 1.66 billion shares traded, decliners beat advancers by more than three to two. On the Nasdaq, losers outnumbered gainers by more than nine to seven as 1.94 billion shares changed hands.

The number of Americans filing new claims for unemployment last week fell to 339,000 from an upwardly revised 350,000 the previous week. Wall Street economists expected 345,000 new claims. While this was certainly a positive, it was overshadowed by the other concerns.

The Conference Board said its index of leading economic indicators fell 0.2 percent in June, following a downwardly revised gain of 0.4 percent in May. Economists expected the reading to be unchanged.

Treasury prices edged higher, pushing the 10-year note yield down to 4.45 percent from 4.47 percent late Wednesday. Treasury prices and yields move in opposite directions. The dollar inched higher versus the yen and euro.

Among commodities markets, NYMEX crude oil futures rose 78 cents to $41.36 a barrel. A decision by OPEC to boost capacity by 10 percent failed to inspire a selloff in the oil market. COMEX gold lost $2 to settle at $395.30 an ounce.

|