NEW YORK (CNN/Money) -

U.S. stock markets snapped back Tuesday, rallying after several down weeks, thanks to upbeat earnings from Verizon Communications and others, as well as a jump in the July consumer confidence index.

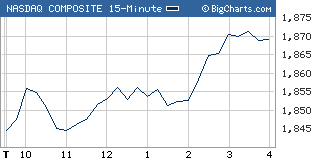

The Nasdaq composite (up 30.08 to 1,869.10, Charts) rose 1.6 percent, bouncing back after closing Monday's session at a new 2004 low.

The Dow Jones industrial average (up 123.22 to 10,085.14, Charts) added 1.2 percent and the Standard & Poor's 500 (up 10.76 to 1,094.83, Charts) index added 1 percent.

Strong earnings from Verizon Communications and others had given stocks a lift at the open. That upward trend was accelerated by the release of the Conference Board's July consumer confidence index, around 10 a.m. Also, home sales fell less than expected.

But in addition to the earnings and economic news, the rally was also largely technical in nature, analysts said.

The major indexes have been falling for most of July, and the Nasdaq closed Monday's session at a new, almost 11-month low.

"We've been down for six weeks on the S&P 500, and if you stretch a rubber band enough, it's going to snap back," said Larry Wachtel, market analyst at Wachovia Securities. "The question is 'is this a head fake or will it continue?'"

Wachtel said the fact that the confidence index was a July number was important, due to the fact that many of the June readings had been weaker than expected. "If you get the July figures over the next few weeks, and they are copacetic, that would temper worries that we've come to a screeching halt in June."

The report on June durable goods orders is due early Thursday. Orders are expected to have risen 1.5 percent after falling 1.6 percent in May.

After the close, business software maker PeopleSoft (PSFT: Research, Estimates) reported earnings and revenue that rose from a year earlier, but missed expectations.

Chip contract manufacturer Amkor Technology (AMKR: Research, Estimates) reported a quarterly loss that narrowed from a year earlier and was narrower than what analysts had expected. But the firm also warned that it will post a loss in the third-quarter, versus analysts' expectations for a profit. Shares fell more than 15 percent in after-hours trade.

Earnings due before the open Wednesday include Boeing (BA: Research, Estimates), Comcast (CMCSA: Research, Estimates) and Time Warner (TWX: Research, Estimates).

Of telecoms and confidence

Dow component Verizon Communications (VZ: up $1.36 to $37.86, Research, Estimates) reported earnings of 64 cents per share, up from 12 cents a year earlier and four cents more than expected, due partly to increased strength in its wireless operations.

Shares popped 3.7 percent, and boosted fellow Baby Bell SBC Communications (SBC: up $0.59 to $25.34, Research, Estimates). Telecom was also one of the strongest performers Monday.

The Conference Board's July consumer confidence index, released at around 10 a.m. ET, rose to 106.1 from a revised 102.8 in June. Economists surveyed by Briefing.com were expecting only a reading of 102, which would have been a modest rise.

In addition, new home sales fell to a 1.33 million unit annual rate in June from a 1.34 million unit annual rate in May. That was a smaller drop than what economists were expecting; they were looking for a fall to a 1.26 million unit annual rate.

"I think that the home sales and consumer confidence reflect continued strength in housing," said John Davidson, president and CEO, PartnersRe Asset Management. He said that this was important as it seemed to dispel the belief that the housing bubble is about to burst.

"The economy seems strong, despite a temporary pause in the June numbers," he added. "But I think the market is still held a bit hostage to the earnings guidance, which hasn't been that strong from some companies."

What else moved?

The gains were broadly based, with 27 out of 30 Dow components rising.

In addition to the telecoms, the Dow's other biggest gainers were Alcoa (AA: up $0.90 to $31.17, Research, Estimates), AIG (AIG: up $1.84 to $70.84, Research, Estimates), Boeing (BA: up $1.22 to $48.22, Research, Estimates) and Honeywell (HON: up $0.88 to $37.35, Research, Estimates).

DuPont (DD: up $0.41 to $42.31, Research, Estimates) reported earnings that slipped from a year earlier and were shy of estimates, due to charges it took for job cuts and the sale of one of its businesses.

Additionally, the chemical maker's quarterly revenue rose and the company also boosted its full-year earnings outlook thanks to slowly improving demand in the industrial sector. Shares added 1 percent.

Also on the earnings disappointment front, supercomputer maker Cray (CRAY: down $2.02 to $3.03, Research, Estimates) reported a quarterly loss, versus a profit a year earlier, due to a delay of a key contract. Analysts surveyed by First Call expected a narrower loss. The company also announced a restructuring program aimed at returning it to profitability and warned that 2004 revenue will miss estimates.

Shares fell 40 percent in active Nasdaq trade.

Nortel Networks (NT: down $0.65 to $3.42, Research, Estimates) lost 16 percent and topped the New York Stock Exchange's most-active list after the telecom gear maker said that costs were still too high and profit margins too low, and that it will announce new cuts next month.

The company is in the process of restating incorrect results from between 2001 and 2003, as part of a securities probe.

Cardinal Health (CAH: down $6.47 to $44.00, Research, Estimates) lost close to 13 percent after the drug wholesaler's chief financial officer unexpectedly resigned, and the company said it would delay the release of its quarterly financial results.

Market breadth was positive. On the New York Stock Exchange, advancers beat decliners by five to three as 1.60 billion shares changed hands. On the Nasdaq, winners topped losers by more than two to one on volume of nearly 1.75 billion shares.

Although it's unlikely to have a direct impact on trading, investors are also keeping an eye on the four-day Democratic National Convention in Boston, which began Monday.

Treasury prices fell sharply, pushing the 10-year note yield up to 4.60 percent from 4.49 percent late Monday. The dollar fell versus the euro and rose versus the yen.

Among commodities markets, NYMEX light crude oil futures rose 40 cents to settle at $41.84 a barrel. COMEX gold fell $3.20 to settle at $389.80 an ounce.

|