NEW YORK (CNN/Money) -

Tech stocks tumbled Wednesday and the broader market posted smaller losses as a late-session blue-chip recovery helped temper the impact of Cisco Systems' profit warning.

The technology-fueled Nasdaq composite (up 2.40 to 2,964.19, Charts) sank nearly 1.5 percent, having been down as much as 2.5 percent earlier in the session. Cisco Systems was its most actively traded component, sliding 10 percent.

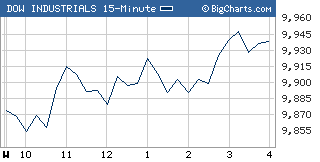

The Dow Jones industrial average (down 6.35 to 9,938.32, Charts) closed little changed while the Standard & Poor's 500 (down 3.25 to 1,075.79, Charts) index lost 0.3 percent.

"We could always point to the obvious, which is Cisco, but right now the market is correlated to the price of oil," said Robert Mikkelsen, senior managing director of equity capital markets at Advest Inc.

"You had a nice relief rally Tuesday tied to the Fed raising rates, but then today, it's almost like business as usual," he said. "The Olympics start Friday, you've got the Republican Convention after that, and I think we're going to be in this choppy, downtrending market at least until Labor Day."

All three indexes had started the session with steep losses after Cisco Systems' earnings outlook exacerbated worries about a slowdown for tech spending.

The depth of the sell-off eased and recharged periodically throughout the session, often with the fall and rise of oil prices.

A late session sector rotation into drug stocks such as Pfizer (PFE: up $0.46 to $31.77, Research, Estimates) and Merck (MRK: up $0.35 to $45.00, Research, Estimates), as well as heavy equipment maker Caterpillar (CAT: up $0.80 to $72.06, Research, Estimates), helped the Dow erase most of its losses.

Thursday brings reports on retail sales and jobless claims, as well as an earnings report from Dell after the close. For a detailed preview of Dell's earnings, click here.

July retail sales are expected to have risen 1.1 percent, after declining 1.1 percent in June. Sales excluding autos are expected to have risen 0.4 percent, after moving down 0.2 percent in June.

The weekly jobless claims report is expected to show that 340,000 people filed new claims for unemployment last week versus 336,000 the week before.

Cisco, National Semi unnerve

Cisco Systems reported earnings late Tuesday that rose from a year earlier and topped forecasts. But the company also said that inventories rose and customers were getting more cautious. The company also forecast that revenue in the current quarter would be in a range that's potentially shy of expectations. Merrill Lynch and others downgraded the stock Wednesday.

Cisco (CSCO: down $2.17 to $18.29, Research, Estimates) shares tumbled 10.3 percent, dragging down other techs. Broadcom (BRCM: down $3.67 to $29.21, Research, Estimates), which makes chips for networkers, fell over 11 percent. PMC-Sierra (PMCS: down $1.16 to $9.79, Research, Estimates), which makes chips for broadband, lost 10.6 percent.

"The reason for the (technology) decline is the combination of the Cisco earnings and the comments from CEO John Chambers," said Hugh Johnson, chief investment officer at First Albany. "He basically said what Intel said recently: that customers are getting very cautious and that spending on technology is slowing."

But Cisco wasn't the only tech company to warn about slowing demand.

Chipmaker National Semiconductor (NSM: down $2.22 to $13.48, Research, Estimates) said current-quarter revenue will come in short of expectations, due to a steeper-than-expected decrease in orders. Shares fell more than 14 percent in active New York Stock Exchange trade.

A variety of other chip stocks tumbled, sending the Philadelphia Semiconductor (down 20.29 to 372.67, Charts) index, or the SOX, down more than 5 percent.

Kulicke & Soffa Industries (KLIC: down $1.76 to $5.26, Research, Estimates) skidded 25 percent on the Nasdaq after the chip gear maker warned that fiscal fourth-quarter revenue will miss expectations substantially due to caution from its customers regarding future demand.

The major indexes had rallied Tuesday, snapping back after several down weeks. The catalyst for the bounce: late afternoon news that the Federal Reserve had raised short-term interest rates by a quarter-percentage point, as had been expected.

But the rally found no follow-through Wednesday.

Dow component Walt Disney (DIS: down $0.66 to $21.78, Research, Estimates) also reported earnings late Tuesday of 29 cents per share, up from 24 cents a year earlier. Results surpassed Thomson First Call estimates by 2 cents per share. But the stock declined.

Market breadth was negative but much improved from the early morning. On the New York Stock Exchange, losers beat winners by about nine to seven as 1.4 billion shares changed hands. On the Nasdaq, decliners beat advancers by better than three to two with almost 1.82 billion shares trading.

Oil prices had plunged after Saudi Arabian officials said the country had increased output and would continue to do so, as necessary, but prices snapped back after weekly U.S. government data showed inventories abruptly dropped last week.

NYMEX light crude oil futures settled at $44.80 a barrel, a gain of 28 cents on the session.

Treasury prices edged higher, with the 10-year note yield at 4.27 percent, down from 4.30 percent late Tuesday. Bond prices and yields move in opposite directions.

The dollar tumbled versus the yen and inched higher versus the euro.

COMEX gold fell $4.40 to settle at $397.90 an ounce.

|