NEW YORK (CNN/Money) -

Dell's earnings gave the Nasdaq a boost Friday, but the broader market ended the session barely higher, due to record high oil prices and lackluster economic news.

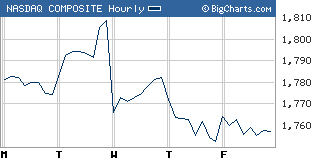

The Nasdaq composite (up 4.73 to 1,757.22, Charts) rose nearly 0.3 percent. For the week, the composite lost 1.1 percent, falling for the second week in a row, and the sixth week out of seven.

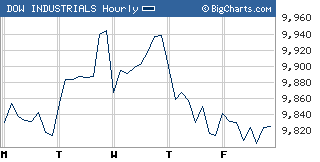

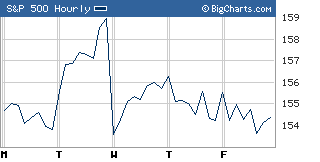

The Dow Jones industrial average (up 10.76 to 9,825.35, Charts) and the Standard & Poor's 500 (up 1.57 to 1,064.80, Charts) index both closed the session and the week with slim gains. The Dow gained 0.1 percent and the S&P gained less than 0.1 percent.

Friday marked a quiet end to a tumultuous week in which the Federal Reserve boosted interest rates by a quarter-percentage point, as expected, oil hit new record highs during every session, and a spate of influential techs offered earnings and forecasts that were less over-the-moon than some Wall Streeters had hoped.

On Friday, oil futures hit an all-time high of $46.65 a barrel on the New York Mercantile Exchange, with supply fears amping up following a refinery blast in Indiana. By the end of the session, oil had scaled back slightly, settling at $46.58, a gain of $1.08.

"Oil keeps gaining and it doesn't seem to want to stop," said Mark Bryant, senior vice president at Brean, Murray & Co. "It's hard to get any (stock) traction when that's happening."

Stocks had gained at the open on a bit of a relief rally after two days of selling and in response to earnings from Dell. The tech leader reported earnings late Thursday of 31 cents a share, up from 24 cents a year earlier, and in line with Wall Street forecasts, due to strong demand for its PCs, among other factors. Dell also said its results will meet analysts' forecasts for the third quarter.

Stocks had tumbled sharply Wednesday and Thursday on a combination of the high oil prices and comments from Cisco and Hewlett-Packard that tech spending is slowing.

"We've got this oversold market that can't find a reason to bounce," said Brian Bensch, investment manager at Melhado, Flynn & Associates.

"I don't know what can get us higher until we at least get through the Olympics and the Republican convention," he added. "Until then, I'm afraid we're going to keep slowly drifting lower."

The Olympics began in Greece Friday. The Republican National Convention (RNC) begins August 30 in New York City and runs through September 2.

"I think a lot of us will breathe a sigh of relief if we can get through those two events without a terrorist attack," said Mark Bryant, senior vice president at Brean, Murray & Co. "Then maybe we can see a little stock rise after that."

Of the few remaining earnings due to be released next week, retailers dominate, with Lowe's (LOW: Research, Estimates) due Monday before the bell and Home Depot (HD: Research, Estimates) due Tuesday.

The NY Empire State Index for August is due before the start of trading Monday. Economists surveyed by Briefing.com expect it to have fallen to 32.3 from 36.5.

Reports due later in the week include surveys on consumer prices and the housing market.

Dell a rare bright spot

Dell (DELL: up $1.39 to $34.51, Research, Estimates) stock jumped more than 4 percent in active trading on the Nasdaq.

While analysts argued Dell's earnings reflected how well Dell is doing, rather than the broader tech sector, the earnings nonetheless helped lift some beaten-down tech stocks.

Stocks -- particularly in the tech sector -- had tumbled the last few sessions after Cisco Systems (CSCO: up $0.07 to $17.86, Research, Estimates), and then Hewlett-Packard (HPQ: down $0.45 to $16.50, Research, Estimates), reported earnings and issued forecasts that disappointed Wall Street.

Investors already sensitive to signs of a corporate profit slowdown seized on these results as a confirmation of such concerns.

More signs that the economic recovery is slowing helped the rising price of oil defeat any sustained rally.

A before-the-bell economic report showed the U.S. trade gap ballooned to a record $55.8 billion in June, surpassing estimates, due in part to surging energy costs. Commenting on the report, Treasury Secretary John Snow said that the levels reflect a slowing world economy.

Also released early Friday, the producer price index edged up 0.1 percent in July after falling in June, coming in below forecasts for a 0.2 percent gain, showing inflation concerns remain pretty tame.

The "core" PPI, which excludes food and energy, rose 0.1 percent in July, as expected, after rising 0.2 percent in June.

Consumers grew less confident in early August than had been expected, another report showed. The University of Michigan's August consumer sentiment index fell to 94 from 96.7 in July. Economists expected it to rise to 97.5

Dell wasn't the only tech company with upbeat earnings news.

Computer data storage maker Brocade Communications (BRCD: up $0.78 to $4.82, Research, Estimates) reported earnings late Thursday that surpassed estimates and rose from a year earlier. Shares jumped more than 19 percent in active Nasdaq trade.

Business software developer BEA Systems (BEAS: up $0.19 to $6.16, Research, Estimates) boosted its fiscal third-quarter earnings per share forecast late Thursday. Shares rose more than 3 percent.

On the downside, Conseco (CNO: down $1.41 to $15.74, Research, Estimates) fell over 8 percent in active New York Stock Exchange trade. The insurance company said late Thursday that its CEO has resigned, that its general counsel will replace him and that its 2004 net income will take a small hit to accommodate the change.

Drug developer Genentech (DNA: down $2.88 to $44.23, Research, Estimates) fell more than 6 percent after issuing a statement, along with the Food & Drug Administration, that its key cancer treatment drug Avastin has been found to cause a higher risk of deadly blood clots in arteries.

Market breadth was positive. On the New York Stock Exchange, winners beat losers by nine to seven on volume of 1.17 billion shares. On the Nasdaq, decliners edged advancers by a narrow margin as 1.33 billion shares changed hands.

Treasury prices rose after the economic reports, pushing the yield on the 10-year note down to 4.23 percent from 4.25 percent late Thursday. Treasury prices and yields move in opposite directions.

The dollar fell versus the euro and yen. COMEX gold gained $4.60 to settle at $401.20 an ounce.

|