NEW YORK (CNN/Money) -

Sina.com, China's biggest Internet service provider, got stung by sanctions again Thursday as part of an industry crackdown on porn and "inappropriate content" -- the latest sign of the huge risks of investing in China's Internet sector.

China Mobile, the state-controlled wireless phone company that allows Internet companies access to their subscribers, slapped a six-month freeze on new multimedia message services and products designed to be sent to cell phones, Beijing-based Sina said in a statement.

Sina's (SINA: down $0.08 to $21.21, Research, Estimates) U.S. shares tumbled as much as 8.7 percent in active Nasdaq trading, though they later recovered much of that ground.

U.S.-listed Chinese Net stocks Sohu.com (SOHU: Research, Estimates) and NetEase (NTES: Research, Estimates) also fell on the news, making clear once again how Chinese Internet companies are at the mercy of China's state-controlled telephone companies.

For investors, as well as executives at Sina, Sohu and rival Internet service providers (ISPs), the concern is that the revenue stream that made the Internet stocks hot-growth prospects -- from providing content to China Mobile customers -- looks more tenuous than ever.

Revenues at risk

China Mobile has barred some 27 Internet service providers from providing content to its customers over the past month -- a big issue, because text messages are crucial revenue sources for the ISPs.

Here's how it works: China has 305 million people with cell phones versus just 87 million people on the Internet, according to the China Internet Network Information Center, a Chinese government affiliated think tank.

And cell phone text messages, rather than e-mail, is the dominant means of sending electronic messages in mainland China. According to the center, cell phone users send an average of 1 billion text messages a day, ranging from simple text messages to graphics-laden news updates, ads, jokes and songs.

When one mobile phone user sends a text message to another, China Mobile keeps the proceeds. But when someone surfing Sina sees a greeting card he wants to send to a buddy's phone, China Mobile gets 15 percent of the profit from that exchange while Sina keeps 85 percent.

And if an advertiser asks Sina to send all its users a message to promote a sale, Sina sends the mass message out over China Mobile's network and keeps the bulk of the ad revenue. Along with illicit content, China is battling phone spam much like U.S. regulators are fighting e-mail spam.

Text messaging generated 60 percent of Sina's fourth-quarter revenue of $38 million, according to Morgan Stanley research, with traditional advertising accounting for 34 percent.

"I've been impressed with the government in certain cases, but these companies' inability to control their environment is very real, and this will keep the market very volatile," said Mark Headley, a portfolio manager at Matthews International Funds, a company that focuses exclusively on Asian markets.

|

|

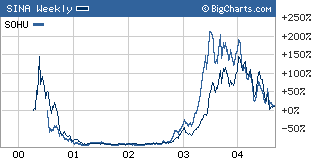

| Weekly prices for Sina and Sohu - April 200 to August 2004 |

The good news, said Headley, is that "if (the government) was going to kill the Net and the business building around it they would have done it." The hard part for investors, he said, is figuring out which revenue streams will stick around and where new ones will come from.

The Wall Street Journal speculated this week that China Mobile is clamping down, because it wants to offer its own wireless content or receive more of the money generated by such services. Wang Yu-quan, an information technology analyst in Beijing, told the paper: "Now the carrier has the power to shift the 85-15 ratio and get a larger portion."

Compromise on control

China's 87 million Internet users -- about a third of the total U.S. population -- are both a source of pride and worry for Communist Party leaders in a country where the average per capita income is just under $1,000 a year.

| Related stories

|

|

|

|

|

But that still leaves 1.2 billion people without Internet access in a country where economic growth is soaring, even if development is wildly uneven. You can get wireless Web access at a Starbucks in Beijing, but outside central China's Wuhan, people still boil tea leaves over coal-fired stoves in homes without plumbing.

This wealth gap and its attendant social instability pose a threat to the Communist leadership, but so does the Internet. At the same time, and somewhat paradoxically, the government has been promoting high-tech development, with the Internet its tool of choice to help close the income gap, according to government officials quoted in state-run media including China Daily and People's Daily.

"More high-tech (information flow) is the key to a better investment climate," the China Daily quoted Shi Dinghuan, secretary-general of the Ministry of Science and Technology, as saying earlier this year.

Officials hope to lure overseas investors to places like Wuhan, using the allure of an underdeveloped Internet sector and the promise of big profits. Foreign investment was instrumental in transforming China's coastal regions into modern cities with wealthy consumers.

"The long-term fundamentals are intact and similar to what we saw here in the Internet sector," said Jason Tsai, vice president of research with ThinkEquity Partners, a fund company specializing in emerging markets. But investors need to remember that, while they track profits, the government is tracking a nation of Internet users.

Analysts agreed that China's infamously opaque and inconsistent regulatory environment would evolve along with the sector. But no one is sure what that evolution will look like, or how the sector's growth may be curbed as it pushes the limits of state control.

"Investors need to be able to stomach this ride, must keep at the forefront of their minds that they're buying into this for the long-term, because there are lots of short-term uncertainties," said Tsai.

|