NEW YORK (CNN/Money) -

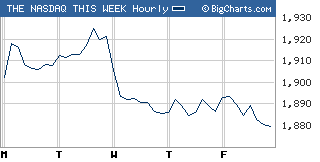

Techs slipped and the broader market was mixed Friday, with investors showing caution at the end of a tough week.

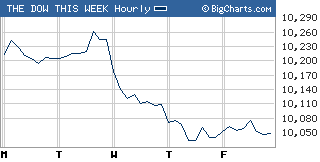

The Dow Jones industrial average (up 8.34 to 10,047.24, Charts) and the Standard & Poor's 500 (up 1.75 to 1,110.11, Charts) index both closed a few points higher. The Nasdaq composite (down 6.95 to 1,879.48, Charts) fell close to 0.4 percent, having traded on both sides of unchanged all session.

Worries about earnings, the economy and rising oil prices took their toll on stocks this week, with all three major indexes losing ground.

Wednesday's big sell-off caused the most damage, with investors bailing out of a slew of sectors one session after the Federal Reserve boosted interest rates by a quarter-percentage point, as had been expected.

Bond prices rallied all week, backing off a little Friday. The yield on the 10-year note fell below 4 percent for the first time since early April.

Crude oil prices closed at a new record high Friday, extending a week-long advance.

Disappointing earnings or profit warnings from Morgan Stanley, Colgate-Palmolive, Unilever and others created jitters about the third-quarter-earnings reporting period, which begins in about two weeks.

"The underlying fundamentals remain decent, but the pessimism is getting higher," said Robert Philips, president and chief investment officer at Walnut Asset Management. "The biggest hindrance right now is oil prices, part and parcel with Iraq."

The Dow lost 2.3 percent this week, it's second weekly decline in a row. The S&P 500 lost 1.6 percent, breaking a six-week winning streak. The Nasdaq fell 1.6 percent, after two weeks of gains.

Friday's economic news was a mixed bag, including the August report on durable-goods orders, which showed a drop in the main gauge but a rise excluding transportation.

Next week's reports include consumer confidence, personal income and spending, manufacturing and gross domestic product growth, among others.

Monday brings the report on new home sales. Sales likely fell to a 1.150 million-unit annual rate in August, according to Briefing.com estimates, from a 1.134 million unit annual rate in July.

Friday's movers

Another pair of chip companies issued profit warnings Friday.

Dutch-based Philips Electronics (PHG: down $0.26 to $22.95, Research, Estimates) said third-quarter chip sales would now be flat with the second quarter, compared to an earlier forecast for low single-digit growth. The company cited weaker global demand for its products.

Cirrus Logic (CRUS: down $0.19 to $4.89, Research, Estimates), which makes chips used in consumer electronics, warned that second-quarter revenue would miss expectations. The company cited an industrywide slowdown and in particular, weaker demand for DVD recorders, which use Cirrus technology.

Neither Philips nor Cirrus' shares were much impacted by the warnings, but the warnings didn't help the overall weakness in semiconductors.

A number of chip and chip gear makers fell. Texas Instruments (TXN: down $0.76 to $21.69, Research, Estimates) lost 3.4 percent, Applied Materials (AMAT: down $0.51 to $16.65, Research, Estimates) lost 4 percent and Altera (ALTR: down $1.00 to $19.30, Research, Estimates) lost 5 percent.

The Philadelphia Semiconductor (down 11.24 to 382.55, Charts) index, or the SOX, fell nearly 3 percent.

Mortgage lender Fannie Mae (FNM: down $1.64 to $65.51, Research, Estimates) lost another 2.5 percent, falling for the third straight session amid criticism from government regulators regarding the company's accounting policies.

Separately, Freddie Mac (FRE: up $0.21 to $64.59, Research, Estimates) revised its 2003 profit lower, as part of a broader restatement of old earnings due to its accounting problems.

Among other movers, PeopleSoft (PSFT: up $0.74 to $19.99, Research, Estimates) gained around 3.8 percent after a Financial Times report said that the European Commission was getting ready to approve Oracle (ORCL: down $0.01 to $11.04, Research, Estimates)'s hostile takeover bid for the company. Separately, Oracle extended its $7.7 billion hostile takeover bid, which had been due to expire Friday.

Cogent (COGT: up $5.98 to $17.98, Research, Estimates), a maker of fingerprint identification technology, rallied nearly 50 percent in its first day of trading as a public company, benefiting from the zest for security stocks. The company's initial public offering priced late Thursday at the top end of its range.

Market breadth was mixed, and volume was light. On the New York Stock Exchange, advancers beat decliners nine to seven as around 1.24 billion shares changed hands. On the Nasdaq, losers edged winners by a slim margin on volume of 1.35 billion shares.

"I'm looking for more of a pullback after today," said Katie Townshend, chief market technician at MKM Partners. "I think you've easily got 4 or 5 percent more on the downside as part of the correction that started Wednesday," she added.

Oil rises; durable goods mixed

Light crude for November delivery rose 42 cents to settle at $48.88 a barrel on the New York Mercantile Exchange.

On Friday, the Department of Energy provided details on the first two refineries that are set to benefit from the department providing oil loans from the Strategic Petroleum Reserve.

The government announced the initiative late Thursday as a means of combating shortages created by Hurricane Ivan. But analysts said the proposed loans would be too small to relieve supply worries.

Orders for durable goods fell a steeper-than-expected 0.5 percent in August, after posting an upwardly revised 1.8 percent gain in July, the Commerce Department reported early Friday. Economists surveyed by Briefing.com expected orders to fall 0.3 percent on average.

Excluding the transportation component, orders rose 2.3 percent in August versus a flat reading in July.

Existing home sales fell to a 6.54 million-unit annual rate in August, the National Association of Realtors said. That was down from a 6.72 million-unit annual rate in July. Briefing.com economists were expecting a smaller slide to a 6.65 million-unit annual rate.

Treasury prices fell, pushing the 10-year note yield up to 4.03 percent from 4.01 percent late Thursday. Bond prices and yields move in opposite directions.

In currency trading, the dollar gained versus the euro and was little changed against the yen.

|