NEW YORK (CNN/Money) -

eBay is the one tech stock that investors can buy today, store away in their portfolio, and not lose any sleep over for the next few years.

Sure, eBay is going to get whipsawed around with other Net stocks every now and then. But consider this: While many Internet stocks are still struggling to bounce back from the rough summer slump in the market, shares of the online auction giant are now just 7 percent below their 52 week high.

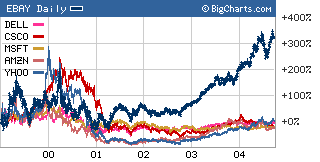

What's even more impressive is that eBay's 52-week high is also its all-time high. You'd be hard-pressed to find many other large cap techs, let alone major Internet stocks, that have completely recovered from the bear market of 2000 to 2002.

Dell is still 35 percent below where it was trading in March 2000. Microsoft is more than 50 percent off its bubbly peak. Yahoo!, despite a nice comeback during the past two years, is more than 70 percent lower than where it closed at the end of 1999.

So can eBay keep climbing higher? I think so.

Martin Pyykkonen, an analyst with Janco Partners, said that investors feel eBay is a less risky play to invest in the volatile Internet sector because unlike other large Net names, there really is little in the way of competitive threats.

Yahoo! has to reckon with the formidable duo of Google and Microsoft. Amazon.com faces challenges from "real-world" retailers like Barnes and Noble and Wal-Mart in addition to online upstarts like Overstock.com.

eBay, however, doesn't just dominate its market. It pretty much is the online auction market.

"Investors are treating eBay as the safest stock in the Internet," said Pyykkonen. "The good news for eBay is they have a defensible monopoly and it's hard to crack that."

A premium price...but it's warranted

Now of course, there is the valuation issue. eBay trades at the lofty multiple of 55 times 2005 earnings estimates.

But Scott Kessler, an analyst with Standard & Poor's, said that the stock deserves a premium valuation because the company shouldn't suffer from the types of boom-bust periods associated with other tech sector names.

|

|

| While many large cap tech and Internet stocks remain well below their peaks from the last bull market, eBay has continued to head higher. |

After all, eBay continued to post healthy gains in sales and earnings during the bear market, even as many other techs struggled. He adds that eBay is less subject to consumer spending downturns as well, given the nature of eBay's business.

"With eBay, you don't have to sit around and wonder what IT spending is going to look like or where the semiconductor cycle is," said Kessler. "In some ways, it's a counter cyclical stock because both sellers and buyers will have more of a reason to transact when the economy isn't as good, since consumers may have a need to raise extra cash or buy used merchandise."

Investors also need to take into account eBay's heady growth prospects in order to judge the stock's relative priciness.

| Recently in Tech Biz

|

|

|

|

|

To that end, Kent Mergler, manager of the Fremont Large Cap Growth fund, said that eBay is one of the most expensive stocks he owns in the fund on a P/E basis. But earnings are expected to grow at a 37 percent annual rate over the next few years.

"The stock is expensive but you'd expect it to be expensive," said Mergler, who has owned eBay in the fund for more than two years. "We consider it a core holding."

When you look at eBay's PEG ratio -- calculated by dividing the P/E by the long-term earnings growth rate -- eBay is actually not that richly valued. eBay has a PEG ratio of just 1.5, which Mergler said is below many of his other top tech holdings.

Microsoft, for example, trades at a PEG of 1.9. For that matter, the S&P 500's PEG ratio is 2.3.

It's really hard to find fault with the company. eBay has made savvy acquisitions, including Half.com and online payment processor PayPal.

The company recently acquired a 25 percent stake in Craigslist, the popular listings site. Pyykkonen said he thinks there's a decent chance eBay would eventually acquire all of Craigslist.

eBay has also purchased stakes in online auction sites in potentially lucrative international markets like Korea, India and China.

"There are not a lot of opportunities in tech that are wholly secular plays as opposed to cyclical plays," said Kessler. "This is a great company and a great stock."

Analysts quoted in this story do not own shares of eBay and their firms have no banking relationships with the company.

Sign up to receive the Tech Investor column by e-mail.

Plus, see more tech commentary and get the latest tech news.

|