NEW YORK (CNN/Money) -

The Dow declined and the broader market drifted Tuesday as investors eyed record high oil prices and some disappointing quarterly earnings forecasts.

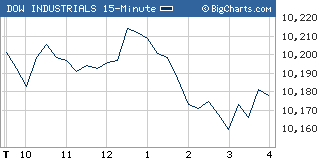

The Dow Jones industrial average (down 38.86 to 10,177.68, Charts) lost nearly 0.4 percent while the broader Standard & Poor's 500 (down 0.69 to 1,134.48, Charts) index closed little changed.

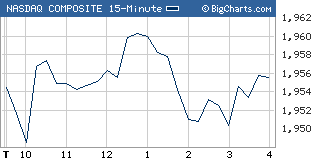

The Nasdaq composite (up 3.10 to 1,955.50, Charts) managed a small gain.

U.S. light crude for November delivery jumped $1.18 to settle at $51.09 a barrel on the New York Mercantile Exchange, a new closing high.

That sent the Dow skidding in afternoon trading and knocked the wind out of a tech rally that had started around midday.

"Oil is certainly not helping," said Mark Bryant, senior vice president at Brean, Murray & Co. "We passed $50 a barrel, and as to be expected, people are now talking $60 or more, which is uncharted territory."

Bryant said investors may be a bit skittish ahead of Friday's monthly jobs report, as well as the start of the third-quarter earnings reporting period.

The earnings period unofficially kicks off Thursday when Alcoa (AA: Research, Estimates) becomes the first Dow component to report. Results are also expected from Yahoo! (YHOO: Research, Estimates) and General Electric (GE: Research, Estimates).

But the week's biggest event is the September payrolls report. Due before the open Tuesday, employers probably added 150,000 jobs to payrolls last month after adding 144,000 new jobs in August. Wall Street economists expect the unemployment rate held steady at 5.4 percent.

The report is the last monthly jobs tally before November's presidential election, and is therefore likely to be even more closely scrutinized than usual.

Ahead of that, a report Tuesday showed a big jump in September job-cut plans, according to the latest survey from Challenger, Gray & Christmas.

Stocks had gained for two straight before hitting some roadblocks Tuesday. In addition to oil prices and the job-cut survey, other factors weighing on the market were a weaker ISM services index and some third-quarter profit warnings.

"We saw a fairly robust rotation out of fixed income and into stocks in the first two days of the quarter," said Barry Ritholtz, market strategist at Maxim Group. "The strength of that took some people by surprise, and now we're seeing markets drifting a bit."

What moved?

Dow component AIG (AIG: down $1.99 to $66.50, Research, Estimates) fell about 3 percent, making it the Dow's biggest decliner. The insurer said Monday that U.S. security regulators may sue the company for making false and misleading statements to investors in a trio of press releases. The company is already facing a potential lawsuit from regulators over allegations that it helped a banking client hide bad loans.

Component Hewlett-Packard (HPQ: down $0.08 to $18.98, Research, Estimates) inched lower after J.P. Morgan cut the stock to "neutral" from "overweight," citing concerns about HP's exposure to PCs and printers, which it said will probably see muted demand over the holiday period.

IBM (IBM: up $0.16 to $87.32, Research, Estimates) was barely changed after J.P. Morgan raised it to "overweight" from "neutral," citing a more positive outlook for fourth-quarter and 2005 earnings.

Both PeopleSoft (PSFT: up $0.63 to $22.83, Research, Estimates) and Oracle (ORCL: up $0.34 to $12.21, Research, Estimates) gained on further signs that PeopleSoft might be willing to have friendly discussions with Oracle about a possible takeover. PeopleSoft has been fighting Oracle's proposed $7.7 billion hostile takeover bid for the past 16 months, but the company recently fired its chief executive officer, who opposed the merger.

Among other movers, Chiron (CHIR: down $7.44 to $37.98, Research, Estimates) shares tumbled after the drugmaker said it won't supply any flu vaccine this winter due to problems at its British plant. The news could portend a significant flu shot shortage, as Chiron supplies roughly half the U.S. supply of flu vaccine.

Merck (MERCK: Research, Estimates) and other drug stocks declined in tandem.

Advanced Micro Devices (AMD: down $0.02 to $13.68, Research, Estimates) was little changed after joining the list of chipmakers warning that third-quarter results will miss Wall Street forecasts.

Shares of Pulte Homes (PHM: down $3.88 to $52.45, Research, Estimates) fell nearly 7 percent in active New York Stock Exchange trading after the home builder said late Monday that third-quarter and full-year profits would miss forecasts due to a slowdown in the once-booming Las Vegas market.

Market breadth was a shade negative. On the New York Stock Exchange, losers and winners were pretty evenly split on volume of 1.41 billion shares. On the Nasdaq, decliners beat advancers eight to seven on volume of 1.72 billion shares.

Investors also noted the morning's weaker-than-expected read on the economy's services sector from the Institute for Supply Management (ISM). The ISM index fell to 56.7 in September from 58.2 in August versus forecasts for a rise to 59. Any reading above 50 points to expansion in the service economy.

Treasury bond prices inched lower, pushing the 10-year note yield up to 4.17 percent from 4.16 percent late Monday. Treasury prices and yields move in opposite directions.

In currency trading, the dollar fell versus the euro and gained versus the yen.

|