NEW YORK (CNN/Money) -

There is nothing like watching a football game on a humongous flat-screen TV.

It is -- dare I say it -- a divine experience.

And with the price of digital televisions beginning to reach more affordable levels for the average consumer, it seems like many people will find religion this winter.

With this in mind, is there a way for investors to capitalize on this trend?

A way to start is by looking at some of the leading makers of semiconductors used in the various types of high definition televisions: liquid crystal display (LCD), plasma, and digital light processor (DLP) rear-projection TVs.

Vijay Rakesh, an analyst with Next Generation Equity Research, said Pixelworks (PXLW: Research, Estimates) and Genesis Microchip (GNSS: Research, Estimates), which both make video-processing chips used in flat-screen TVs, are the best ways to take advantage of consumers' love affair with fancy boob tubes.

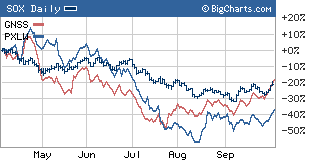

Both stocks have taken a hit, along with most other chip companies, during the past six months. But Rakesh thinks that investors are focusing more on potentially weak third quarter results and are not factoring in what should be a very strong fourth quarter.

"Soft expectations for the third quarter are priced in to the stocks -- you should see them going up in the fourth quarter," said Rakesh.

|

|

| Pixelworks and Genesis Microchip, like other chip stocks, have struggled on Wall Street lately. |

Rakesh likes Pixelworks a little more than Genesis and it is the cheaper stock, trading at 19 times 2005 earnings estimates. Genesis trades at about 26 times for its next fiscal year, which ends in March 2006. Both companies are expected to post earnings increases of about 17.5 percent over the next few years.

But these aren't the only chip companies that have exposure to the HDTV market. Trident Microsystems (TRID: Research, Estimates) and ATI Technologies (ATYT: Research, Estimates), which will report its fiscal fourth quarter results on Thursday, also make high-end graphics processors used in digital televisions.

And Texas Instruments (TXN: Research, Estimates), the leading manufacturer of semiconductors used in cell phones, is seeing strong demand for its digital light processor (DLP) chips used in digital rear-projection TVs.

Tough pricing for panels...but not for glass

In addition to chip stocks, there are two Asian manufacturers of LCD panels that also could be appealing to investors. LG.Philips and AU Optronics are both among the top manufacturers of panels for LCD TVs.

| Recently in Tech Biz

|

|

|

|

|

But the panel makers are probably the least attractive ways to try and invest in this trend. LG.Philips (LPL: Research, Estimates) and AU Optronics (AUO: Research, Estimates) are just a few of many companies making flat-panel displays, which means that competition will remain tough for the foreseeable future. And that's a big reason why both stocks have tumbled recently after going public earlier this year.

Consumer electronics retailers, however, should be winners regardless of which brands or types of digital TVs, wind up garnering the most market share. For this reason, Matt Kelmon, president of Kelmoore Investment Company, said he's a big fan of industry leader Best Buy (BBY: Research, Estimates), which he owns in several of the firm's mutual funds.

"Best Buy is a great way to play the HDTV trend. If they fly off the shelves at Christmas, then Best Buy will be a huge beneficiary," he said.

And finally, there's a telecom equipment company with a familiar name that may stand to benefit the most from the increased adoption of LCD TVs: Corning.

Yup, Corning (GLW: Research, Estimates) the beaten-down maker of fiber optic equipment has a thriving glass business. (What's old is new again, it seems.)

Corning is the leading manufacturer of glass used in LCD screens. John Harmon, an analyst with Needham & Co, said he expects glass volume for LCD screens to increase 50 percent a year through 2006 and that this should fuel sales growth for the company.

| More about consumer electronics

|

|

|

|

|

"Corning is the best way to participate in the LCD boom," Harmon said. "I think this is still a large and emerging opportunity for them."

Of course, if plasma screen TVs gain in popularity, that could hurt Corning. But Corning's stock is relatively inexpensive, at about 20 times 2005 earnings estimate, even though earnings are expected to increase at about a 15 percent clip for the next few years.

What's more, since Corning faces little competition in the glass market, it is more immune to pricing pressure, Harmon said.

So as investors continue to worry about the health of the overall tech sector, they should keep this in mind: flat is where it's at.

Analysts quoted in this story do not own shares of the companies mentioned and their firms have no investment banking relationships with the companies.

Sign up to receive the Tech Investor column by e-mail.

Plus, see more tech commentary and get the latest tech news.

|